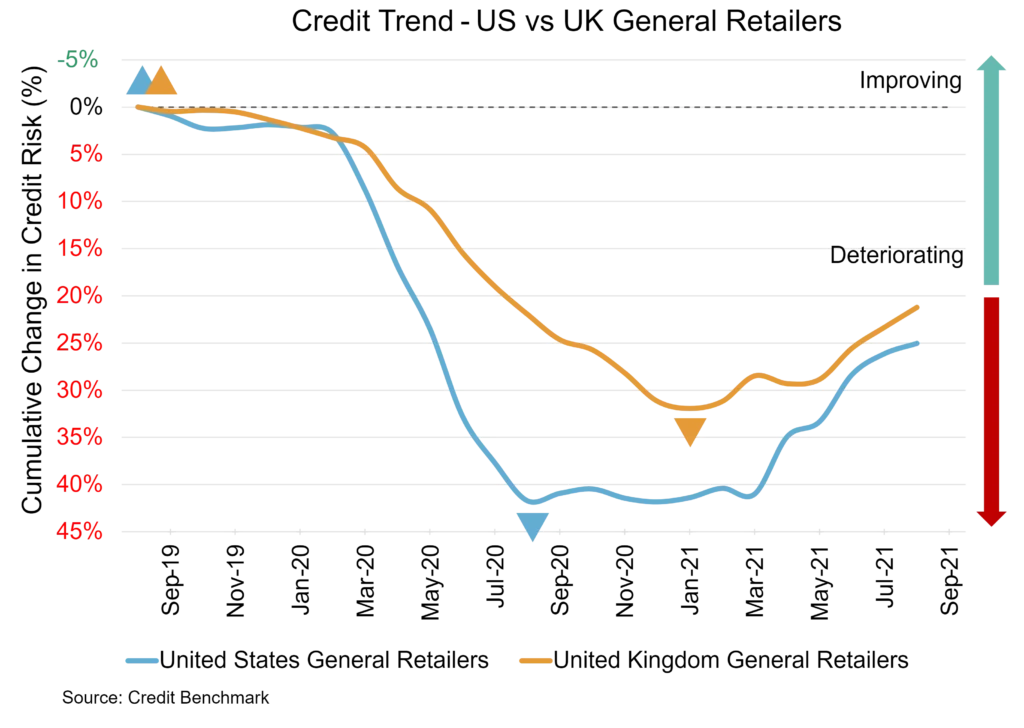

US and UK Retailers are enjoying a steady improvement in credit fortunes after a long period of difficulty and some big increases in default risk. Strong vaccination rates along with accommodative monetary and fiscal policy should continue to support each sector.

The major issue continues to lie with supply chains. This is at the forefront of US and UK Retailer’s minds, affecting everything from the goods sold to the drivers that transport the goods to the catalogues that many still use. Turmoil in energy markets isn’t helping. Even if the worst of this massive problem has passed, the negative effects may linger for some time. Measures like extending the hours of a major shipping port can only do so much in the short-term. With bottlenecks threatening to curtail Christmas buying, the festive season may look different this year.

The future is looking brighter for retailers, but supply chain issues may lower the ceiling for improvement in the months ahead.

US General Retail Firms

US retail keeps moving in the right direction. Credit quality has improved by 1% from last month and 12% over the last year. Default risk remains at 58 bps, compared to about 65 bps six months ago and at the same point last year, reflecting the period last year into the beginning of this year when default risk saw only minor change. The sector’s overall CCR rating is bb+ and 79% of firms are at bbb or lower. Overall US corporate default risk is 61 bps, with a CCR of bb+ and 80% of firms at bbb or lower.

UK General Retail Firms

The outlook for UK retail is also getting better. Default risk was high at the same point last year (96 bps), then worsened (was 103 bps six months ago). It was 97 bps last month and is now 95 bps. This reflects a slight improvement in credit quality of 2% compared to last month, 8% compared to six months ago, and 1% compared to the same point last year. The sector’s overall CCR rating is bb and 92% of firms are at bbb or lower. Overall UK corporate default risk is still 80 bps, with a CCR of bb and 90% of firms at bbb or lower.

Please complete your details to continue reading this report and to access the single name credit matrix:

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 60,000 financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.