The Real Estate market is being pulled in multiple directions. The “race for space” has driven up land prices, but supply chain issues are also pushing up the cost of newbuilds. Cities are returning to some form of normality, but existing offices are operating at less than full capacity while many new offices are struggling to find tenants in the face of hybrid working practices. Industrial property has been boosted by the need for huge fulfilment centres as online shopping thrives.

Real Estate is at the junction of Wall St and Main St. COVID did not affect these two pillars of the economy equally: Figure 1 shows that, in credit terms, global Financials were impacted less by COVID, but Corporates showed a faster recovery.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

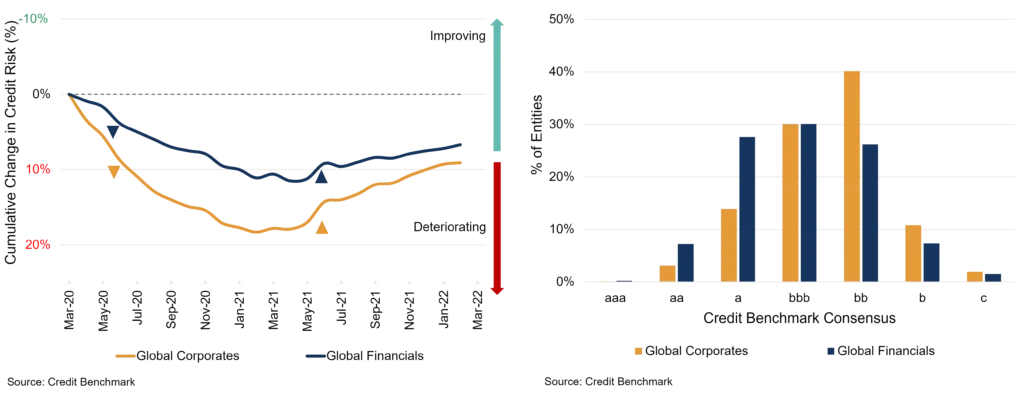

Figure 1: Credit Trend and Current Credit Distribution for Global Corporates and Financials

Corporate credit risk was increased by more than 18% by the COVID crisis, while Financial credit risk was only increased by 11%. Recovery started in May-21 for both Corporates and Financials; Corporates have experienced a quicker recovery and are now more in line with Financials. However, the bb credit category still dominates the Corporate universe, whereas Financials are more evenly spread; with nearly 30% in the a category.

Within Financials, there is another split. Figure 2 shows Banks, Insurance (Life and Non-Life) and Real Estate Investment Trusts (as a proxy for all Real Estate) as separate series.

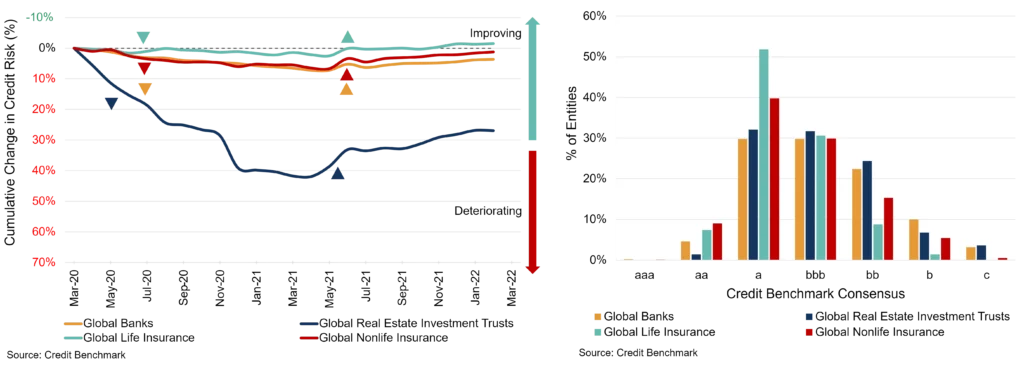

Figure 2: Credit Trend and Current Credit Distribution for Global Banks, Insurance and Real Estate Investment Trusts (REITs)

The Global Financial credit risk changes shown in Figure 1 are entirely driven by REITs – Banks and Insurance companies show minimal change over the same period. Banks and REITS still have very similar credit profiles (banks have more in aa, REITS in bbb).

Figures 3 to 7 show detailed credit trends for REITs companies.

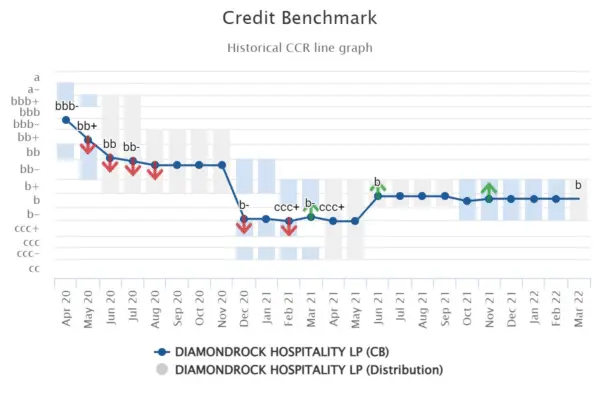

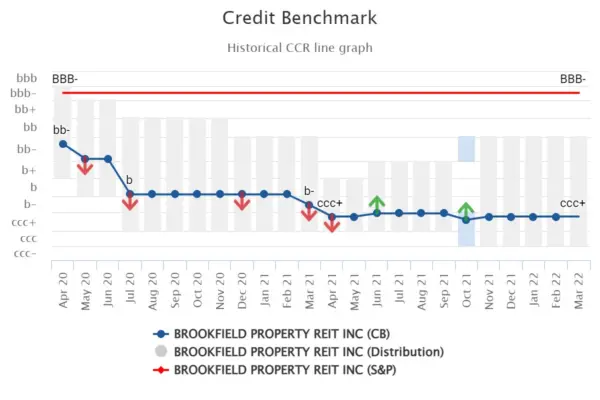

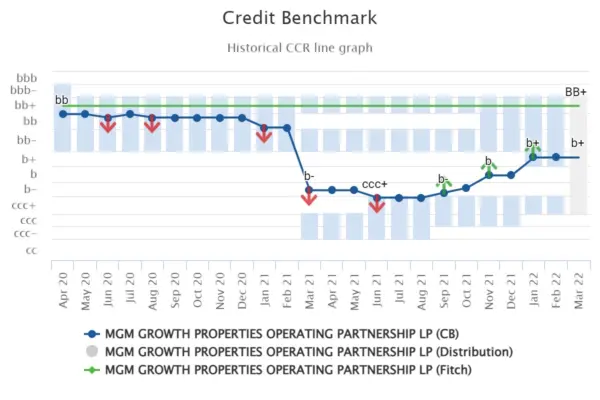

DiamondRock Hospitality LP, Brookfield Property REIT Inc and MGM Growth Properties Operating Partnership LP were substantially impacted by COVID and have been slow to recover.

Figure 3: DiamondRock Hospitality LP

Figure 4: Brookfield Property REIT Inc

Figure 5: MGM Growth Properties Operating Partnership LP

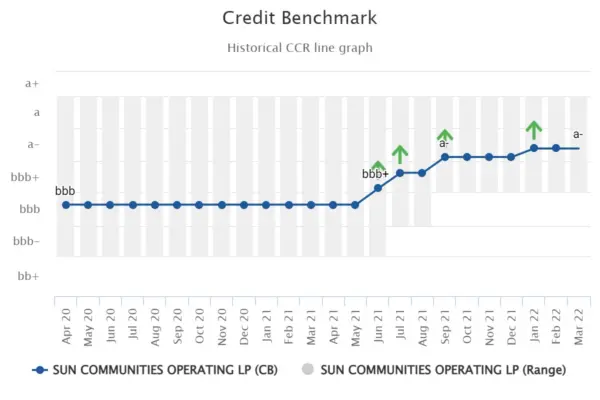

Broadstone Net Lease LLC and Sun Communities Operating LP were impacted less by COVID, currently holding better post-COVID credit ratings than pre-COVID.

Figure 6: Broadstone Net Lease LLC

Figure 7: Sun Communities Operating LP

REITS show some recovery from their COVID lows, but there is a long way to go. While real estate is traditionally a hedge against inflation, higher interest rates will hurt funding and profitability. Any recovery is likely to remain sluggish.