Evolving Opportunities in the SRT Market

This is the first joint update on the Significant Risk Transfer (SRT) market from Credit Benchmark and Oxane Partners. In this update, we examine key market developments and emerging trends across the SRT landscape, and analyze how investors can continue to execute, monitor, and manage SRT investments effectively amidst evolving market dynamics.

SRT transactions have become a valuable tool for banks aiming to optimize regulatory capital and diversify risk. The SRT market is currently approximately $80B outstanding, and loans linked to these transactions have reached $1T, of which two-thirds have been in Europe[1]. SRT trades offer investors attractive risk-adjusted returns and diversification through exposure to portfolios of bank loans without the operational burden of managing and servicing these loans.

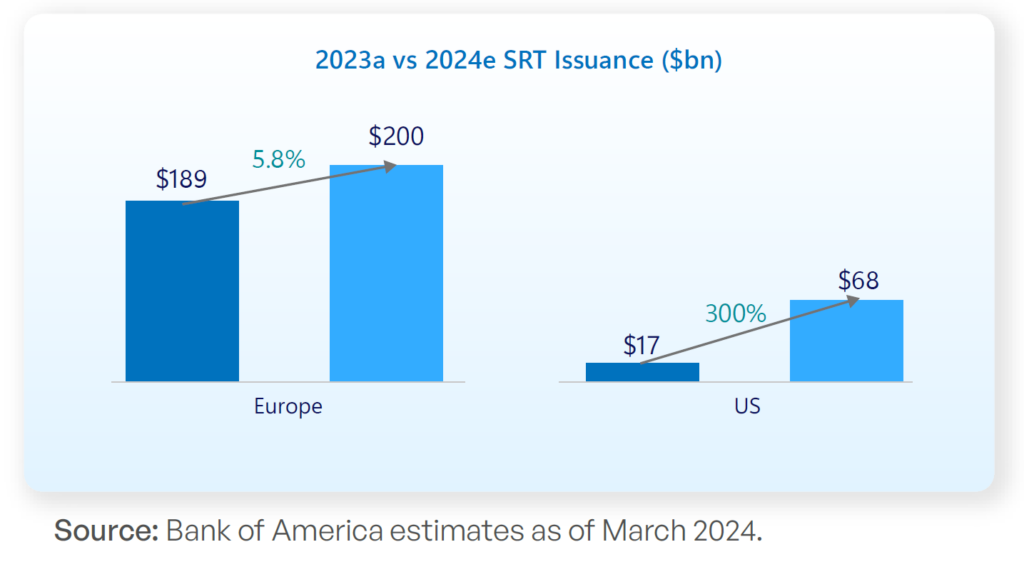

The European SRT market is relatively mature due to early adoption and regulatory clarity. The US has lagged because of regulatory uncertainty. However, US banking regulatory clarifications in September 2023 have added impetus to SRT issuances in the US[2], with estimates of the US market now representing about 30% of global share. Let’s explore the key developments and trends shaping the SRT landscape.

Structural evolution and nuances of SRT trades

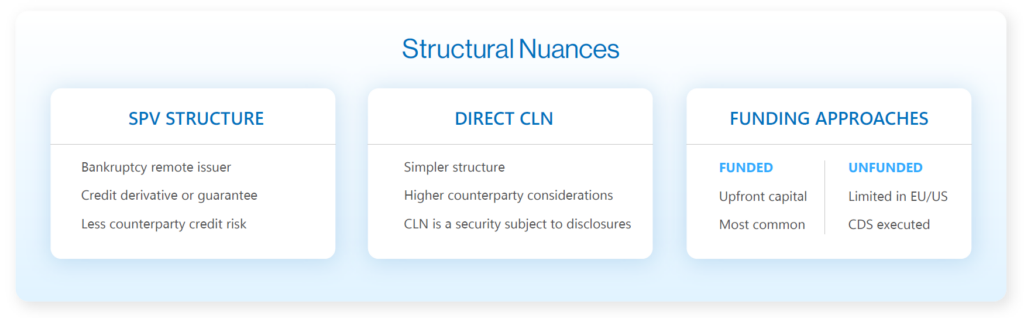

Special Purpose Vehicle (SPV) – Credit-Linked Notes (CLN) structure: With the simple, transparent and standardized (STS) framework in Europe, and prior precedent risk transfer practices in the US, this transaction structure uses a bankruptcy remote SPV and either a guarantee or credit derivative between issuer and the SVP to isolate the transferred credit risk and minimize the counterparty credit faced by the investor.

Direct CLN: The note purchase proceeds serve as collateral against credit losses; however, without an SPV between the issuer and investor, the originating bank retains higher control over note proceeds. To account for the distinctions in risks of direct CLNs, investors will monitor the issuer’s credit ratings and Credit Default Swap (CDS) spreads to assess counterparty risk.

Tranche and funding approaches: With varying levels of information on underlying credits, disclosure/reporting distinctions, and (at times) a paucity of data, investors may have considerable assessment challenges. Furthermore, nuances on replenishment pools, amortization structures, and call options are also evolving across SRT trades. Mezzanine tranche investments are gaining traction, and retained junior notes must be accounted for in transaction valuations. Modeling cashflows according to these structural nuances is pertinent to forecast loss coverage and coupon payments. These structural differences in trades necessitate robust data, and sophisticated modeling and valuation approaches to accurately capture the right assumptions, nuances of payment waterfalls and loss allocations. The valuation modeling approach adopted needs to be flexible and comprehensive to deal with complex payment waterfalls and loss appropriations.

Competition

The SRT market is experiencing significant growth on the investor side while issuers remain predominantly unchanged—limited to large banks with established track records in SRT trades and securitizations. This skewed supply-demand dynamic has led to spread compression, even as underlying credit fundamentals have remained relatively stable. As competition intensifies, investors must regularly track market dynamics, and risk adjustments on yields should account for changes in the market environment.

In response to these competitive pressures, some investors are developing strategic partnerships with key issuer banks, creating value for both parties. As competition affects transaction terms, investors need to differentiate themselves and find competitive advantages. Some investors are now trying to find relative value by evaluating more complex transactions—those involving novel asset classes, relatively riskier portfolios of proven asset classes, or structures presenting distinct challenges. To enhance valuations and monitoring capabilities, investors can partner with independent service providers who provide comprehensive market insights and data analytics, enabling deeper understanding of nuances for informed investment decisions.

Diversification and disclosures of reference pools

Reference pool composition: The composition of reference pools in SRT transactions has evolved significantly in recent years. While corporate loans continue to dominate in Europe, reference pools have diversified to include subscription lines, commercial real estate loans, residential mortgages, trade finance, CLOs, auto loans, and SME loans. This diversification has been accompanied by increasing geographic diversification, with multi-jurisdiction reference pools becoming more common. Even within reference pools of corporate loans, industry sector distribution has become an important focus for investors seeking to avoid concentration in cyclical industries. Transaction sizes have also grown, with typical reference pool sizes growing, allowing for more diversification within individual deals.

Disclosed vs blind pools: Banks can issue SRT transactions with varying levels of transparency into the underlying obligors. In a “disclosed pool”, the identities of the borrowers are fully revealed to potential investors, while in a “blind pool” the specific borrowers are not disclosed, but varying levels of metadata such as company size, geography, and industry may be provided. A growing number of investors use Credit Consensus Ratings (CCRs) to make informed risk-reward assessments before agreeing to a deal. For undisclosed obligors, investors can use custom indices, credit transition matrices, and sector correlations provided by Credit Benchmark to gauge the likely range of associated risks represented by that portion of an SRT transaction.

Growth in the US SRT market

The European SRT market has historically dominated the global market, accounting for up to 85% of global issuance[3]. This dominance was due to early regulatory adoption and a stable framework. However, US banks are increasingly utilizing SRTs to manage risk and support capital ratios. Previously, US issuance was hindered by regulatory uncertainty, particularly regarding bank-issued CLNs, which required approval from federal regulators. In September 2023, the Federal Reserve clarified that directly issued CLNs are eligible for regulatory capital relief, leading to a modest surge in US issuance.

With the growth in the US expected to continue, a more diversified investor base has emerged. Asset managers view this as a viable source of risk that is complementary to existing credit portfolios of more traditional asset allocations such as CLOs, ABS, and Private Credit.

While there was an expectation of SRT issuances by regional banks in the US in 2024, this expectation was not met to the extent anticipated. Regional banks are navigating some of the initial challenges of structuring these transactions, constructing the right reference portfolios and managing operational and regulatory requirements in executing these transactions. However, regional banks are likely to increase participation as pressures mount to optimize capital efficiency and manage risk exposures.

As allocations to SRT grow in the US, investors will require a systematic and data-driven approach to underwriting, analyzing and monitoring these transactions.

Credit Benchmark’s credit consensus ratings data (CCRs) and proprietary mapping services provide a valuable independent benchmark to SRT participants.

1. Independent Credit Validation and Benchmarking

Credit Benchmark aggregates anonymized credit risk views from 40+ global banks, covering over 110,000 entities globally, a significantly higher number than those rated by the traditional agencies. Investors and advisors can independently validate portfolios, particularly those with undisclosed or privately rated entities, ensuring regulatory compliance and confidence in credit assumptions. Credit Benchmark has been recognized as SRT “Service Provider of the Year” at the Structured Credit Investor (SCI) CRT Awards (2024), as “Category Leader” for Credit Risk Data Solutions, and “Best of Breed” for Credit Portfolio Management and for Regulatory Risk Reporting in the Chartis Research RiskTech Quadrants (2024).

2. Integrated Solutions for Operational Efficiency

Credit Benchmark’s CCR data is available across data feeds, API and web-app, offering end-to-end support from trade execution to portfolio monitoring. CCR data combined with Credit Benchmark’s proprietary data mapping service streamline workflows, reduce manual processes, and enhance transparency in SRT investment monitoring and valuations.

3. Predictive Analytics for Default Rate Projections

Credit Benchmark’s 12-month projected default rate distributions enable stakeholders to anticipate credit deterioration and optimize tranche pricing. Investors gain a forward-looking view of portfolio risks, allowing for robust scenario analysis and enhanced pricing accuracy.

4. Portfolio Diversification Insights

Credit Benchmark’s cross-sector and cross-region indices provide a macro-level view of portfolio diversification opportunities.

Investors can identify negatively correlated sectors or regions to mitigate risk concentration.

5. Dynamic Monitoring of Credit Migration

The 6-month rolling Deterioration-Improvement Net (DIN) metric tracks credit migration trends across geographies and industries. Real-time migration data enables investors to adjust exposures proactively and recalibrate models for emerging risks.

Credit Benchmark’s mission is to enable global financial market participants to make better-informed decisions.

Oxane Partners’ independent valuation expertise for SRT transactions

Oxane Partners delivers robust independent valuations for SRT transactions across diverse asset classes, structures, and geographies. Oxane combines technical expertise with market insights to provide investors with reliable, audit-compliant valuations.

1. Comprehensive Expertise

Oxane’s valuation team has extensive expertise on the nuances of SRT transactions.

Underlying Asset Classes: Corporate loans, residential-and-commercial mortgages, SME loans, subscription lines, synthetic CLOs, etc.

Structures: Static portfolios, replenishing portfolios, disclosed and blind pools, protected tranches (both first loss and mezzanine).

Geographies: North America, Europe (including Germany, France, Ireland, United Kingdom, etc.), covering both developed and emerging markets and multi-jurisdictional reference pools from many leading issuer banks.

2. Rigorous, transparent, and reliable valuations

Oxane’s analysts perform exhaustive analyses by running multiple scenarios, varying assumptions across time periods and refining them at the portfolio and rep-line levels. Oxane also integrates benchmarking and proprietary data such as Credit Benchmark’s credit consensus data to develop sophisticated loss-adjusted cash flow projections. Oxane provides detailed approach notes for complete transparency to valuation methodologies and assumptions.

3. Market insights

Oxane provides valuations on diverse transactions across the global SRT landscape, including various asset classes, protection tranches (first loss and mezzanine tranches), issuer banks, and geographic regions. Oxane’s experience spans complex deal structures featuring synthetic spreads, time call, and various amortization structures with conditional triggers. Working across clients and deals, we stay current on market liquidity, spreads, and pricing trends.

4. Fully independent

Unlike many valuation providers controlled by investment firms, Oxane holds no investment positions, ensuring independent and objective valuations. Oxane takes primary responsibility for auditor reviews of positions under independent valuations.

5. Proven expertise

Oxane provides periodic independent valuations on SRT trades with £90+ billion reference obligation notional amount in the UK, Europe, the US and Canada. Oxane has been consistently recognized as a leading valuation provider and has won several accolades including “Best valuations support for private credit” award in STORM 2024 by Chartis Research, “Best Valuation Service” in European Credit Awards 2022 by Hedgeweek and Private Equity Wire, “Best valuation service” award in Buy-Side Technology Awards 2021.

A Powerful Combination

As the market becomes more competitive and sophisticated, deeper access to data and market insights becomes crucial. Investors need to understand both individual investment performance and broader market trends and risks. Enhanced data and market visibility allow investors to make more informed decisions about both existing investments and new opportunities. By combining independent credit consensus data with robust valuation frameworks, Credit Benchmark and Oxane Partners empower SRT investors to optimize risk, meet regulatory expectations, and drive superior returns.

Download

[1] 1Q25 estimate based on prior research by Chorus Capital Management and reported by Bloomberg, 21 October 2024; https://www.bnnbloomberg.ca/business/2024/10/21/loans-tied-to-srts-reach-1-trillion-on-record-pace-of-sales/

[2] Frequently Asked Questions about Regulation Q; https://www.federalreserve.gov/supervisionreg/legalinterpretations/reg-q-frequently-asked-questions.htm

[3] European Systemic Risk Board: https://www.esrb.europa.eu/pub/pdf/occasional/esrb.op23~07d5c3eef2.en.pdf