Download the full whitepaper below.

- The COVID-19 crisis has highlighted how sensitive banks impairment numbers are to changes in the economy.

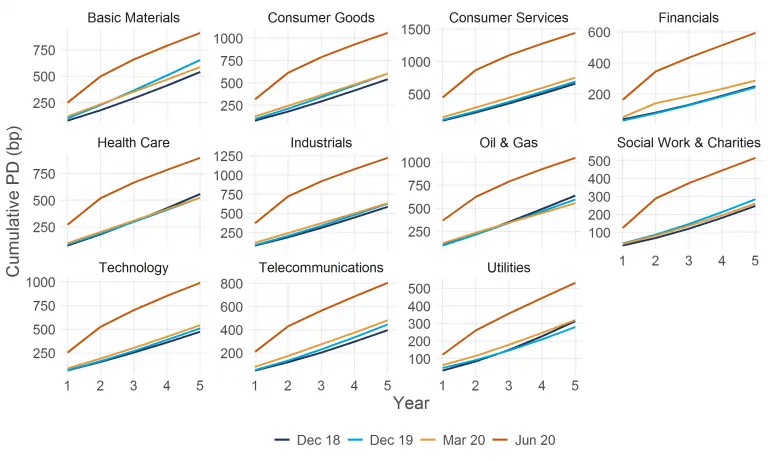

- PIT PD curves have increased substantially across all industries.

- Banks have changed their PIT PD curves quicker and more severely than their TTC PDs.

- Banks have increased the severity of their forward-looking downturn scenarios.

The COVID-19 crisis has highlighted how sensitive banks’ impairment numbers are to changes in the economy. Under IFRS9 accounting rules, banks have to hold impairment now against their future expected credit losses. When countries shut down large parts of their economies due to COVID-19, banks had to react quickly to reassess the increase in the current and future credit risk of their portfolio.

Many banks’ recent half year results show substantial increases in their impairment provisions and the impact this has on their profits.

A key component of banks’ IFRS9 impairment calculation is their point-in-time (PIT) Probability of Default (PD) estimates that reflect their prediction of the economic impact on credit risk forecasts forward in time. Higher PIT PDs lead to higher impairment, both directly through the formula for expected credit losses (ECL) and through loans migrating from a 1 year ECL to a lifetime ECL. If banks hold more impairment it reduces their funds available for lending, which can in turn impact the economy causing a negative feedback loop.

In this report, we use aggregated PIT PD curves to look at the impact COVID-19 has had on banks’ forecasts of credit risk and impairment. Here we focus on the results from the UK banks contributing data to Credit Benchmark.