The Brexit vote has had a major impact on the credit quality of British industry over the past three years. Credit Benchmark has regularly reported on the declining credit health of a range of UK Sectors, including Auto Companies, Retailers, Large Corporates, Healthcare, and Telecomms. The UK has experienced uncertainty since the vote took place in June 2016, and with no deal or certain exit date yet agreed, big business will continue to feel the ‘Brexit Effect.’

The ‘Leave’ campaign emphasised the return of economic power to regional areas. But how will Brexit affect Small and Medium Enterprises (SMEs) across the United Kingdom? Gauging the credit quality of SME businesses around the UK is a useful measure of how the prospect of Brexit has already affected local economies, and gives some clues as to future performance.

Credit Benchmark collects, anonymises, and aggregates internal credit observations from 40+ of the world’s leading financial institutions. There are ~245,000 SMEs in the UK (excluding sole proprietorships, non-employing businesses and micro enterprises). Credit Benchmark currently collects over 140,000 individual credit observations on UK SME companies, representing coverage on over half of the UK SME sector. This rich dataset offers unique insights into the credit quality of UK SMEs across countries and regions.

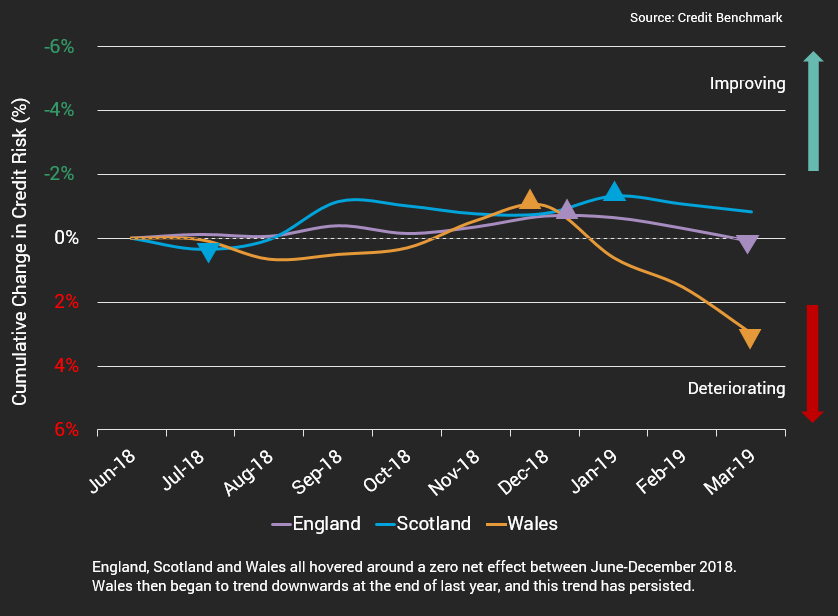

Credit quality for England, Scotland and Wales hovered around a zero net effect between June-December 2018. Wales then began to trend downwards at the end of last year, and this trend has persisted – echoing Welsh First Minister Carwyn Jones’s assertion that Brexit will have a negative effect on the Welsh economy.

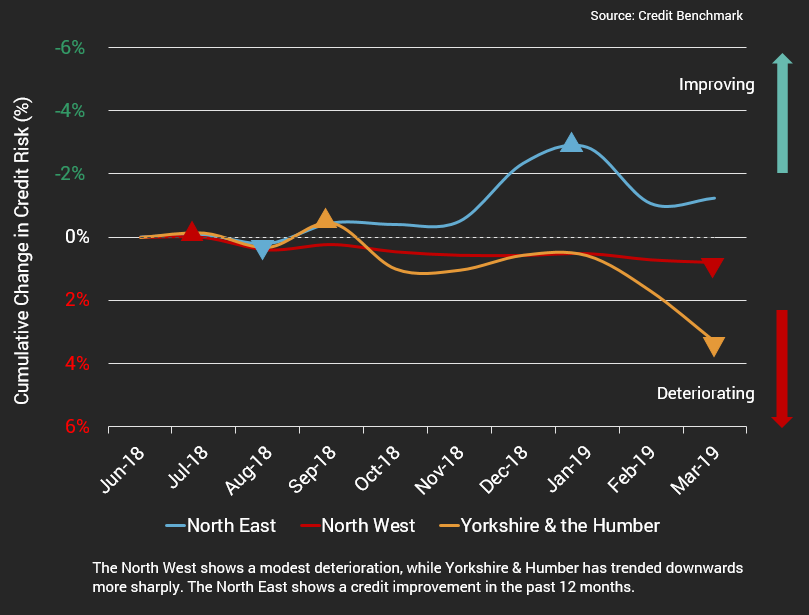

In Northern England – one of the heartlands of the Leave vote – there are mixed credit trends for each region. The North West shows a modest deterioration, while Yorkshire & Humber has trended downwards more sharply. On the other hand, the North East – despite dire post-Brexit economic forecasts and the highest credit risk in the UK – actually shows a credit improvement in the past 12 months.

Credit Benchmark SME data and analysis covers all regions across England and further insights into Scottish and Welsh credit quality are available. For more, please get in touch with us at [email protected]