Insights

Credit Spotlight on Global Defense

Rising defense budgets and investment in new technologies are seeing a boost to the credit quality of global aerospace and defense firms. Credit Benchmark reviews recent credit trends in the industry.

FILTER:

ARCHIVES:

SEARCH:

Russia – Ukraine Credit Shock Hits European Food Producers

The war in Ukraine has already had a dramatic impact on the global food trade with Russian aggression damaging global food supplies, and the fertiliser industry is also due to feel the pinch. EU Food Product firms are taking the hit, with a 4% drop in credit quality in the last month. Consensus data will continue to track the effect of the war on sectors and companies, rated and unrated, across the globe.

Gender Diversity and UK Corporate Financial Health: Stronger Credits Have More Female Board Members

In 2011, FTSE350 boards were 91% male – since then, a target of 33% average female representation has been achieved. Corporate diversity has been proven to improve performance, and consensus credit data shows that firms with more women on their board are also a better credit risk. This report analyses credit performance for companies that do and do not meet the 33% target.

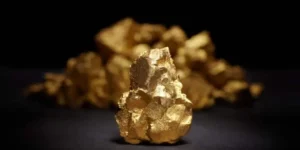

Gold Mining: Russian Invasion Squeezes Supplies and Boosts Demand

Russia is one of the world’s largest gold producers, and sanctions and inflation fears have seen the price of gold and other precious metals spike in the past month. Outside of Russia, many suppliers may have their eureka moment as prices continue to rise. This report compares credit consensus ratings to equity prices for some of the largest global mining companies.

VIX, Credit Spreads and Consensus Credit Risk

Market risk indicators are increasingly important amid global tensions and interest rate volatility. Consensus credit data offers a view beyond the VIX index and credit spreads – and recent data suggests financial institutions see the current problems translating into higher default rates.

Unpacking Bond Portfolio Risk with Consensus Credit Data

As credit markets become more challenging and volatile amid Fed tightening and expanding credit spreads, consensus data provides a stable reference point for assessing underlying portfolio credit risk. This report analyses a universe of bonds tracked by the iBoxx High Yield Index.

US Leads Oil & Gas Credit Recovery

The energy sector had a difficult pandemic and Government attempts to pursue net zero carbon policies added further challenges. But with the UK oil giants announcing record profits, it is clear that their setbacks were short-lived. This report examines regional credit trends and recovery patterns for US, UK, EU and Asian Oil & Gas companies