Credit Benchmark have released the March Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for Global, UK & US Oil & Gas based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for Oil & Gas. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

UK Oil & Gas firms return to positive credit balance this month after ended their run of five months of positive credit balance last month. Global and US Oil & Gas firms also record net credit improvement.

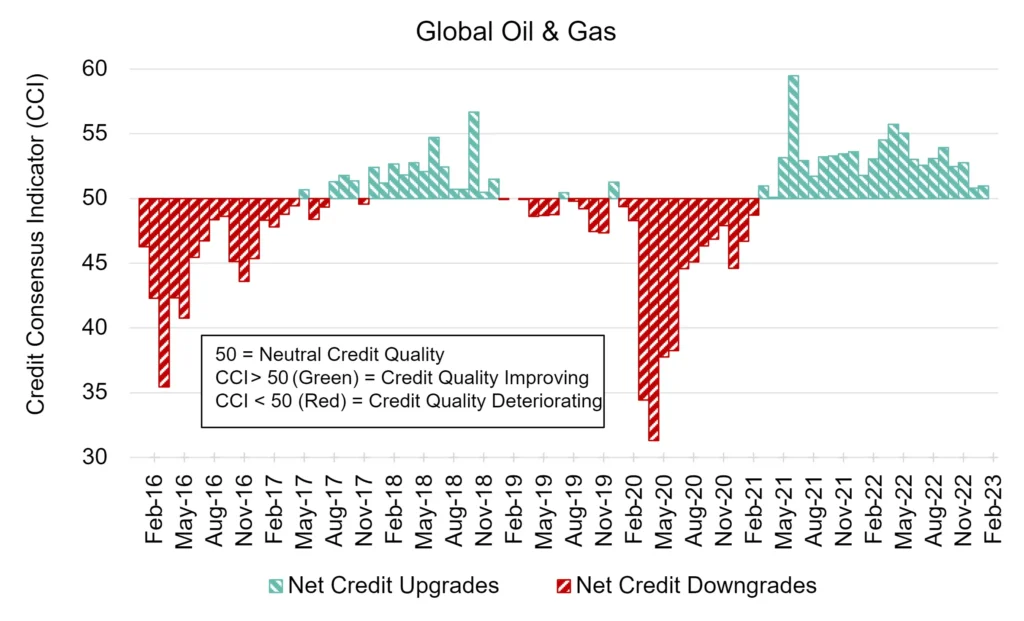

Global Oil & Gas: Positive Streak Continues

Global Oil & Gas firms have gone from strength to strength, boasting CCI scores above 50 for 23 consecutive months and maintaining long-term net positive credit balance.

The Global Oil & Gas CCI score is 51 this month, a slight increase from last month’s CCI of 50.8.

Oil slipped this week as signs of ample supply and rising US crude inventories countered hopes for higher demand arising from a jump in manufacturing in top crude importer China.

.

