To download the May 2021 Oil & Gas Aggregate PDF, click here.

.

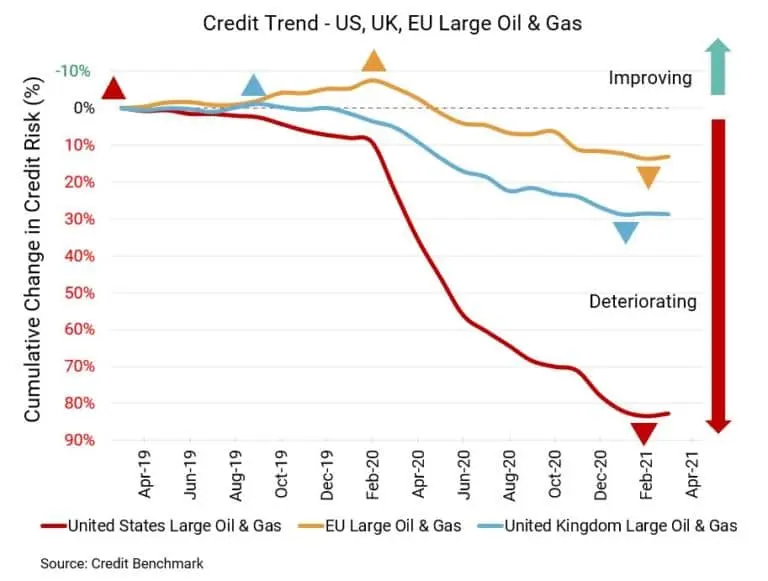

Dynamics look better for the US, UK, and EU energy sectors. The IEA is projecting demand for all fossil fuels to grow “significantly” in 2021. Demand is coming back for oil and natural gas as economies reopen, even if sectors like travel have yet to return to pre-pandemic levels. Some companies are optimistic about a recovery; others are further along. There will be bumps along the way, like potential cyber attacks, and some companies will still be in distress. Demand will grow but perhaps not as smoothly as some would like, especially if some areas still suffer from the pandemic. But the overall direction is more positive than negative.

Credit Benchmark consensus data show little recent change in credit quality for the three energy sectors. If market conditions continue to improve, real improvements in credit may come sooner rather than later.

.

US Oil & Gas

US energy gets a breather. Credit quality has fallen 49% year-over-year and 8% from six months ago but is largely unchanged from last month. Default risk is currently 71 bps; it was 72 bps last month, 66 bps six months ago, and 48 bps at the same point last year. Now this sector’s overall rating is bb+ and 86% of firms have a CCR rating of bbb or lower. Overall Large US Corporate default risk is 57 bps, with a CCR of bb+ and 80% firms at bbb or lower.

UK Oil & Gas

UK energy remains stable. Credit quality is down 49% year-over-year and 8% from six months ago but mostly unchanged from last month. Default risk remains at 50 bps; it was 48 bps six months ago and 41 bps at the same point last year. Now this sector’s overall rating is bb+ and 75% of firms have a CCR rating of bbb or lower. Overall Large UK Corporate default risk is 64 bps, with a CCR of bb+ and 86% firms at bbb or lower.

EU Oil & Gas

EU energy is also steady. Credit quality has dropped 20% year-over-year and 6% from six months ago but is essentially unchanged from last month. Default risk remains at 32 bps; it was 30 bps six months ago and 27 bps at the same point last year. Now this sector’s overall rating is bbb and 72% of firms have a CCR rating of bbb or lower. Overall Large EU Corporate default risk is 34 bps, with a CCR of bbb- and 73% firms at bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.