Recently Italy and China signed a “memorandum of understanding” announcing their intentions to work together on China’s massive investment and infrastructure project, the Belt and Road Initiative (BRI).

This would make Italy the first G7 country to agree to a cooperation package under the BRI program covering transport, infrastructure and – controversially – an extension of China’s soft power globally.

The EU and the US are united in their opposition to this, primarily on security grounds, but Italy has downplayed these fears. A number of other EU countries have already signed up to a more limited deal aimed at improving transport links, and some commentators see the Italian move as part of a trend towards wider EU-China cooperation.

But some developing countries have become dependent on Chinese loans. Italy’s very public debt issues raise speculative concerns that this could be the first step towards them embracing China as new creditor to avoid painful short term adjustments required by the EU.

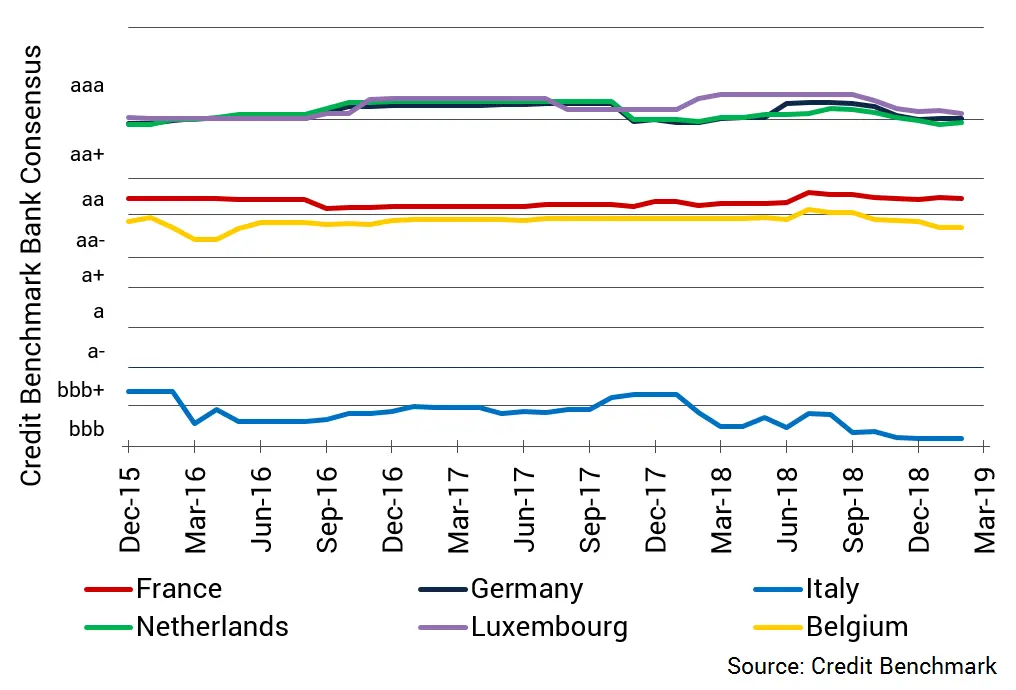

The chart below shows consensus credit risk ratings for the main EU countries sourced from 30+ global financial institutions.

Italy is a founding member of the EU, but in credit terms it has remained far below the other five original members. This suggests that – while EU membership may lead to more synchronised growth, inflation and interest rates amongst member states – national appetites for debt can be very entrenched.

Will closer ties with China allow Italy to maintain its appetite?