Political and economic factors have driven some major changes in credit over the last year. Trade disputes, geopolitical tensions and climate change have all played a role in steering the credit quality of international industry.

Credit Benchmark’s global credit Chartbook draws on the credit risk views of 30,000 expert analysts from 40+ leading financial institutions to explore the impact of these global influences. This exclusive analysis provides a comprehensive overview on Corporate and Financial credit trends across 20 individual countries and associated regions.

Illustrated across 30+ detailed charts displaying credit trends, changes, levels and distributions, we explore:

United States: Has the positive “Trump Effect” on Financial and Corporate credit risk run its course?

Americas: Corporates and Financials show improvements in nearly all countries – with one exception.

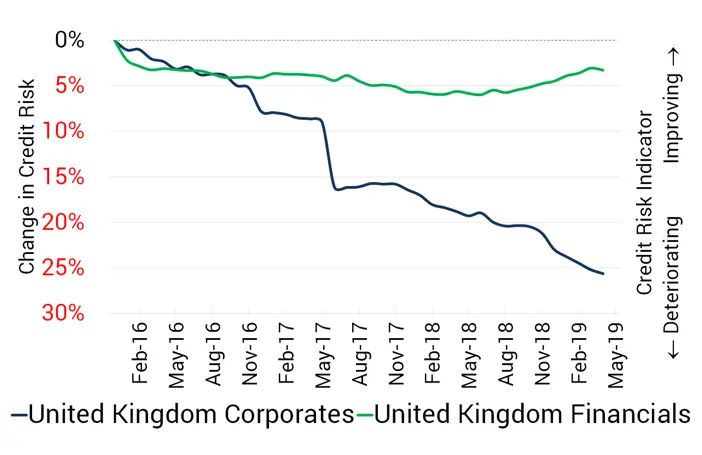

United Kingdom: What is the impact on UK Industries following the Brexit vote?

Europe: Most of the European Countries analysed show overall improvements in Corporate and Financial credit risk over the last year, with a couple of key highlights.

Asia: All countries show improving Corporate credit risk over the past year. Most Financials also have improving trends, with a couple of exceptions.

UK and US Oil & Gas: The most recent data shows a dip in credit quality – but is a turning point in sight?

.

For access to the full Chartbook, please enter your details below