Global Healthcare has had a difficult time in recent years, with Deloitte reporting that global healthcare spending grew by less than 3% in the period 2013-2017.

Governments face the challenges of aging populations, increasing longevity, a growing list of chronic health conditions, and increasingly expensive traditional medical technology. The sector has also been hit by trade disputes with added uncertainty over the impact of US healthcare policy on global pharmaceutical prices.

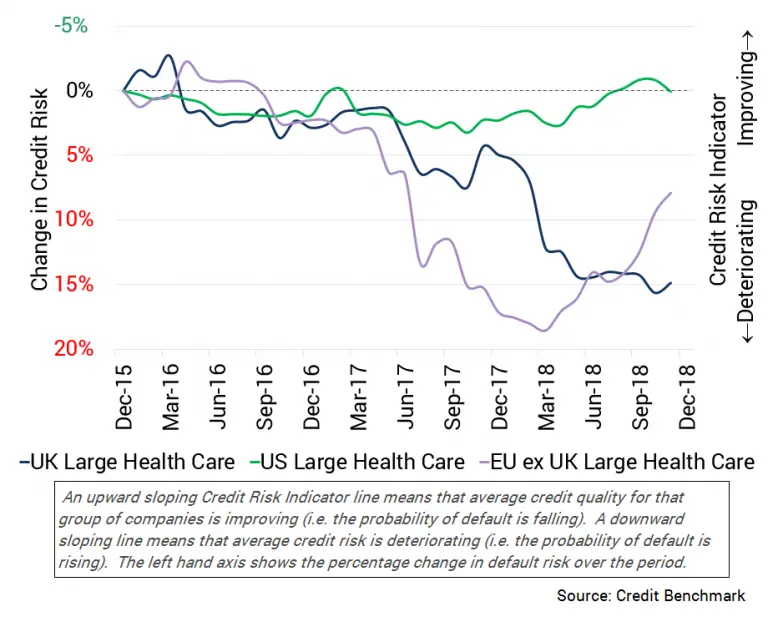

Data from Credit Benchmark charted below shows that credit trends in the US, UK and EU (excluding UK) reflect the recent Healthcare difficulties, with all regions showing various rates of decline in credit quality in 2016 and early 2017. The decline has persisted in the UK.

However, per the data, the US has stabilized, and in the EU (excluding UK) there has been a sustained recovery in recent months.

Indeed, the outlook for healthcare in 2018-2022 is looking brighter, with spending projected to grow at more than 5%, reaching an annual level of $10trn.

In addition, increased use of digital technology – such as AI and nanotechnology – raises the prospect of cheaper but more efficient healthcare over the next decade.

The European Commission recently announced plans to boost the development and use of AI in Europe, with specific focus on healthcare and other sectors. The aim of the initiative is to reach €20bn of private and public investments by the end of 2020.

The healthcare sector is also seeing a surge in venture capital investment and M&A; Pitchbook reports that investment deals in healthcare devices and supplies rose 150% in 2018.