Auto sales for July are expected to decrease by 1.8% compared to a year ago, according to the most recent J.D. Power and LMC Automotive forecast. The gloomy outlook is supported by Cox Automotive, who have reported a 2.2% decrease in sales for the first half of 2019 and are expecting an even larger reduction of 3.4% in the second half of the year.

Car manufacturers are steeling themselves for reduced demand. Continental tentatively projected stable production levels back in March, despite the apparent risk factors of an unresolved Brexit plan and ongoing trade disputes between the US and China. The large automotive supplier has since revised its forecast, taking the view that global auto production will fall by 5% in 2019.

While sales figures are dropping, the average price of new vehicles continues to rise to record levels, reaching a high of USD$33,182 this month as reported by J.D. Power. Consumers may be discouraged by reduced availability of affordable vehicles, coupled with the habit of deferring expensive purchases in uncertain economic times.

Auto manufacturers are highly susceptible to the ebbs and flows of global supply chains, and the ongoing uncertainty stemming from global trade tensions has dented the risk appetite for lenders over recent months. Falling sales figures are not going to help restore confidence in the sector.

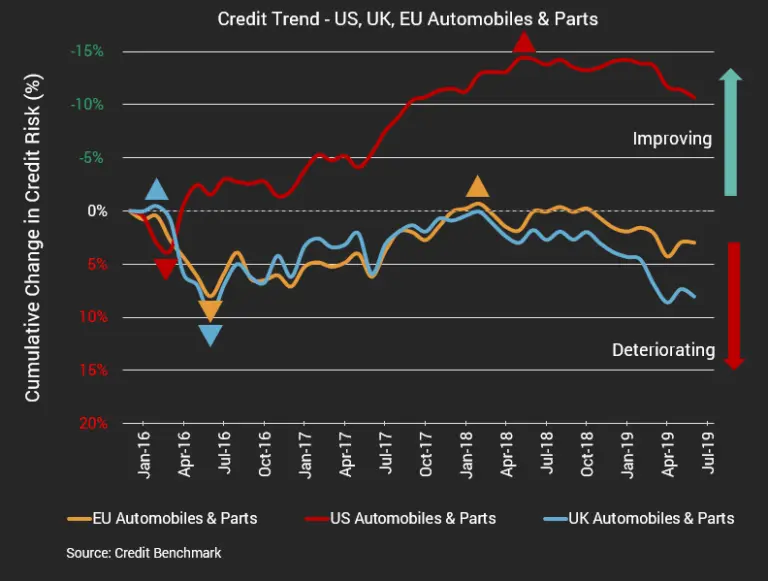

Consensus risk data from Credit Benchmark, sourced from 40+ of the world’s leading financial institutions, shows credit risk levels increasing for EU, UK and US Automobiles & Parts companies. Both the EU and UK companies have seen declining credit quality over the past year, dropping by ~4% and ~6% respectively. US companies have fared better, possibly due to the Trump administration fiscal package. In the past year however, the improving trend stalled and began to decline in early 2019. As lenders take stock of revised sales forecasts for the year, credit risk levels may rise further in response.

.