Credit Benchmark have released the March Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The US is the real standout this month. For the first time in an over a year, forward-looking sentiment is above 50. It looks like the strength exhibited early in 2021 may have boosted optimism in the sector. More recent data presents a mixed picture and may tempter expectations. However, the US is seeing great success with its vaccination program. The White House also signed into law its $1.9 trillion fiscal relief package and along with Congress is discussing options for additional spending on infrastructure. Growth expectations for the US are improving, and the Federal Reserve has said monetary policy will remain loose for a while.

There may be also be growing optimism for the UK and EU, whose CCI scores inched closer to 50, although the EU’s economy isn’t as strong as the US’ and it has had struggles with vaccinations.

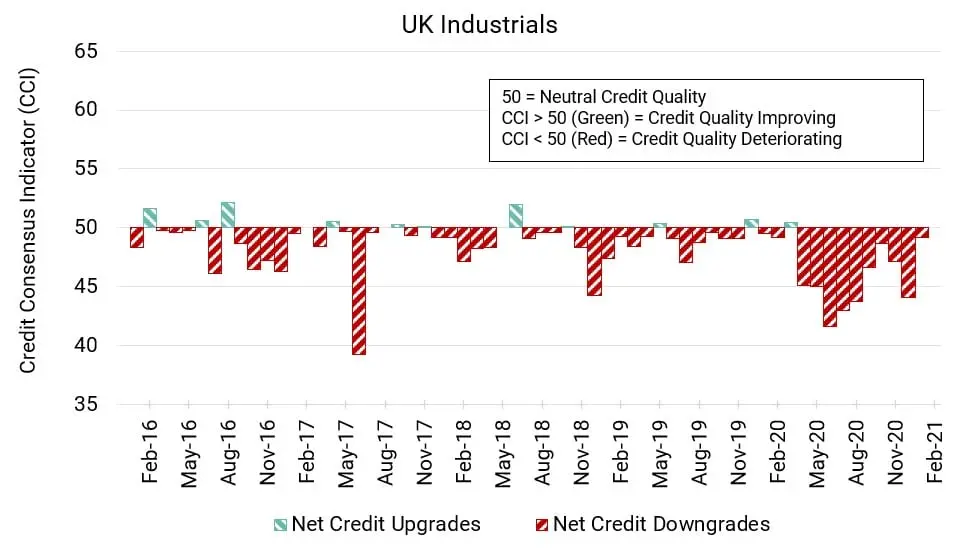

UK Industrials: Nearing Neutral

The recent plunge in sentiment for UK Industrials has been followed by a sharp recovery.

This month’s CCI score is 49.1 compared to 44 the prior month.

This change broke the downward trend and is the highest CCI score for the UK since March 2020. In addition to sector-specific issues or general economic problems, Brexit is proving to be an issue for numerous firms.

.

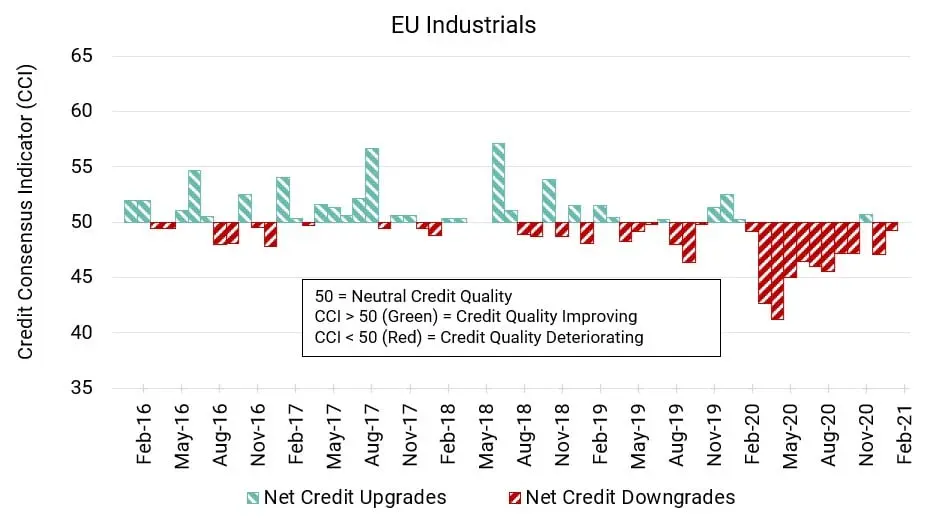

EU Industrials: Edging Closer

The EU score moved even closer to the neutral 50 mark this month.

The March CCI for EU Industrials is 49.3, compared to 47.1 last month.

A few months ago, the EU was the first of the three regions to see a score above 50 since COVID began. Beyond problems with vaccinations and overall economic growth, some sectors like airlines are still facing headwinds. But recent data is positive and the EU is looking to the future for local tech manufacturing.

.

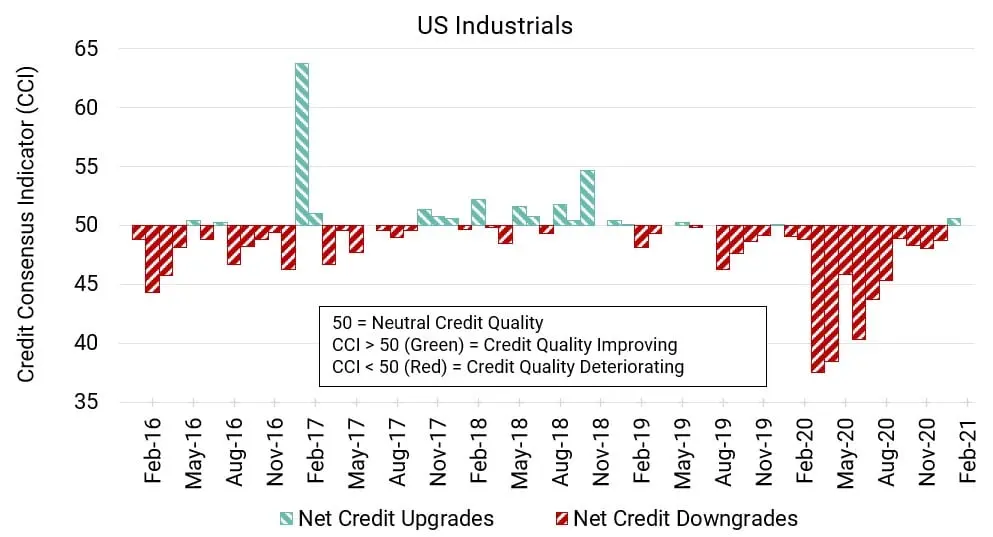

US Industrials: Some Optimism

For the first time since December 2019, the US score finished in positive territory.

The CCI for this month for US Industrials sits at 50.6, compared to 48.7 last month.

The CCI is far higher now than during mid-2020. Recent problems with industrial production and the economy appear to be more weather-related than anything else. But there considerable supply chain problems could cause trouble in the months ahead.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: