Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

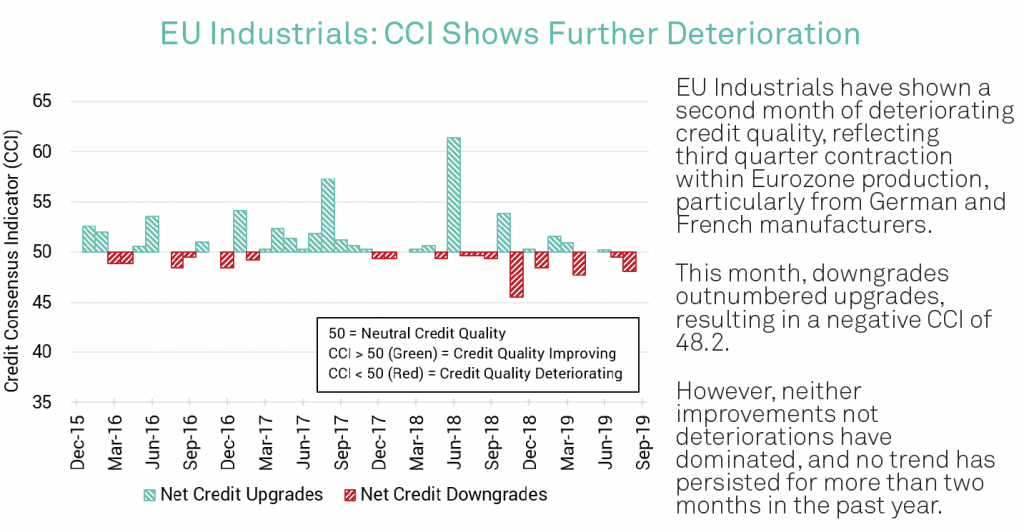

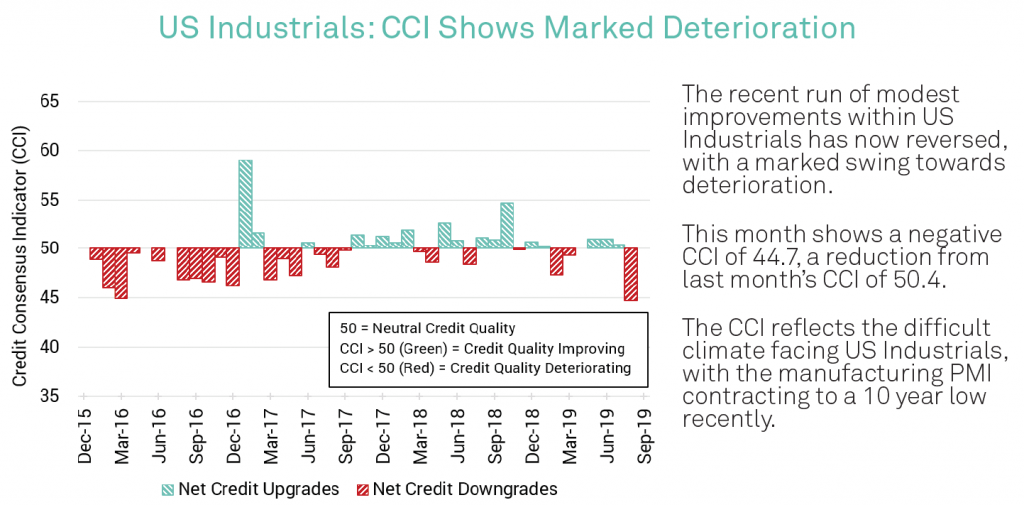

The October CCIs show a continuation of the previous month’s deterioration in UK and EU ex-UK industrial companies, and a sharper increase in downgrades for US industrial companies, reversing a recent run of overall modest improvement.

The UK CCI for October is 49.4; trend remains in negative territory.

.

The EU CCI for October is 48.2; deterioration persists.

.

The US CCI for October is 44.7; recent run of modest improvement reverses, downgrades dominate.

To download the full CCI tear sheets for UK, EU (ex-UK) and US Industrials, please enter your details below: