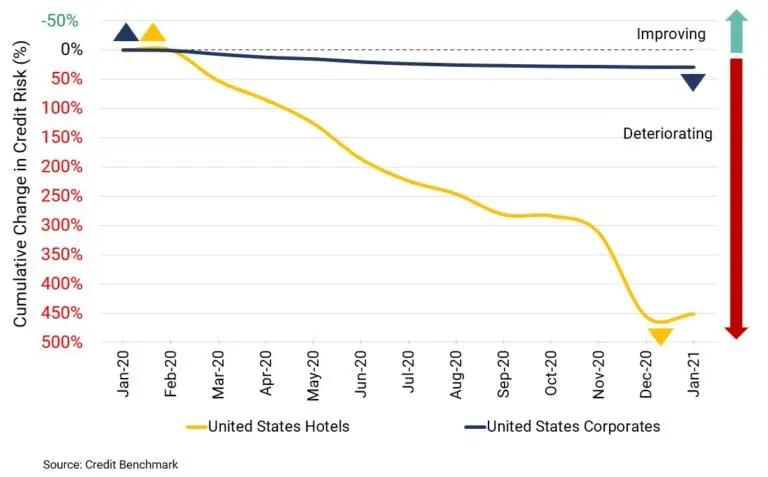

The US stimulus package should coincide with further lockdown easing as the vaccine is rolled out. With savings rates at historical highs, a major slug of pent-up cash is likely to make its way into the hard-hit leisure sector. And in that sector, hotels have been hardest hit, with average credit risk climbing by a staggering 456% from 58 Bps to a peak of 322 Bps in the past year. This is roughly a 1 in 30 chance of default over a one-year horizon.

Figure 1: Changes in Average Credit Risk, US Hotels and US Corporates

This move is the largest increase of any sector monitored by Credit Benchmark; Figure 1 shows that the equivalent increase for US Corporates overall is about 25%.

But despite occupancy rates below 50% of their norm and revenues down 35%, equity shares in some of these firms have been outstanding recent performers – since hitting bottom in May 2020, Marriot and Hilton are up 100%, Hyatt are up 150%, and Wyndham are up an astonishing 230% – better than Bitcoin.

Figure 2 shows the more recent, 6-month impact of COVID on 32 US hotels and casinos [please continue below to access full report].

Figure 2: Six month credit levels and changes for US Hotels and Casinos

Credit Benchmark data is now available on Bloomberg – high level credit assessments on the single name constituents of the sectors mentioned in this report can be accessed on CRPR or via CRDT . Get in touch with us to request your free trial for Credit Benchmark Premium Data and Analytics on Bloomberg.