Credit Benchmark has published the latest monthly credit consensus data (from April 2017), with 13 contributor banks now providing bank-sourced credit views (CBCs*) on more than 8,400 separate legal entities.

Additions to the data include Nvidia Corp, Insight Enterprises, Korean Airlines, Hormel Foods Corp, Tupperware Brands, National Basketball Association, England & Wales Cricket Board, SL Green Realty Corp, and Fidelity National Financial.

Across the Month of April – out of approximately 8200 obligors:

- 209 obligors saw improved consensus in their credit standing by at least one notch

- 282 deteriorated

- 56 moved more than one notch

- Compared with the previous month, downgrades now outweigh upgrades, with a small decrease in notch changes of more than one

The March data showed improved consensus across 251 obligors and decreased consensus across 276. Amongst those obligors that saw movement, 80 moved by more than one notch.

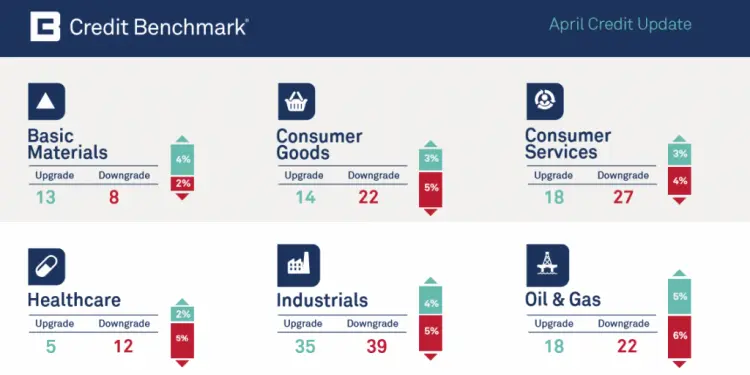

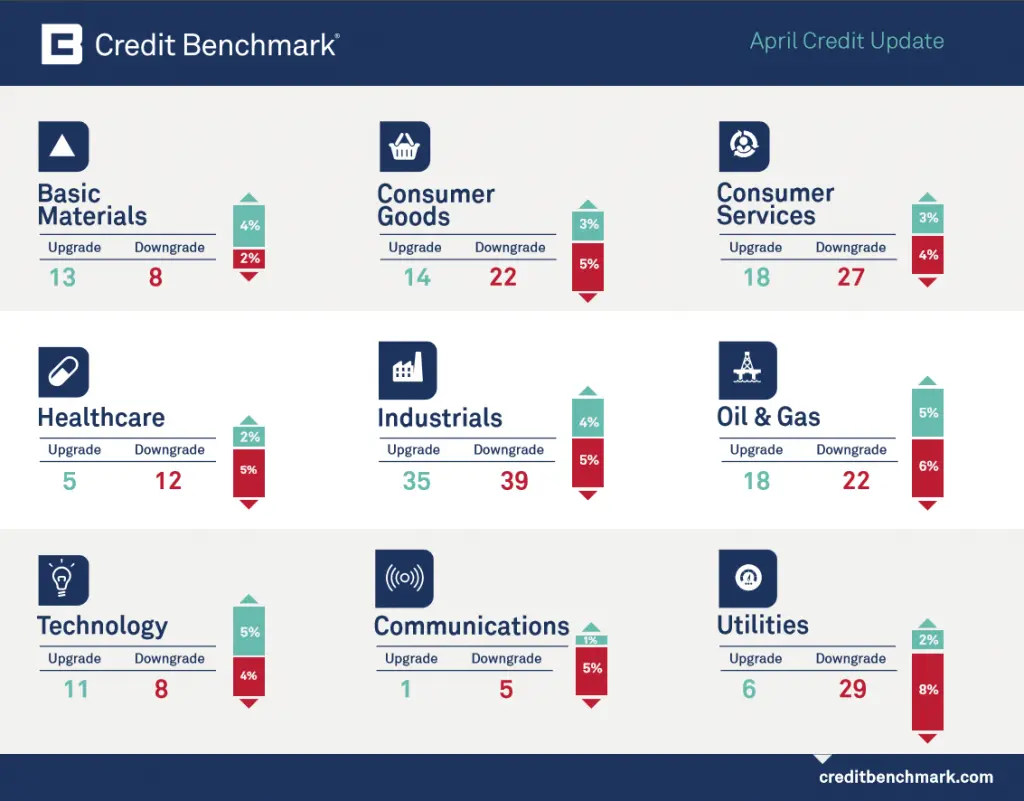

Industries:

- Downgrades dominate upgrades in 7 out of 9 reported industries

- The most significant deterioration of credit quality occurred in Telecommunications with five downgrades and one upgrade

- Utilities with 29 downgrades and six upgrades

- Health Care with 12 downgrades and five upgrades

- Industries with improving credit ratings include Basic Materials with 13 upgrades and eight downgrades, and Technology with 11 upgrades and eight downgrades

Sovereigns :

A number of African countries have been affected by the recent oil price drop. Overall, African Sovereigns have had a consensus downgrade of 0.6 notches over the past year. More details of the credit background to the oil industry are available in the recently published White Paper on Oil & Gas industry.

*CBC = Credit Benchmark Consensus; a 21-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.

SaveSave