Companies increasingly face a legal requirement to disclose their Gender Pay Gap. According to the FT, the majority of large UK businesses pay more to men than women, with an average median difference of 9.7%. The average male/female % split in each company is close to 50/50, but the top quartile is 63% male. The US Congress Joint Economic Committee reports that, in 2016, women earned 79 cents for every dollar paid to men.

The Gender Pay Gap is real and global, but its causes and solutions are currently the subject of intense debate. For example, the salary distribution in most companies depends on employee age; in some companies specific age brackets will be dominated by one gender. But academic studies that have attempted to correct for age, educational attainment and lifecycle factors (e.g. women with / without families) have usually found that a significant gap persists.

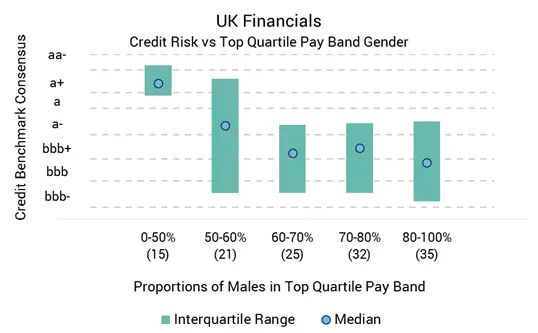

The chart below plots credit risk ranges for bank-sourced data across 128 companies in the UK Financial sector, and this appears to show a trend difference between gender-based pay measures and credit risk. The 15 companies where the top quartile pay band is more than 50% female show significantly lower credit risk, with a median CBC* of a+. The 35 companies with a very high (>80%) proportion of males in their top quartile pay band have the highest credit risk with a median CBC of bbb. The critical threshold seems to be 50%-60%; it has a very large interquartile range and a median CBC of a-. Where males represent more than 60% of the top quartile pay band, the median CBCs are bbb+ or bbb, and the ranges are narrower.

These differences reflect a complex set of related factors which simultaneously affect gender pay and credit risk. For example, old and established companies may employ more males, especially in senior positions but may also, for historic but unrelated reasons, have lower credit quality. Younger companies may embrace a culture which employs more women in senior positions and may also be well funded because they have not had to weather as many credit cycles. But they may also arise directly from gender differences in attitudes towards risk. It is more than a decade since McKinsey showed that the best performing companies have strong female representation at senior levels, and in 2013 consultants Rothstein Kass showed that hedge funds that are majority-owned by women had outperformed the broader peer group for more than 5 years.

Correlation does not imply causation; but the data suggests that – for UK Financials – the Gender Pay Gap may be one of a number of proxies for credit risk. Further research will look at this effect in other industries.

*Credit Benchmark Consensus (“CBC”): this is a 21-category alphanumeric scale based on bank-sourced one-year probability of default estimates. It is similar to the scale used by the main credit rating agencies, so that a CBC of bbb is approximately equivalent to BBB reported by S&P and Fitch, and Baa2 reported by Moody’s