To download the March 2021 Retail Aggregate PDF, click here.

UK retail sector credit is in rough shape, according to Credit Benchmark consensus credit data.

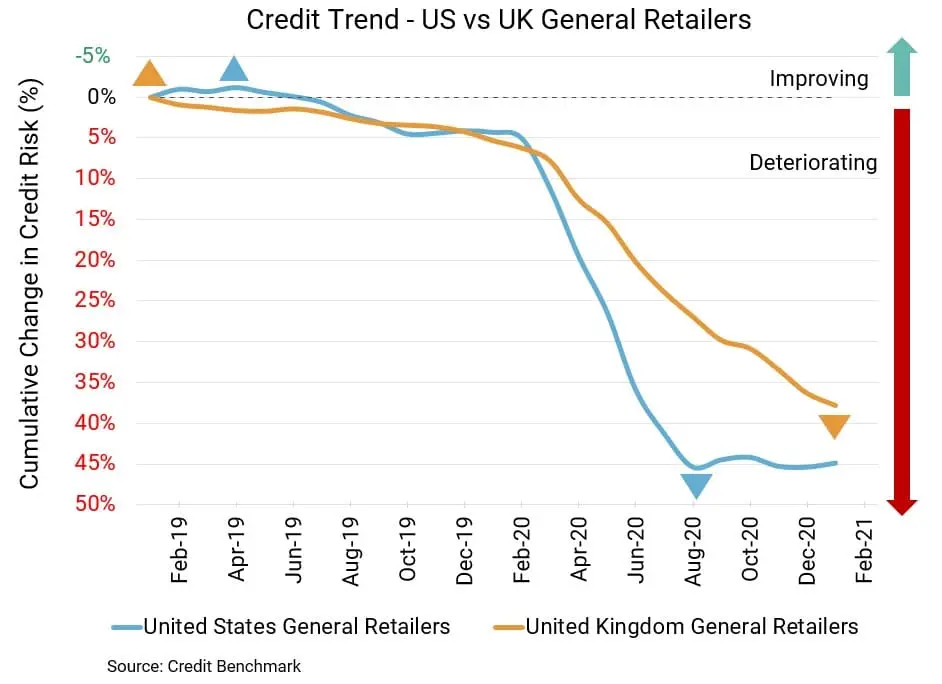

The divide between US and UK retail sector default risk continues to grow. Similarly, default risk for UK retail, at 105 bps, remains much higher than the equivalent global retail aggregate (now at 74 bps) and the overall UK corporate sector (now at 81 bps). These gaps in default risk are now the widest since Credit Benchmark began tracking this data. In fact, the UK retail sector has some of the highest default risk for any UK industry or sector.

Recent news for the sector is mixed and suggests conditions will be arduous for the near future, but there may be some positive signs, as financing costs fall and the UK government unveils additional support. Still, dour consensus views about this sector have yet to abate.

Default risk for US retail, at 67 bps remains higher than for overall US corporates (at 65 bps), but the difference of about 2 bps is much narrower than for the UK cohort. US retail sales climbed in January by the most in seven months.

US General Retail Firms

The recent levelling off in credit quality and default risk for the US retail sector may have staying power. Deterioration was 39% year-over-year and 3% from six months prior, yet there’s been essentially no change for the last few months. Remaining at 67 bps, default risk is still higher than it was six months ago at 65 bps and at the same point last year at 49 bps. About 80% of firms have a CCR rating of bbb or lower, and this sector’s overall rating is bb+. Despite previous troubles, the worst may be over for the US retail sector.

UK General Retail Firms

The ongoing deterioration in UK retail sector credit may not show huge monthly shifts, but cumulative changes are pronounced. Credit quality has declined another 1% last month, on top of declines of 11% from six months prior and 31% from the same point last year. Default risk is now 105 bps, compared to 104 bps last month, 94 bps six months prior, and 80 bps at the same point last year. About 92% of firms have a CCR rating of bbb or lower, and the sector’s overall rating is bb. Simply put, it remains in much worse shape than the US retail sector.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 55,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.