Download May intra-month flash update infographic below.

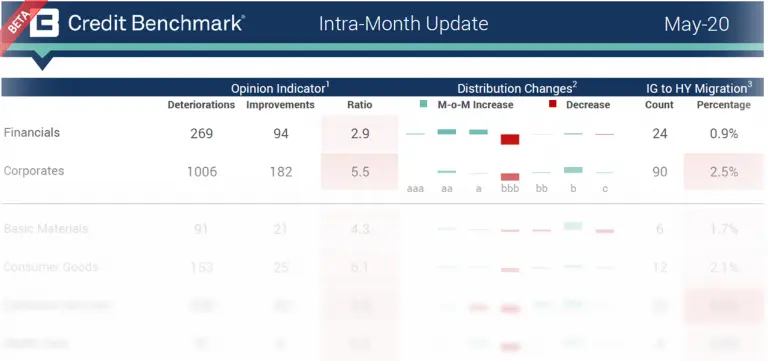

Credit Benchmark have released the intra-month flash update for May, based on a partial subset of the contributed credit risk estimates from 40+ global financial institutions.

In the update, you will find:

- Opinion Indicator: Assesses the month over month observation-level net downgrades or upgrades.

- Ratio: Ratio of Deteriorations and Improvements calculated as Deteriorations / Improvements

- Distribution Changes: The increase or decrease in the percentage of entities in the given rating category

- IG to HY Migration: The absolute and relative movement from investment-grade to high-yield

Compared to the figures seen in the April End-of-Month Update, the May intra-month flash update shows:

- The previous bias towards deterioration flagged by the opinion indicator ratio is now even more pronounced in Corporates. In Financials, the previous small bias towards improvements has flipped to a stronger bias towards deterioration.

- The opinion indicator marks the most impacted industries:

- There is an 31.6:1 deteriorating/improving ratio for Oil & Gas entities (a large increase from 11:1 in the end-of-month April update update).

- There is an almost 7:1 deteriorating/improving ratio for Consumer Services (up from 6.2:1).

- There is a 6:1 deteriorating/improving ratio for Consumer Goods (up from 3.8:1).

- Healthcare has increased from a modest 1.2:1 deteriorating/improving ratio to a current ratio of 5.2:1.

- Telecommunications is the one industry showing net improvements; now at a 0.8:1 deteriorating/improving ratio, compared to the previous ratio of 5.5:1.

- The percentage of Investment Grade (IG) entities migrating to High-Yield (HY) increased for 13 of the 20 cuts. Of the industries, Consumer Services again show the strongest tendency to transition to HY with 4.9% of IG entities migrating (down from 5.3%). Travel & Leisure is also again one of the most impacted sectors with almost 15% of IG entities being downgraded to HY (similar to last update).

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.