The decline of the Turkish Lira has raised a number of financial contagion worries.

Initially these focused on European banks, but closer analysis suggests that the direct effect on Europe is manageable (MarketWatch).

There are more fundamental concerns about some of the Developing markets, with South Africa in particular seeing a sharp currency drop. Investors are worried that the recent trade friction will hit the Developing countries especially hard: if the US is willing to turn its back on strategic lynch pin Turkey, then what does that say about its stance on other countries? As bilateral deals begin to erode the WTO framework, there will be winners and losers amongst Developing countries; some may seek closer trade links with Russia or China.

For Europe, this environment creates opportunities as well as threats. Merkel has maintained good relations with neighbours Russia and Turkey; and the EU has earmarked a growing budget for aid to Developing countries as part of a long run, sustainable approach to tackling the economic migrant issue.

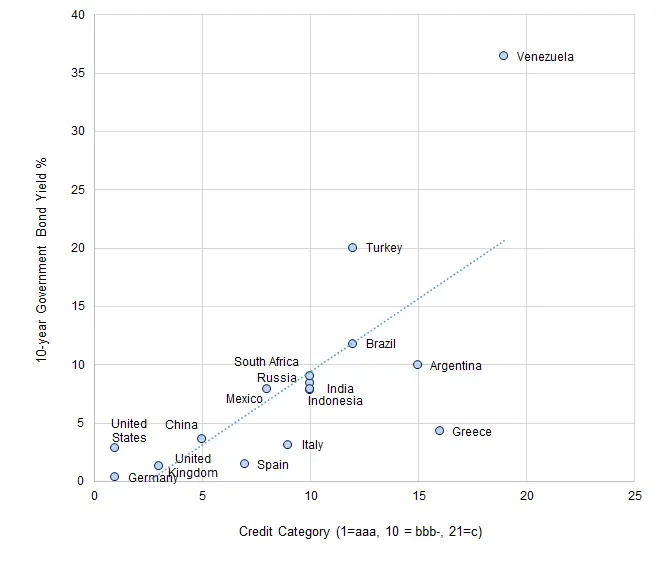

The chart below shows the relationship between bank-sourced views of Sovereign credit risk and the nominal 10-year Government bond yield for a sample of Developed and Developing countries. (Real yields distort the chart too much due to Venezuela’s hyperinflation; with the exception of Venezuela, the charts looks similar for real and nominal yields.)

Source: Bloomberg, Credit Benchmark

The fitted line tracks the stable, positive relationship between credit risk and nominal yields. Argentina and especially Greece – both recovering from years of crisis – are trading on low nominal yields compared with their credit risk. Turkey and Venezuela are on particularly high yields, and neither of these have been adjusted for the higher expected inflation due to currency weakness. Venezuela is already firmly in the hyperinflation zone, while Turkey is likely to see a significant one-off increase in inflation due to the sharp depreciation of the Lira this year.

Emerging market crises are a periodic feature of financial markets; typically these trigger sell-offs in currencies, bonds and equities across the Developing Economies. The chart suggests that Russia, India, South Africa and Indonesia are all clustered around the Investment Grade boundary, with bond yields trading in the range 7% – 9%. Mexico is on a similar yield but is well within the Investment Grade category. In credit terms, China sits between the UK and Spain; its bond yield is about 1 percentage point above the US.

This suggests that there is increasing economic diversity within the Developing Economies; as a result, any blanket market sell-off is likely to create selective investment opportunities.