Credit Benchmark have released the January Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The news was positive across all three regions this month, with industrial firms maintaining their positive credit quality or returning to it after previous drops. Credit strength was most evident for US Industrial firms, which have maintained a positive CCI reading for 11 consecutive months. EU and UK firms have a weaker grasp on this improving trend.

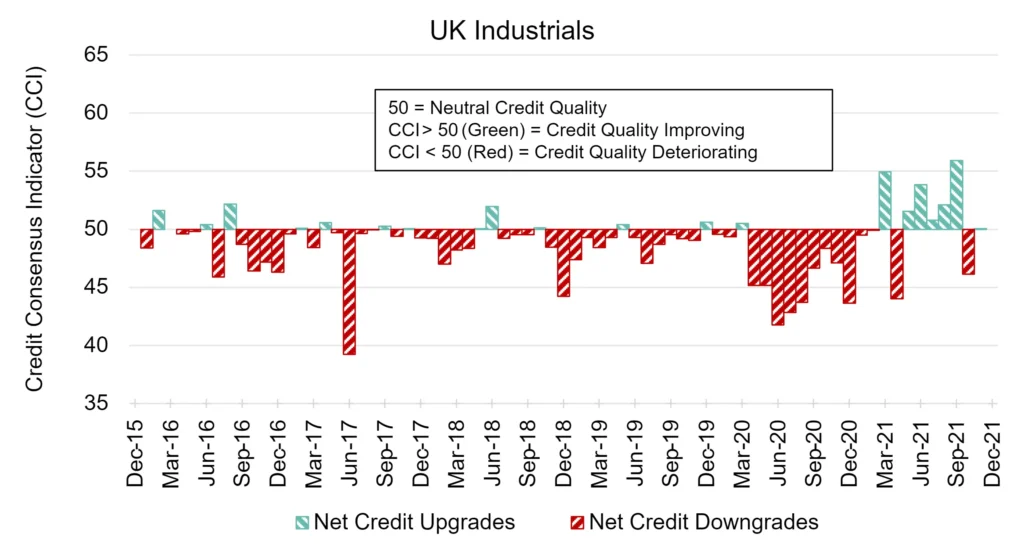

UK Industrials: Incremental Gain

After a material negative drop last month, the consensus credit quality of UK Industrial firms has returned to positive territory this month, albeit incrementally.

The UK CCI score is now 50.1, just scraping above the neutral mark after last month’s negative score of 46.1.

UK manufacturers are keeping the faith, with a survey showing 73% of firms expect conditions to improve in 2022 – though this optimism is tempered by labor shortages and rising costs.

.

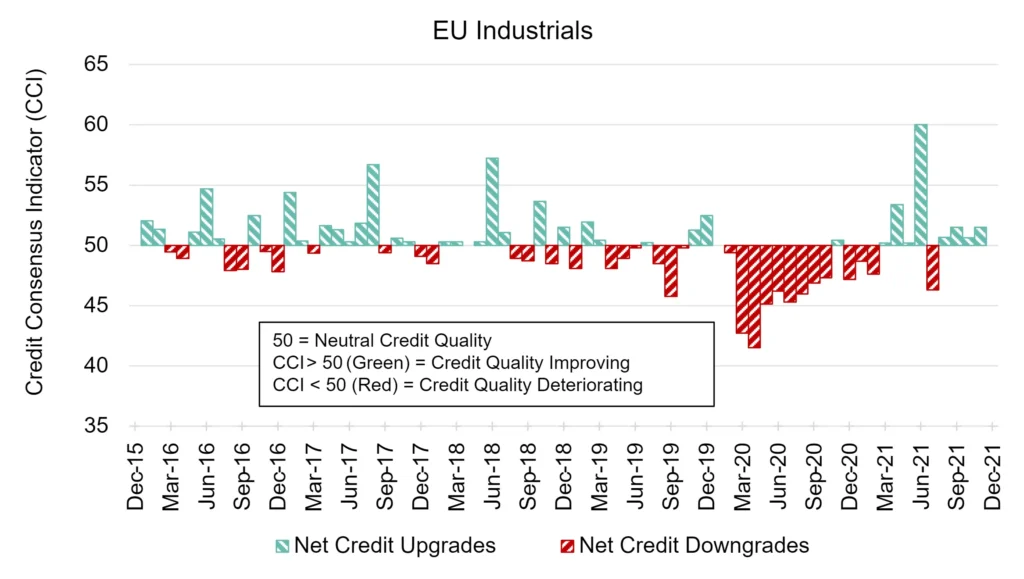

EU Industrials: Mild Positivity

Consensus credit quality for EU Industrial firms has been idling for the last four months, with modest positive readings and little change month-on-month.

The EU CCI score has marginally improved this month, sitting at 51.5, up from 50.6 last month.

European manufacturing continued to expand in late 2021, with tentative signs that ongoing supply chain pressures are beginning to recede – though Omicron-related disruptions cannot be ruled out.

.

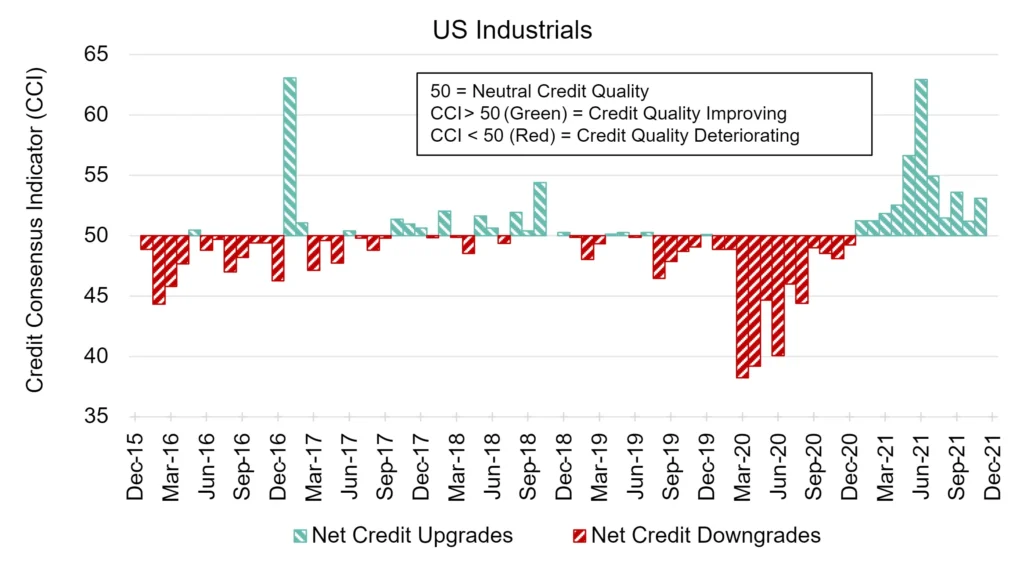

US Industrials: Retaining Power

US Industrial firms have gone from strength to strength in recent months, with their collective credit quality remaining in positive territory for an 11th consecutive month.

The US CCI score is 53.1, an improvement from last month’s weaker score of 51.2.

Though last month did indicate some slowing, the industry is experiencing an easing of supply constraints and a cooling of input prices, and the credit quality of the sector reflects these tentatively positive signs.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: