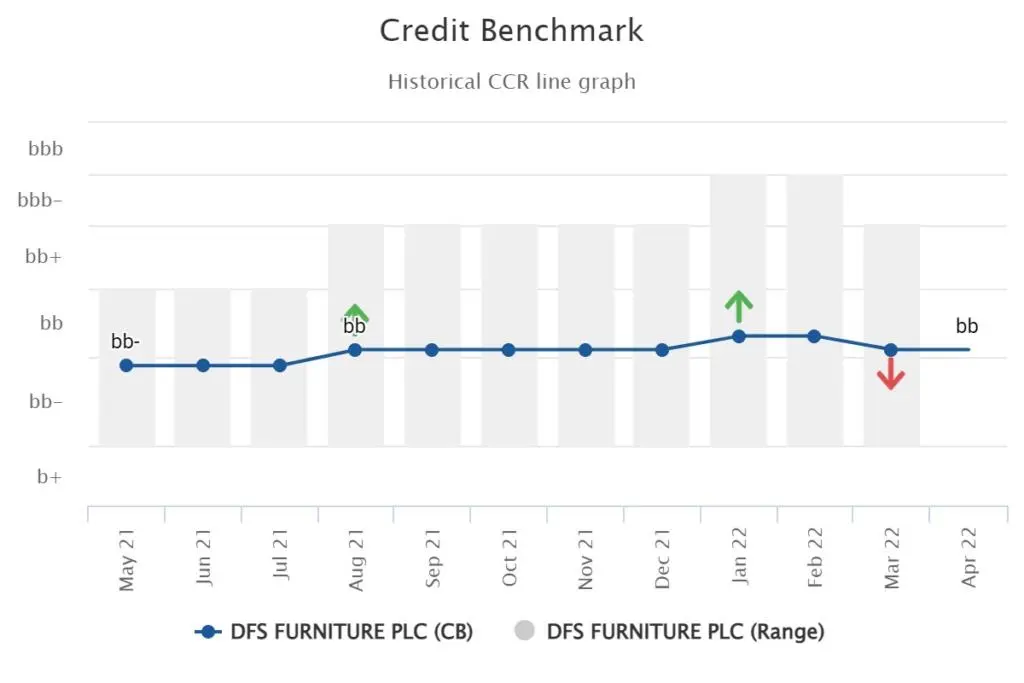

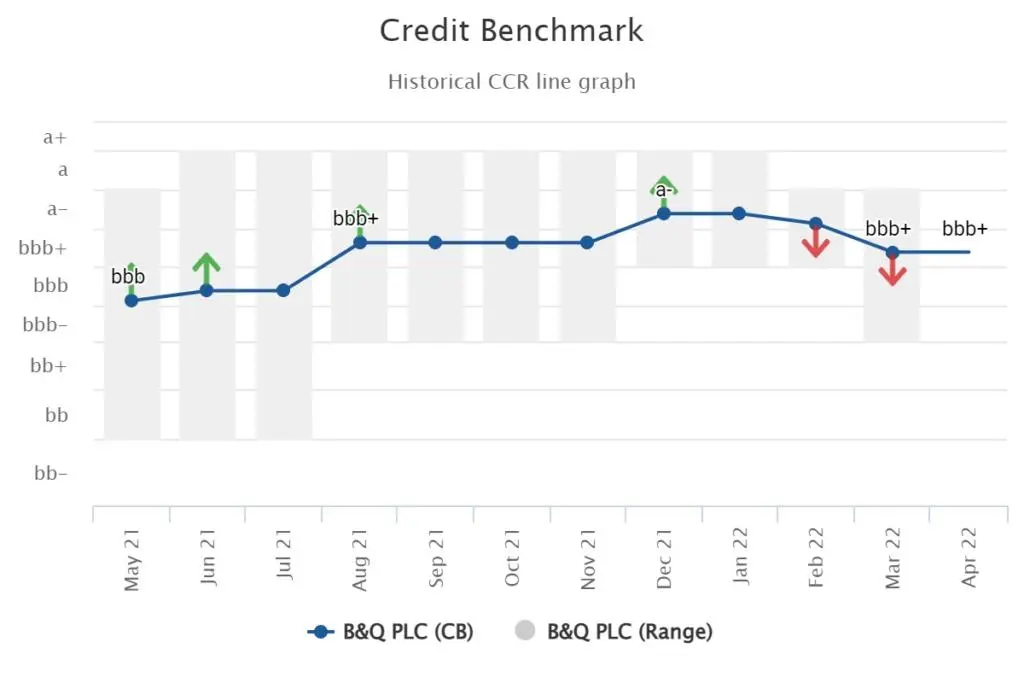

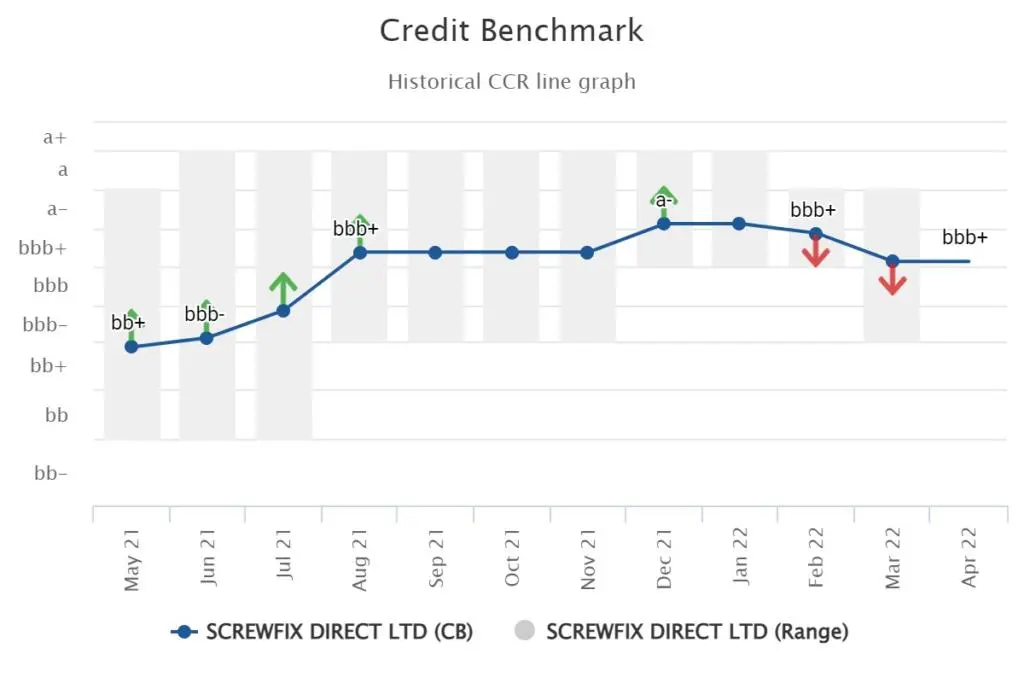

As offices and city centres come back to life, consumption patterns are shifting after the sustained impact of COVID lockdowns. The main early beneficiaries were grocery delivery firms such as Ocado, as customers favoured the convenience of online delivery services above queuing for socially distanced supermarkets. Later, home improvement companies such as B&Q and Screwfix did good business as working-from-home owners invested spare time upgrading their properties.

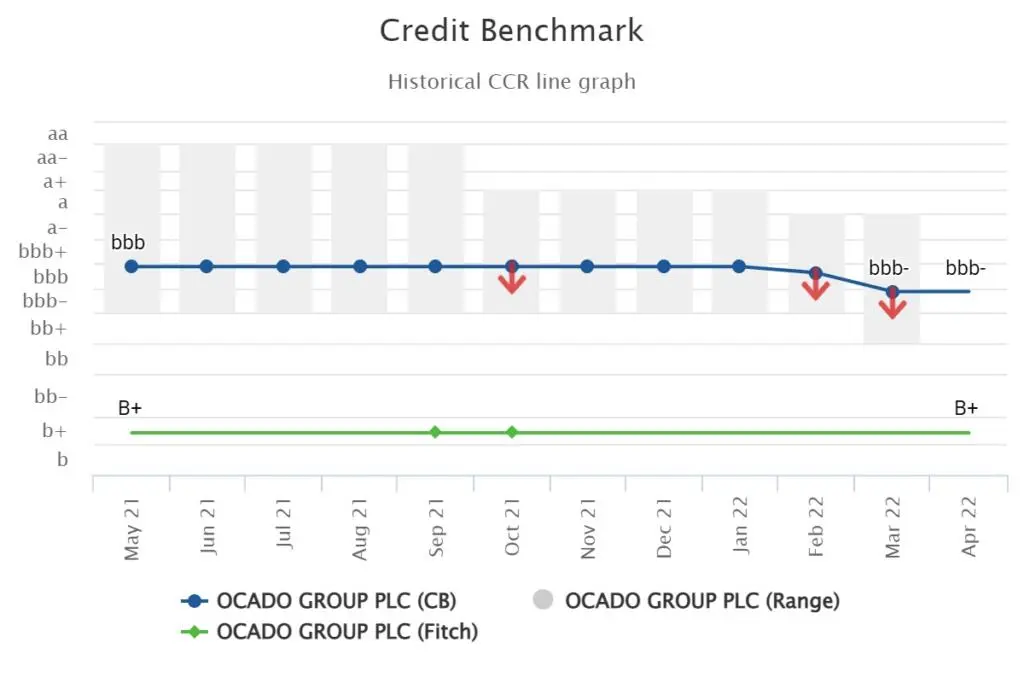

As the pandemic eases and workers return to their offices, the COVID beneficiaries are facing the double hit of a return to more traditional buying habits and an inflation squeeze on household budgets.

Figures 1 to 4 show detailed credit trends for some UK home improvement and grocery delivery companies – all show a recent decline in credit quality.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: B&Q PLC, owned by Kingfisher PLC

Figure 2: Screwfix Direct LTD, owned by Kingfisher PLC

Figure 3: Ocado Group PLC

Figure 4: DFS Furniture PLC