The Trade Credit Insurance market is dominated by a few large companies, but competition is surprisingly healthy due to a large number of smaller firms, with some of them only transient participants.

The market broadly follows growth in the global economy, but recent trade tensions (US-China, Brexit) have caused significant disruption to supply chains, with some major realignment in cross-border trade credit risks.

The credit insurance market operates on tiny margins. According to AU Group, a specialist trade credit insurance broker, revenues for the largest firms only represented about 0.3% of the underlying insured exposure in 2018. But loss ratios (the proportion of revenues paid out to cover policyholder losses) are currently around 50% (close to their global lows), so the industry is charging a healthy premium for current risks.

The current loss ratio is relatively benign, with the industry viewing 70% as the maximum sustainable loss rate. But loss ratios can show dramatic swings, having peaked above 100% in the last major downturn about a decade ago.

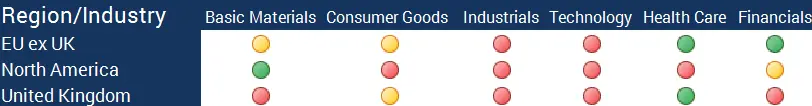

Credit data sourced from the world’s leading financial institutions provides some clues about future trends in loss rates. Figure 1 plots percentage changes in credit risk over the past 6 months for a range of industries and regions.

The red circles show that credit quality is deteriorating and credit risk is increasing. The green circles show that credit quality is improving and credit risk is decreasing. These trends are likely to have some bearing on trade credit insurance premiums.

Most of the UK industries shown here are seeing deteriorating credit quality; Industrial and Technology companies across all regions are also deteriorating. Improvements are concentrated in Basic Materials (North America), Health Care (EU ex UK, and UK) and Financials (EU ex UK).

Clearly, trade is suffering as a result of the prolonged US-China tariff war and Brexit-related uncertainty. The outlook for trade credit insurance in 2020 will be closely linked to global credit trends and the resolution of current global trade tensions will be critical to the future direction.

Further insights into how consensus data can assist with mitigating trade credit insurance costs and supply chain credit risk can be found in our previous whitepaper on the topic.

If you’d like to learn more about how consensus data can help your business manage trade credit insurance risk, please get in touch with us.