Warning signs continue to flash in the $5.5trn US Commercial Real Estate (“CRE”) market, with rising rent arrears and defaults, plus sales of some properties and real estate loans at steep discounts. The latter now extends to performing loans as lenders and investors anticipate widening problems.

Office sectors are worst affected by the persistence of hybrid working, with a Knight Frank survey reporting that most large firms are cutting office space. Retail is another casualty of work-from-home; already heavily indebted malls and former flagship stores are struggling with lack of footfall.

There are knock-on effects: municipal revenues will be hit by a shrinking property and sales tax base; the CMBS market is likely to see lower volumes and falling prices; and banks may struggle to liquidate property collateral for broader corporate (i.e. non-real estate) loans if those also turn sour.

Most of these problems are concentrated in cities like tech-hub San Francisco, or more generally in older properties in cities like Washington DC and New York. And there are also opportunities: demand for storage and warehousing space is growing. Industrial property demand in some locations is benefiting from onshoring as companies bring manufacturing home and hold more manufacturing inventory. Second-tier office sites are being converted to residences.

The S&P US REIT index reflects some of these issues, down 12% over the past year (vs. S&P 500 +3%). And real estate funds have explicit “gates” to manage withdrawals and avoid a property market overhang. So far, the adjustment has been modest.

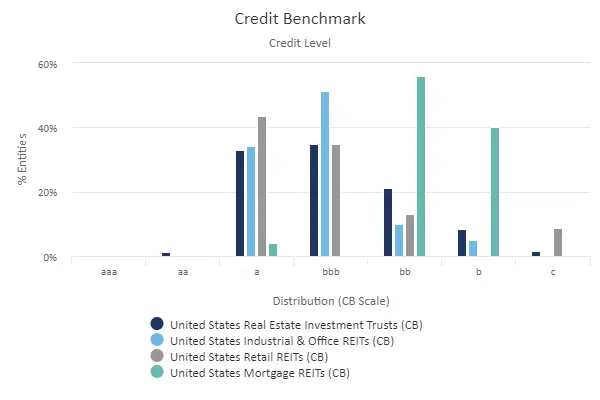

The consensus credit distribution chart below shows that the majority of US REITs are investment grade, with around two-thirds in the a and bbb categories. The exception is Mortgage REITs, representing secured CRE loans. The majority are in the bb category and 40% are in single b. Retail REITS are generally high quality but just under 10% are in the c category – i.e. significant risk of default.

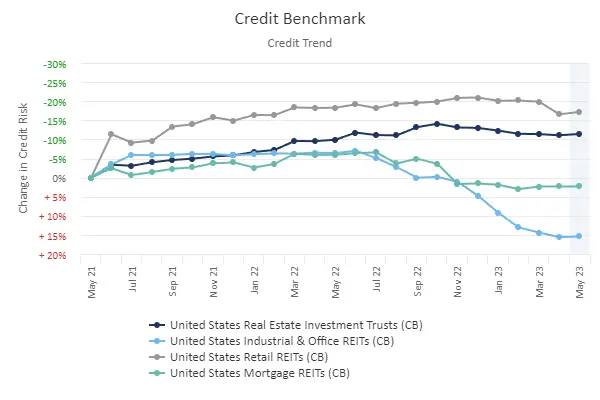

The next chart shows recent credit trends for these sectors.

In the past two years, the main index shows a credit risk improvement of 10%, now flattening. US Retail has been even stronger, particularly after Covid lockdowns ended. Mortgage REITs have underperformed, giving up all their post-Covid gains. The worst performer is the combined Industrial & Office category, with a 12M credit deterioration of 10%. This suggests that any Industrial improvements have been more than weighed down by problems in the Office sector.

