Download the latest Industry Monitor below.

Credit Benchmark have released the end-month industry update for end-October, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

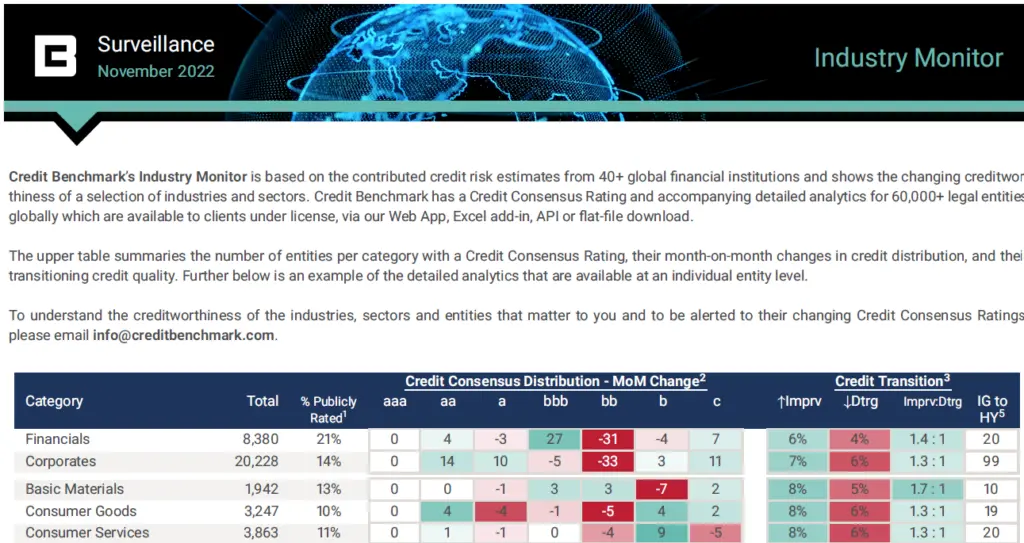

Corporate credit quality maintained a bias towards net credit improvement this month – but more instances of deterioration have crept in at the industry level than what was seen last month. Corporates and Financials showed similar credit movement this month, with ratios of 1.3:1 and 1.4:1 respectively.

Amongst the industries, the top performer was once again Oil & Gas, with a positive ratio of 3.1 improvements to each deterioration. Basic Materials were the next strongest, with a ratio of 1.7:1. This month, two industries saw net credit deterioration, with Consumer Services worse off at 1:1.5 improvements to deteriorations. Telecommunications and Utilities both remained neutral.

Oil & Gas credit strength was reflected at the sector level, with UK, US and Canadian firms all showing high positive ratios. Travel & Leisure followed, with a ratio of 1.7 improvements to each deterioration. There were no instances of net deterioration amongst the sectors, however US Corporates and Construction & Materials both came in at neutral.

In the update, you will find:

- Credit Consensus Distribution Changes: The net increase or decrease of entities in the given rating category since the last update.

- Credit Transition: Assesses the month-over-month observation-level net downgrades or upgrades, shown as a percentage of the total number of entities within each category.

- Ratio: Ratio of Improvements and Deteriorations in each category since last update, calculated as Improvements : Deteriorations.

- IG to HY Migration: The number of companies which have migrated from investment-grade to high-yield since the last update (known as Fallen Angels).

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.