OPEC production cuts agreed in December 2018 as well as US sanctions on Iran and Venezuela have pushed the price of WTI futures to more than $55, the highest level this year.

But the group faces major headwinds: Qatar recently left the organization, and some other countries appear to be increasingly ambivalent about membership.

OPEC’s main problem is that US supply continues to increase, and – according to the IEA – global oil demand is in trend decline. On most projections, OPEC members will need further production cuts just to maintain the status quo.

Declining demand is partly cyclical as the global economy slows, but there are structural drivers as well: alternative energy sources, increased fuel efficiency, and the growing shift to hybrid and all-electric vehicles.

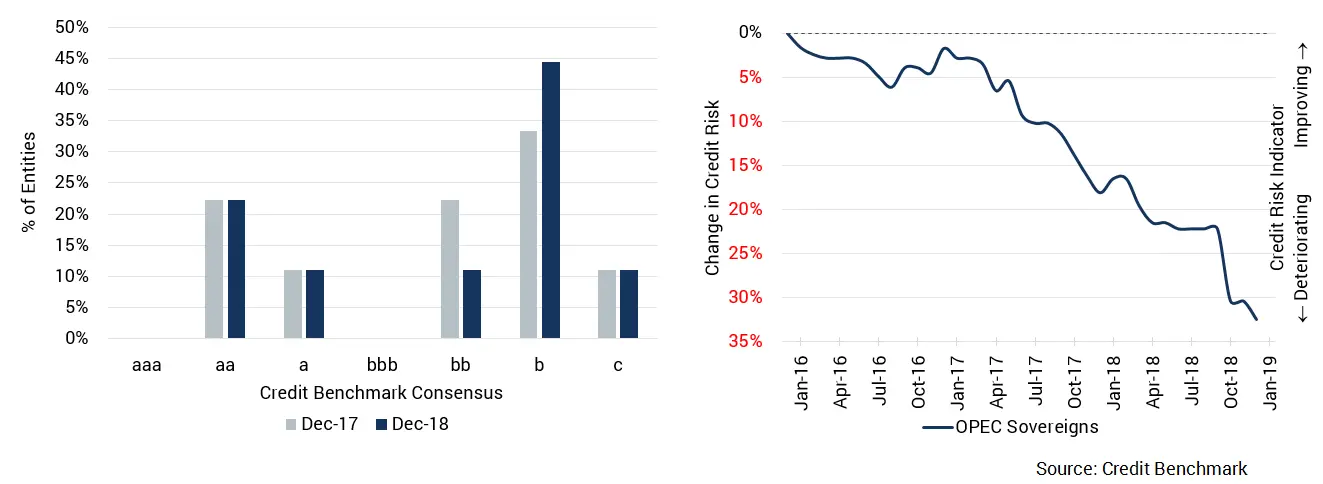

The chart shows levels and trends in Sovereign credit risk for 12 of the 14 OPEC member countries.

OPEC member Sovereign ratings are an unusual mix of very high and stable credit quality (the proportion of aa and a is unchanged over the past year), but with a growing majority rated as Non-Investment Grade.

Saudi Arabia – the core of OPEC – has seen its consensus rating decline from aa- to a over the past three years. Its plan to capitalize the financial value of its reserves by floating Saudi Aramco was shelved last year; the global oil supply/demand outlook may mean that the window of opportunity has passed for now.

The largest category is b, and the proportion has increased in the past year. Average Sovereign credit risk for OPEC members has deteriorated by more than 30% over the past three years.

OPEC’s own demand forecasts are similar to the pessimistic IEA projections – so it seems that even OPEC recognize that their power is waning. Against this background, OPEC members will need concrete plans to diversify away from oil if they are to avoid further credit deterioration.