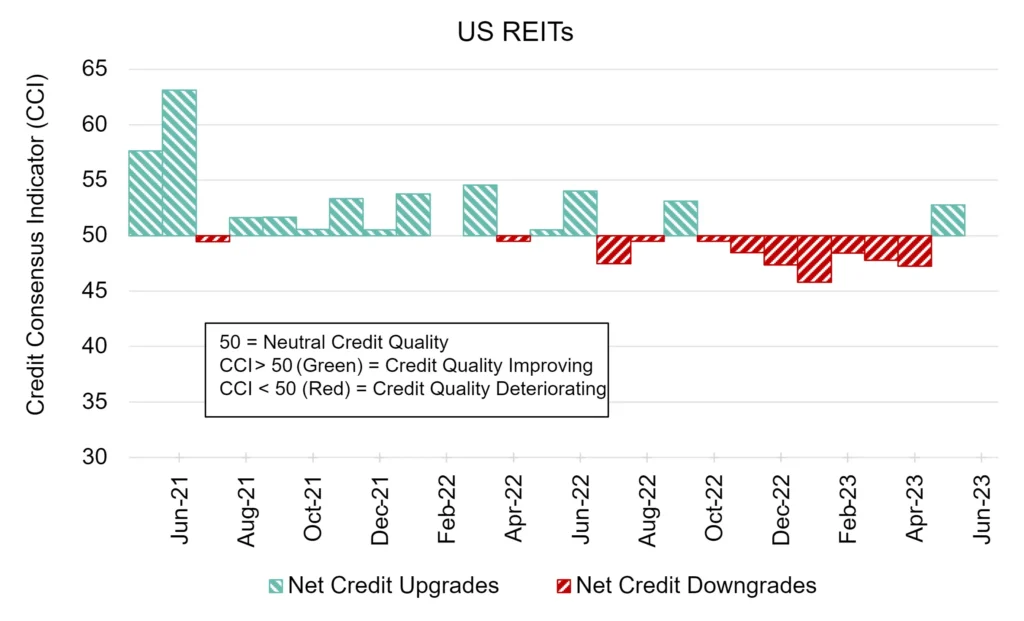

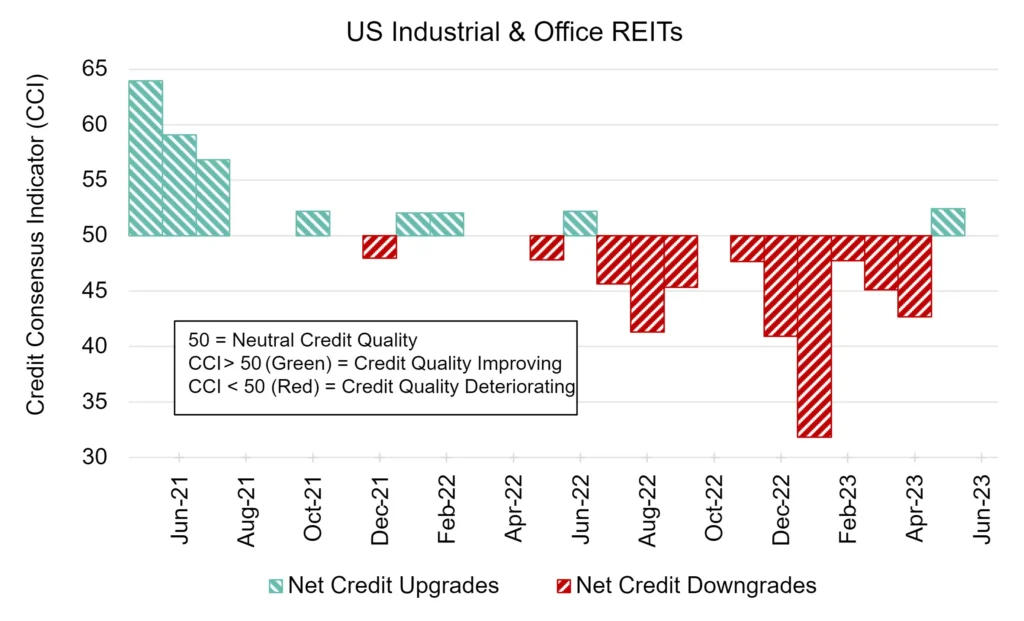

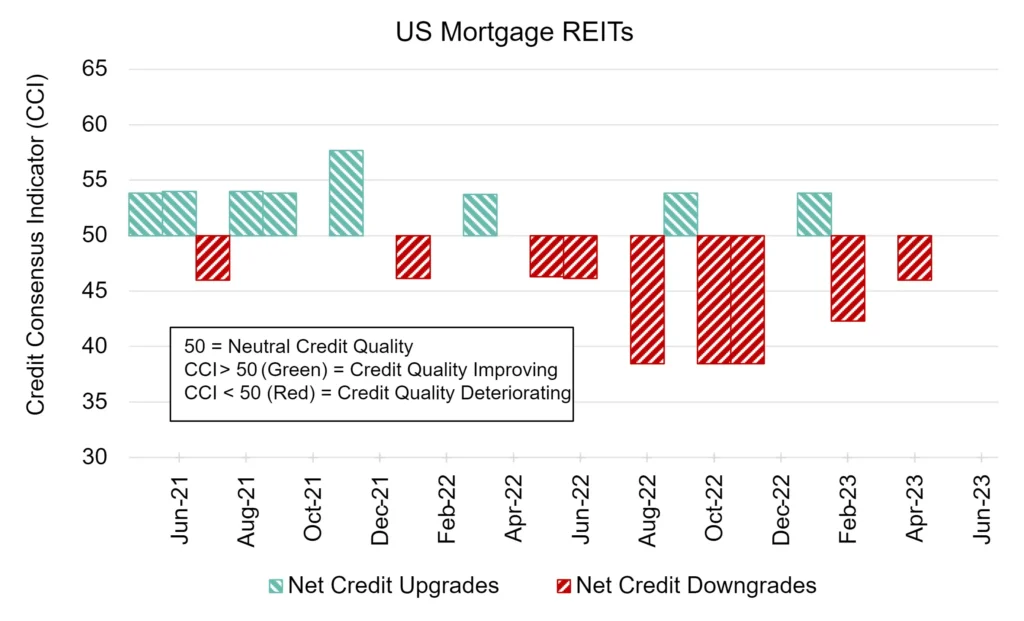

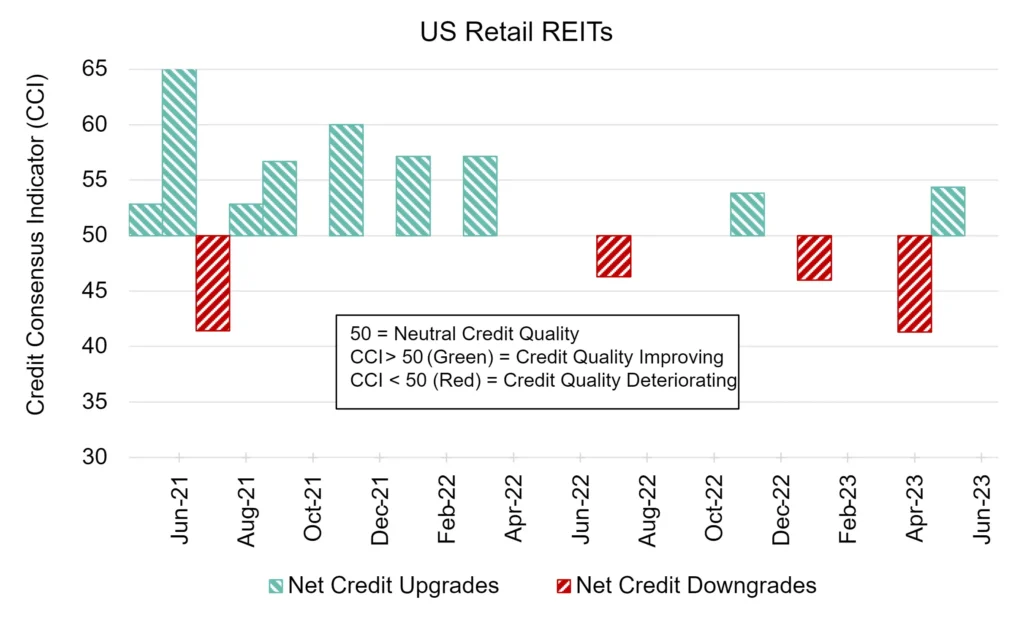

The next set of 4 charts plot the 2-year Credit Consensus Indicators (“CCIs”1).

The US REIT universe actually turned positive this month after being in net downgrade territory for most of the past year. Industrial and Office shows the largest downgrade bias in this period, although the pace has recently eased, and is currently positive. Retail also shows a positive credit outlook in the latest month, but Mortgage REITs are mired in downgrades with only brief moments of modest respite.

1 The CCI tracks the monthly net level of credit upgrades / downgrades for a given sector, based on the combined risk views of expert credit analysts at over 40 global banks. A CCI score of 50 indicates an equal number of upgrades and downgrades; over 50 is improvement; under 50 is deterioration.