Credit risk for the Telecoms sector has been relatively stable but the next few months will be critical in understanding how the balance of power in and around Telcos, Corporates or Big Tech will play out. Major changes in credit risk for Telcos are likely.

The global Telecoms sector faces a significant transformation. 5G technology is now in advanced testing and 5G mobile devices are due early next year. Corporates are interested – they increasingly want their own fast, secure and private networks to support their processes and products. For example: safe autonomous vehicles require the rapid exchange of huge data volumes.

The bottleneck in all of this is network coverage. 5G should mean no more buffering – if you can get a 5G signal. Responsibility for that sits with Telecom companies, and it is understandable that they are reluctant to let Corporates have a free ride on their networks.

US Telcos face some unique new challenges: low US population density has historically meant a lack of competition (providers often have local monopolies), making US internet access very expensive (3x) compared to Europe. But Big Tech (especially Amazon and Google) are aiming to grab a free 5G ride, by creating a network of networks. This would give them the super-fast broadband they need to provide exponentially increasing volumes of streaming content. The EU does not yet face the same threat from Big Tech, but European Corporates are now competing – they will be significant bidders in the next bandwidth auction.

These changes may also provide an opportunity for traditional Telcos, with 5G giving them the bargaining power that they need to charge for access. And the controversial repeal of US Net Neutrality laws could generate capital for Telcos to ramp up investment in fibre infrastructure and overall coverage, but they need to ensure that they get a sustainable return on that increased investment.

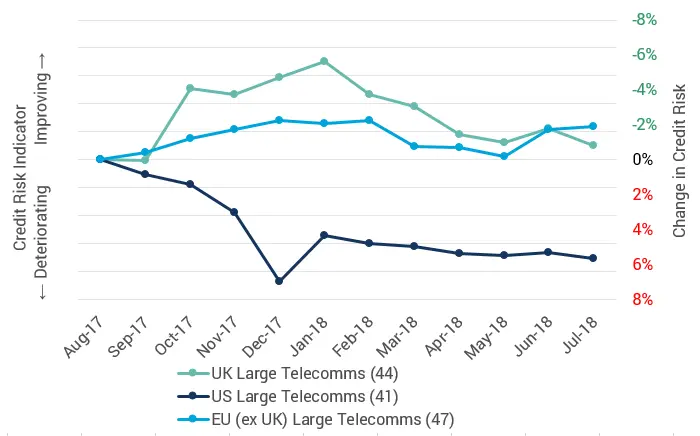

Bank-sourced credit data is beginning to reflect these uncertainties. The chart below shows a modest but sustained deterioration in US Telco credit quality (-6%) over the past year. Credit risk for large EU and UK Telcos have deteriorated so far this year, especially the UK. The next few quarters will no doubt further exaggerate these trends.