Debate about the likely economic impact of Brexit has dominated UK news for weeks. Location changes and business warnings from some high profile UK stalwarts – such as Jaguar Land Rover, Bentley, Dyson and Barclays – suggest growing risks.

And the corporate credit risk picture appears to confirm that UK plc faces some challenges which are not affecting the wider world.

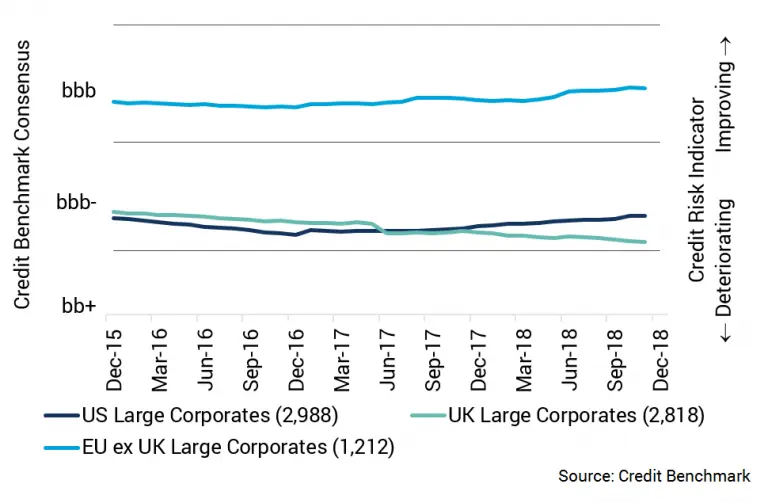

The chart below plots average credit trends for a very large sample (more than 7,000 companies) across the UK, US and EU ex UK. This shows a steady improvement in the EU (ex UK) although recent German growth concerns may cause this to stall. The US decline in 2016 reversed, in part because of the fiscal package. But the UK shows a steady decline; average UK credit risk is now close to breaching the Investment Grade threshold.

But – as always – the devil is in the detail. Per data from Credit Benchmark, bank-sourced credit views on many of the companies in the UK sample haven’t changed recently, and the overall number of upgrades almost matches the number of downgrades. What is happening is that specific sectors – consumer goods, consumer services, and technology – are seeing large changes in credit risk, which is pushing the average risk up and the average rating down.

Brexit-related uncertainty is clearly an important factor in corporate credit risk assessments and consumer demand, but there are other factors involved. With Brexit looming, the UK Government has also focused on improving its finances; the UK Sovereign rating is currently at aa according to major banks (albeit down from aa+ a few months ago). The associated fiscal austerity has hit some consumers very hard, and this has dented demand for consumer goods and services as well as consumer technology and software.

Public spending cuts have also contributed to the woes of the Government outsourcing sector, with the Carillion bankruptcy as a particularly high profile example. But austerity has had a negative impact on a broad range of IT consultants and contractors. A little-known factor here is IFRS 15. This accounting standard became effective in early 2018, and means that revenue recognition rules are now much more closely aligned with US-based FASB standards. IFRS 15 makes it more difficult to recognize large accrued income values as current revenues, and has generally resulted in much shorter amortizations periods for capitalized development costs – with a significant impact on some technology companies, especially in the UK.

By contrast, the credit position of many FTSE 100 companies has benefited from overseas earnings and Sterling weakness. The average consensus rating for this group has improved modestly, with risk dropping by about 5% over the past year. And Oil & Gas, Utilities and Health Care all show a recent balance in favor of Upgrades, while Industrials are in balance.

Whatever form Brexit takes, credit risks for the typical FTSE 100 constituent are unlikely to be affected, with Energy and Utilities in particular looking more like safe havens. And if austerity is coming to an end, then even the Consumer and Technology sectors might provide some positive surprises.