According to the JD Power LMC Automotive Forecast for September, US auto sales are expected to decline 13.3% year on year following record sales results in August, when retail sales rose 6.2%. In addition to the fact that Labor Day sales were counted in August’s report instead of September’s, the decline is likely due to increasing prices hurting consumer spending.

Across the third quarter, retail sales are expected to be flat compared with the same time period last year, an improvement from the first half of the year. Looking ahead to the fourth quarter, overall consumer affordability will likely be aided by rate reductions.

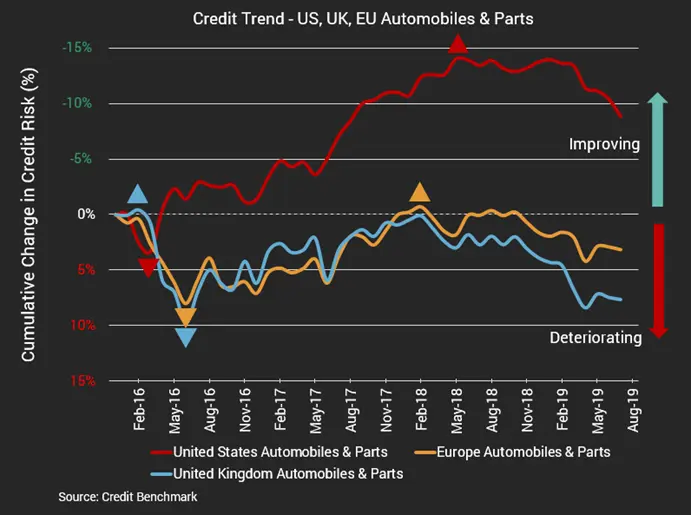

Consensus risk data from Credit Benchmark, sourced from 40+ of the world’s leading financial institutions, shows credit risk levels increasing for EU, UK and US Automobiles & Parts companies.

According to the data, the UK, EU and UK have all seen declining credit quality from July 2018 to July 2019, with the US seeing the biggest decline at 5.3% after earlier improvement. Both the EU and UK auto companies have seen declining credit quality over the past year, dropping by 3.1% and 4.8% respectively.

Why are financial institutions taking their foot off the gas in terms of their opinions on auto companies’ credit quality? For one thing auto manufacturers continue feel the impact of global supply chain challenges and ESG risks. For another, delinquencies on auto loans are on the rise. For these reasons, the auto sector should continue to be closely monitored.