Credit Benchmark have released the January Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

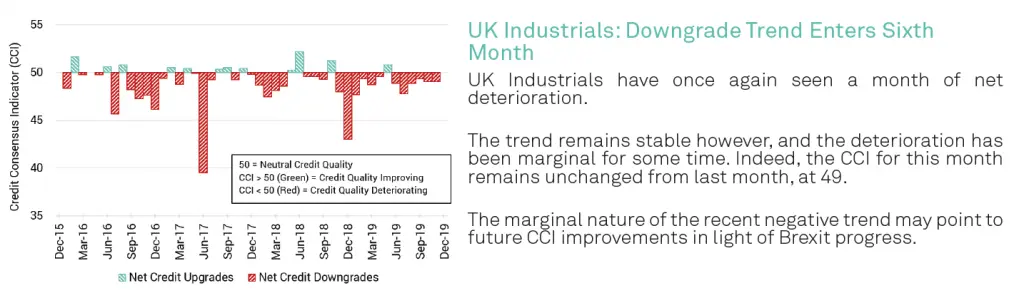

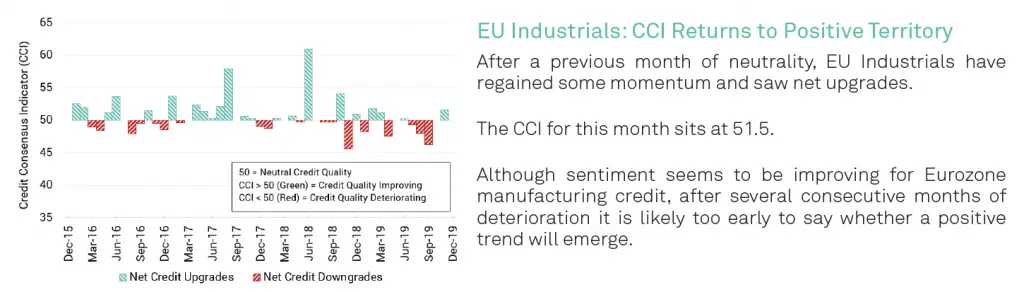

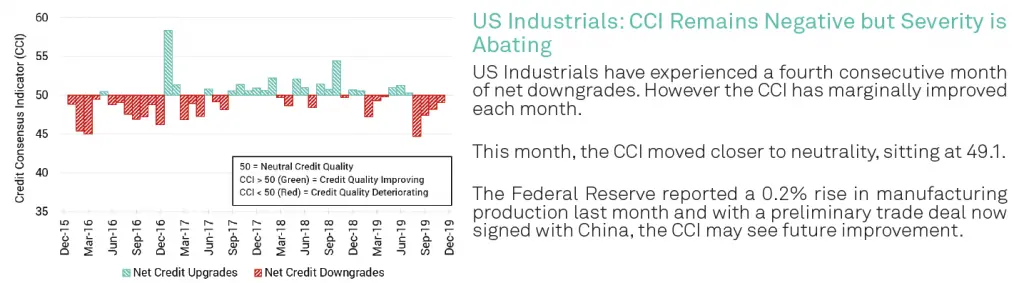

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The January CCIs have seen continued deterioration in both UK and US industrial companies however downgrades for both regions this month were marginal. EU ex-UK industrial companies have shown a modest recovery this month, with more upgrades than downgrades.

The UK CCI for January is 49; downgrade trend enters sixth month.

.

The EU CCI for January is 51.5; CCI returns to positive territory.

.

The US CCI for January is 49.1; CCI remains negative but severity is abating.

.

To download the full CCI tear sheets for UK, EU (ex-UK) and US Industrials, please enter your details below: