Flexible-office operators suffered during the early part of the pandemic, in part because their short-term leases were easier to exit than traditional office leases.

However, many companies are embracing hybrid-work schedules when sending their employees back to the office. This is increasing demand for offices and meeting rooms, especially for those with flexible, short-term booking options.

In Jan-22, property brokerage JLL reported that the US office market registered positive net absorption for the first time since the onset of COVID during the fourth quarter of 2021.

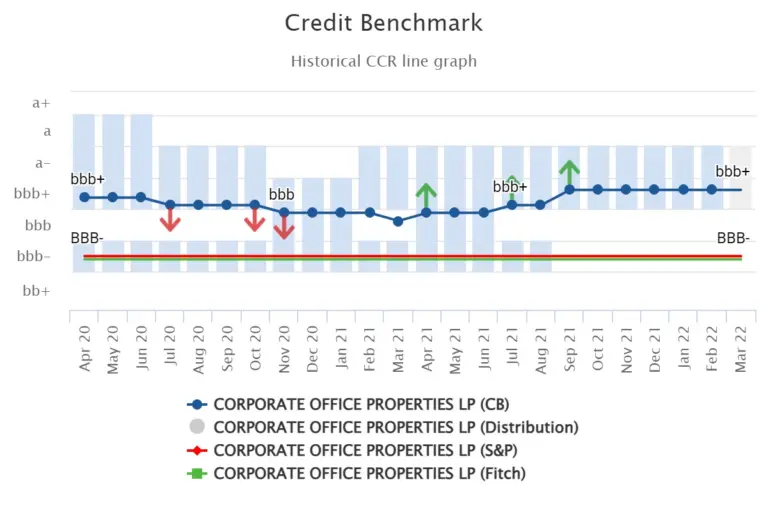

Figure 1 (below) shows the consensus aggregates and current credit distribution for US Industrial and Office REITs compared with Global Real Estate Investment & Services and Global REITs (which includes Industrial & Office REITs companies).

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Credit Trend and Current Credit Distribution

By Dec-20, US Industrial and Office REITs credit risk had increased by over 15%, due to COVID. However, it was impacted by COVID less and recovered sooner than Global Real Estate Investment & Services and Global REITs. Today, US Industrial and Office REITs has almost fully recovered from COVID.

Over 92% of US Industrial and Office REITs companies are IG rated, this is compared to 54% for Global Real Estate Investment & Services and 65% for Global REITs.

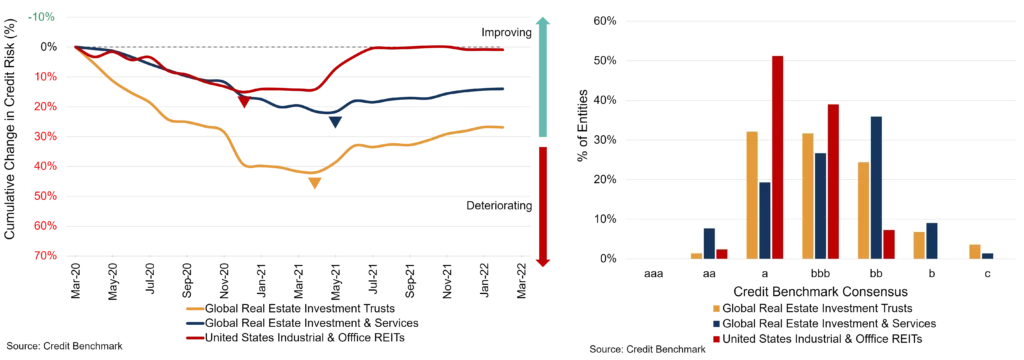

Figure 2 shows a detailed credit trend for Corporate Office Properties, L.P., a US real estate investment trust that owns, manages, leases, develops, and selectively acquires office and data centre properties.

Figure 2: Corporate Office Properties, L.P.