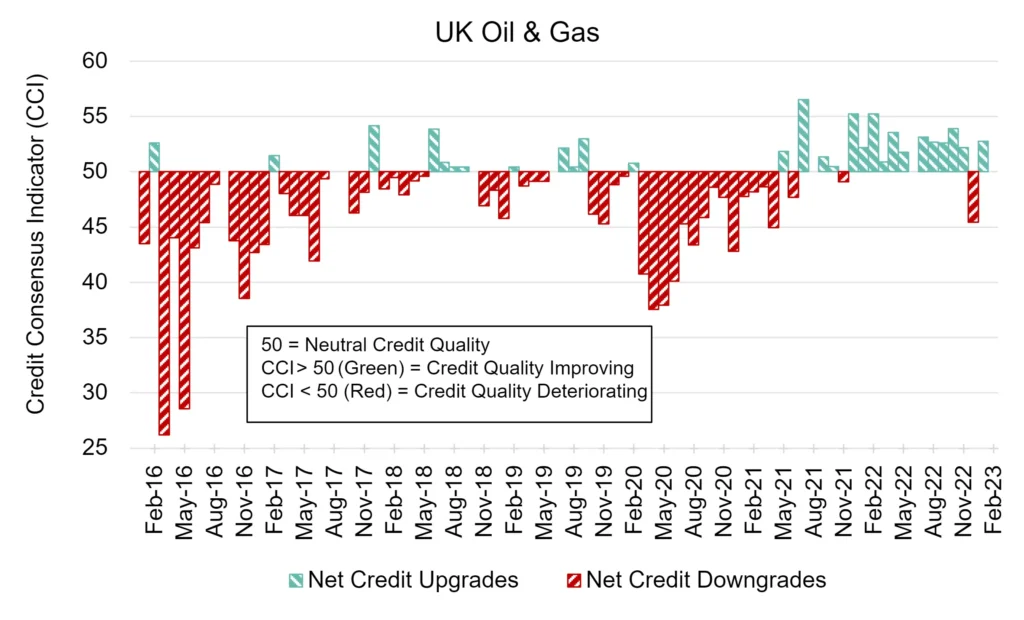

UK Oil & Gas: Return to Trend of Net Improvement

UK Oil & Gas firms return to positive credit balance this month after ended their run of five months of positive credit balance last month.

The UK Oil & Gas CCI score is 52.7 this month, a significant increase from last month’s CCI of 45.4.

The industry’s trade body warns that Oil and Gas companies are scaling back North Sea operations and prioritising investment outside the UK because of the government’s windfall taxes.

.

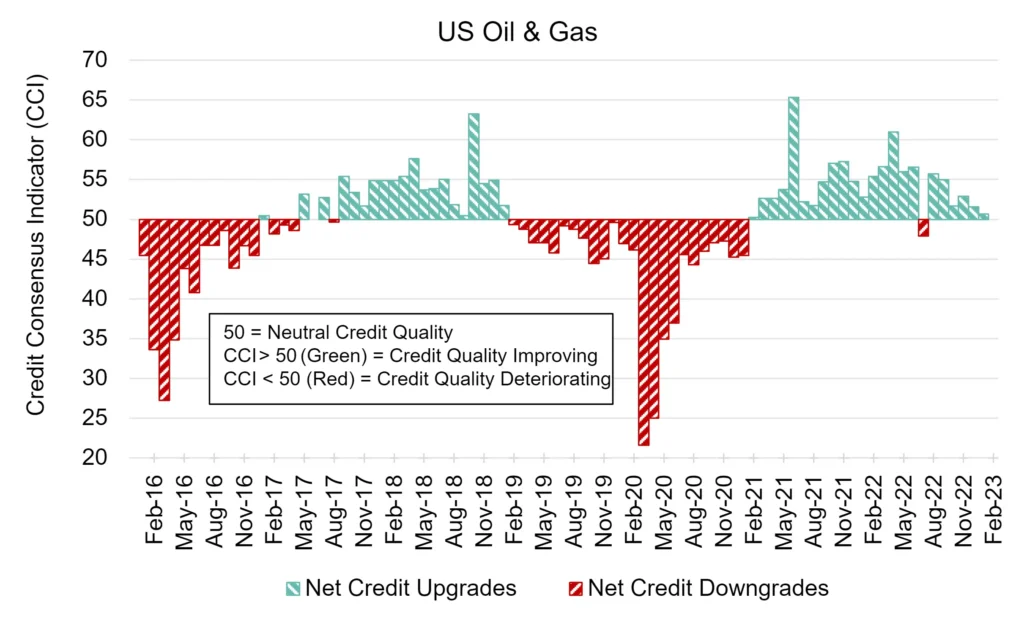

US Oil & Gas: Trend of Net Improvement Slows

US Oil & Gas firms have maintained positive credit balance for six consecutive month. However, trend of net improvement is slowing down.

This month, the US Oil & Gas CCI score is 50.7, a decrease from last month’s CCI of 51.5.

US Oil and Gas companies are pushing to solve the short-term problem of a tight European gas supply, driven by Russia’s invasion of Ukraine, with long-term gas contracts.

.

To download the full CCI tear sheets for Global, UK & US Oil & Gas, please enter your details below: