Credit Benchmark have released the June Credit Movement Indicators (CMIs). The CMI is an index of forward-looking credit opinions for US, UK & EU Oil & Gas based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CMI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for Oil & Gas.

US and EU Oil & Gas both maintain a negative credit outlook for a consecutive month. UK Oil & Gas show recent instability in their collective credit outlook.

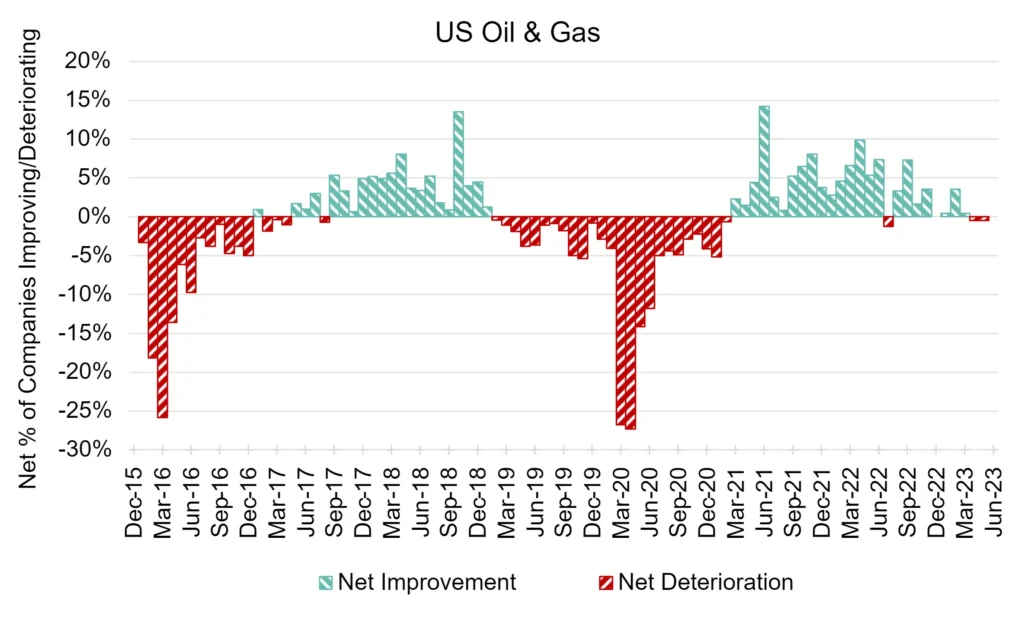

US Oil & Gas: Net Deterioration Persists

US Oil & Gas companies maintain a negative credit outlook for a consecutive month.

In the latest month, 0.5% more US Oil & Gas companies are showing deterioration than improvement – the same as last month.

Latest US Crude Oil Production shows increases; US natural gas futures are fluctuating.

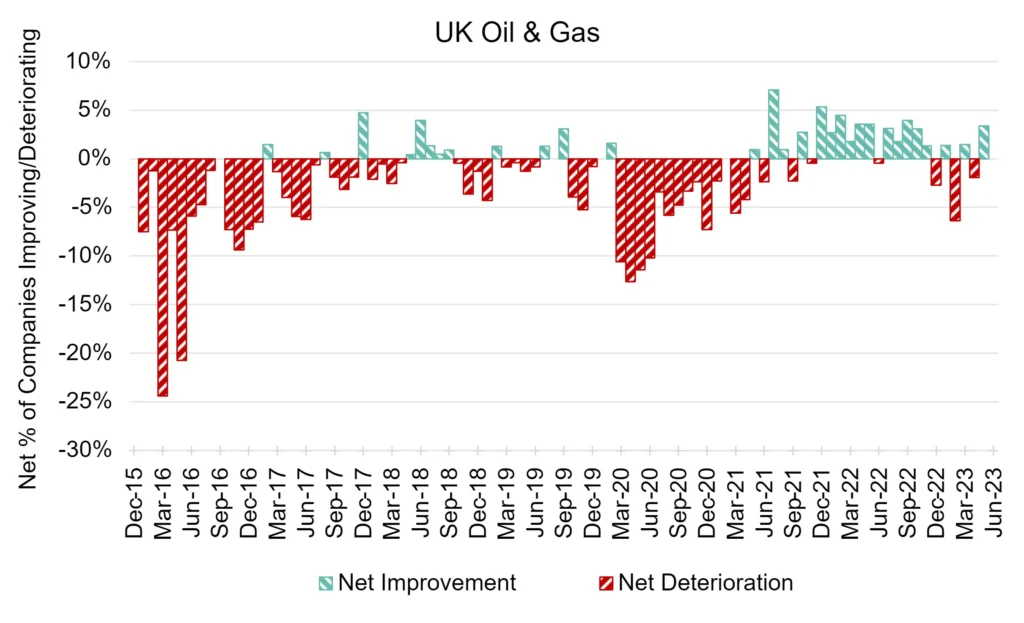

UK Oil & Gas: Ups and Downs

UK Oil & Gas companies show recent instability in their collective credit outlook.

In the latest month, 3.4% more UK Oil & Gas companies are showing improvement than deterioration – a change in outlook from last month.

Latest UK Crude Oil Production shows increases; UK natural gas futures fall again, extending the decline.

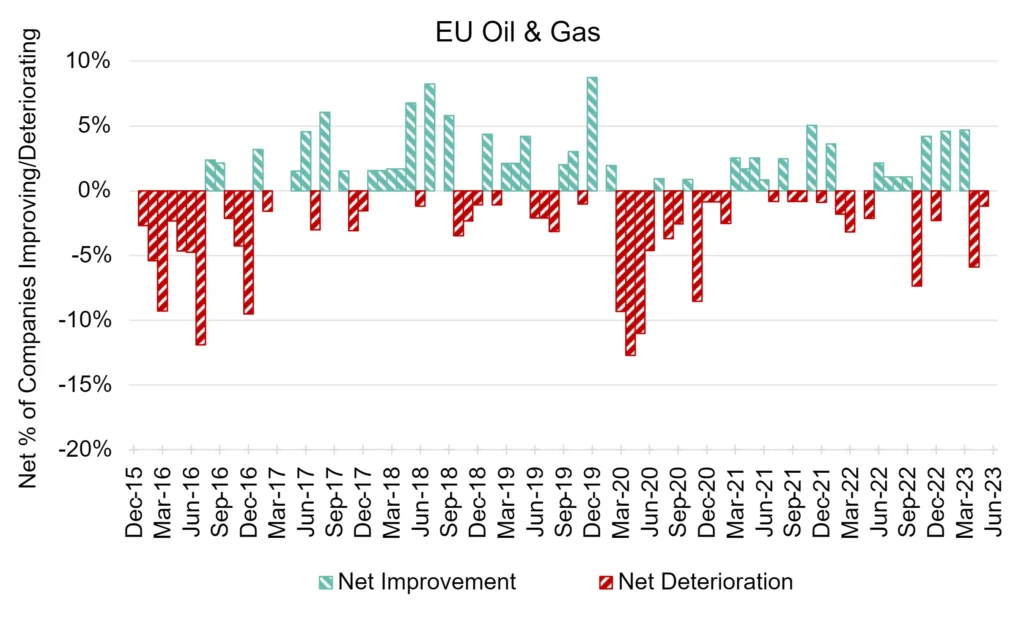

EU Oil & Gas: Net Deterioration Continues

EU Oil & Gas companies maintain a negative credit outlook for a consecutive month.

In the latest month, 1.2% more EU Oil & Gas companies are showing deterioration than improvement – an improvement from last month.

Latest Europe Crude Oil Production shows increases; Europe natural gas futures decline from the two-month high.

..

To download the full CMI tear sheet for US, UK & EU Oil & Gas, please enter your details below: