Credit Benchmark has published the latest monthly credit consensus data (from October 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities.

The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix.

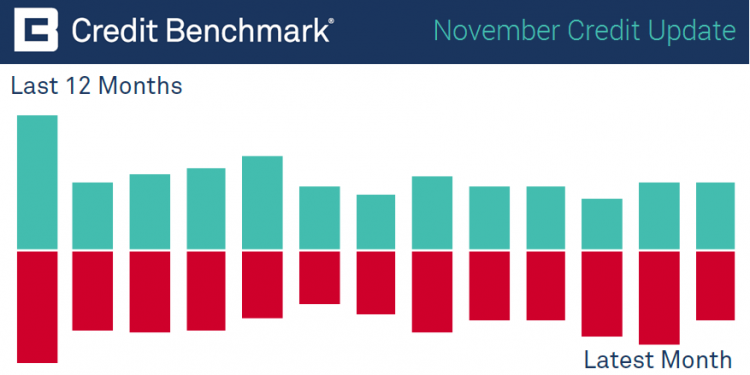

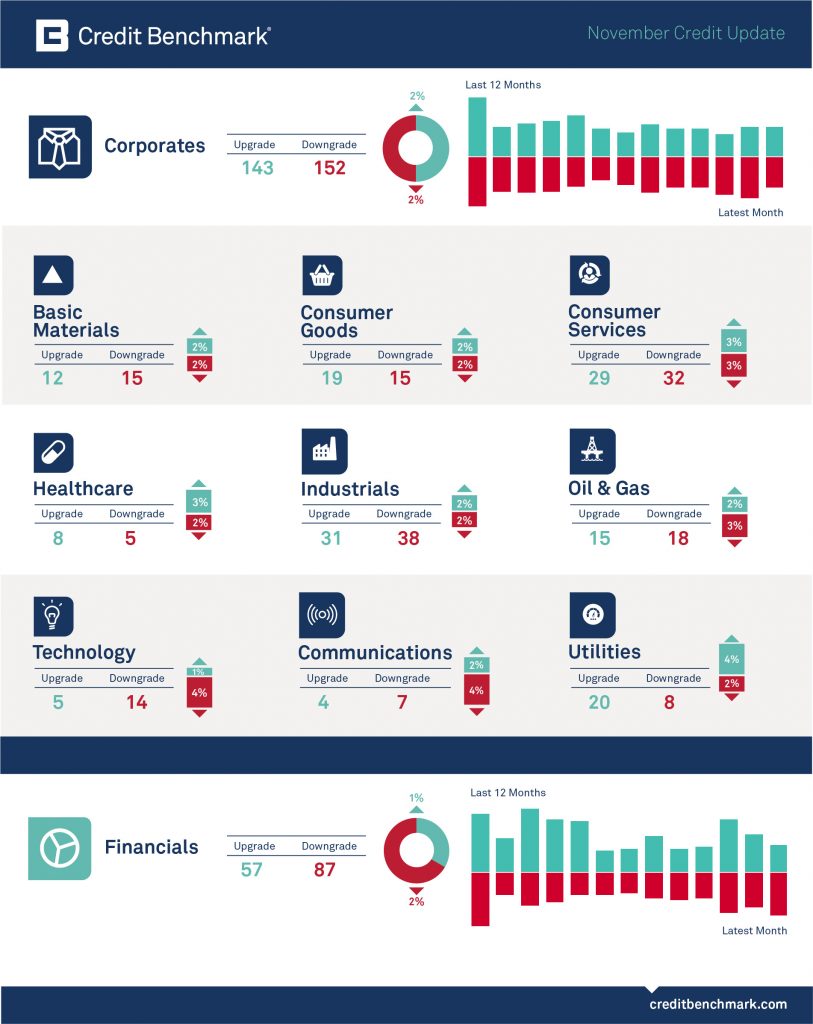

Monthly consensus upgrades and downgrades:

Last month showed improvements across 357 obligors and deterioration across 335, with 61 moving by more than one notch.

Industries:

Note: Monthly upgrade / downgrade movement is based on 26,000 individual Consensus PDs.

To learn more about consensus ratings and analytics from Credit Benchmark, email [email protected].

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.