Rising inflation has pushed up Government bond yields and many Central Banks are now increasing short rates. Shortages of labour and materials are driving a major short-term adjustment to the price level, and the challenge for rate-setters is to manage long-term inflation expectations downwards without completely derailing the global economy as it recovers from COVID containment measures.

Consensus credit data is available for 1,000 corporate and financial aggregates (based on more than 30,000 issuer-level credit estimates), with monthly time series back to 2016. These aggregates represent unweighted geometric means across the constituent issuers. This data gives some insights into the possible impact of rising rates on credit risk.

This short study focuses on models of changes in selected PD aggregates for UK sectors, and uses changes in the UK Corporate Credit Consensus PD average, the Fed Effective rate, the WTI Oil Price and the US High Yield OAS as explanatory variables. Rate, spread and oil data are sourced from the St Louis Fed website. The study period is mid 2016 – early 2020, pre-dating the aggressive rate cuts in response to COVID restrictions. This includes a period when the Fed had been steadily tightening policy.

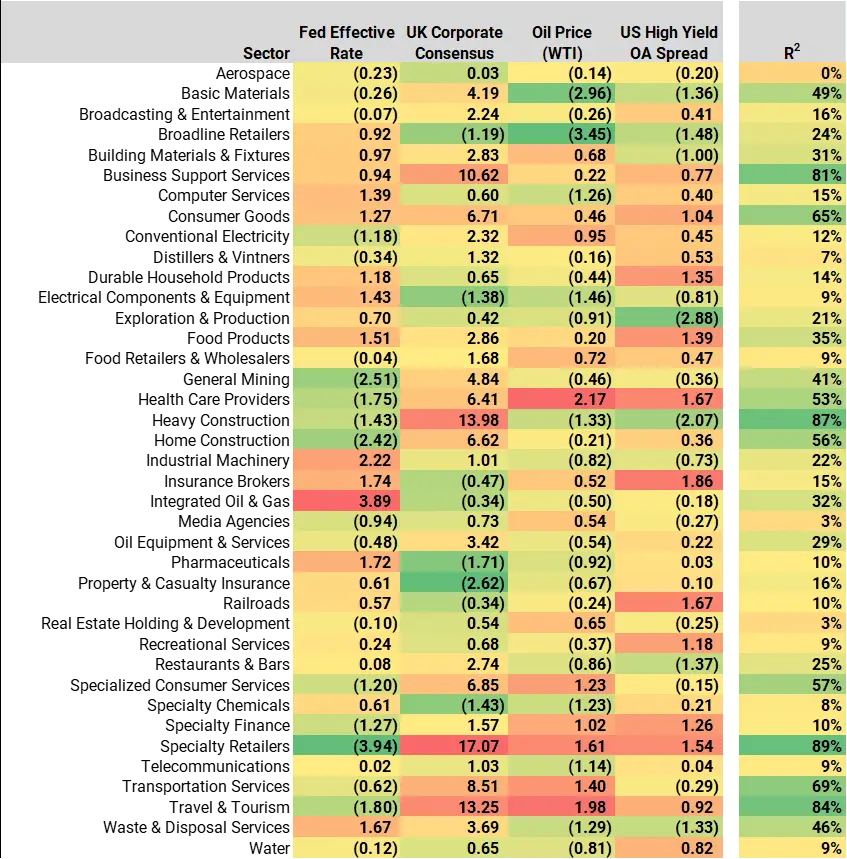

Figure 1 shows the t-statistics and R2 results for a large group of UK sector aggregates.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Summary Regression Results: t-statistics and R2 for UK Sectors

The t-statistics indicate how much each sector PD is positively or negatively affected by each of the four factors, after removing the impact of direct correlation between those factors.

The R2 shows the combined influence that the four t-statistics have on the overall credit risk of each sector – the influence is as low as 3% for Media Agencies and as high as 89% for Specialty Retailers.

The UK Corporate Consensus represents general UK credit risk, and understandably it explains a lot of the variation in some of these aggregates; but other factors are important for some key sectors.

After removing the effect of general UK credit risk, there are some sector-specific effects that are explained by the other factors. For example, Fed hikes strongly increase credit risk in the UK Integrated Oil & Gas and Industrial Machinery sectors. Other sectors which are likely to see a moderate risk increase include Food Products, Insurance Brokers, Pharmaceuticals and Waste Disposal Services.

Fed hikes actually reduce risk for Mining, Health Care, Construction, Speciality Retailers and Travel & Tourism. (Some of these sectors may be responding to associated currency effects that reflect changing interest rate differentials).

Rising oil prices are bad credit news for Healthcare Providers, Speciality Retailers, Transport, and Travel & Tourism. In credit terms, Basic Materials and Broadline Retailers benefit from oil price rises; it is worth noting that the credit risk for Integrated Oil & Gas companies is largely unaffected by the oil price – perhaps because price rises can be passed on and price drops are not.

An increase in US High Yield spreads – as a proxy for global high yield bond risk and funding costs – is credit negative for Health Care providers, Insurance Brokers, Railroads, and Speciality Retailers. It is positive for Broadline Retailers, Oil E&P companies, and Heavy Construction.

Sectors that are most strongly influenced by the overall level of UK Corporate credit risk include Basic Materials, Business Support Services, Consumer Goods, General Mining, Health Care, Heavy Construction, Home Construction, Specialized Consumer Services, Speciality Retailers, Transport, and Travel & Tourism. These are the sectors that will suffer most in a downturn and benefit most in an upturn.

With Central Banks raising rates to tackle inflation at time of materials and labour shortages, it is likely that the default rate will rise and the forward-looking probability of default will anticipate this.

This analysis shows which sectors are likely to see the largest increase in credit risk as a result, and in particular those sectors that are particularly vulnerable to adverse developments in multiple factors.

With the full consensus credit data set (more than 1,000 aggregates) this type of analysis can be extended to different countries, sectors, time periods and explanatory variables.