The Federal Reserve’s Federal Open Markets Committee is set to meet this week for the third time this year. Although no interest rate movements are expected, investors will still be watching to see if the Fed will continue its ‘wait and see’ approach.

Considering the outcome of the March FOMC meeting reflected a change in expectations from two rate hikes this year to zero, it’s likely that the new ‘patient’ approach will remain this time around.

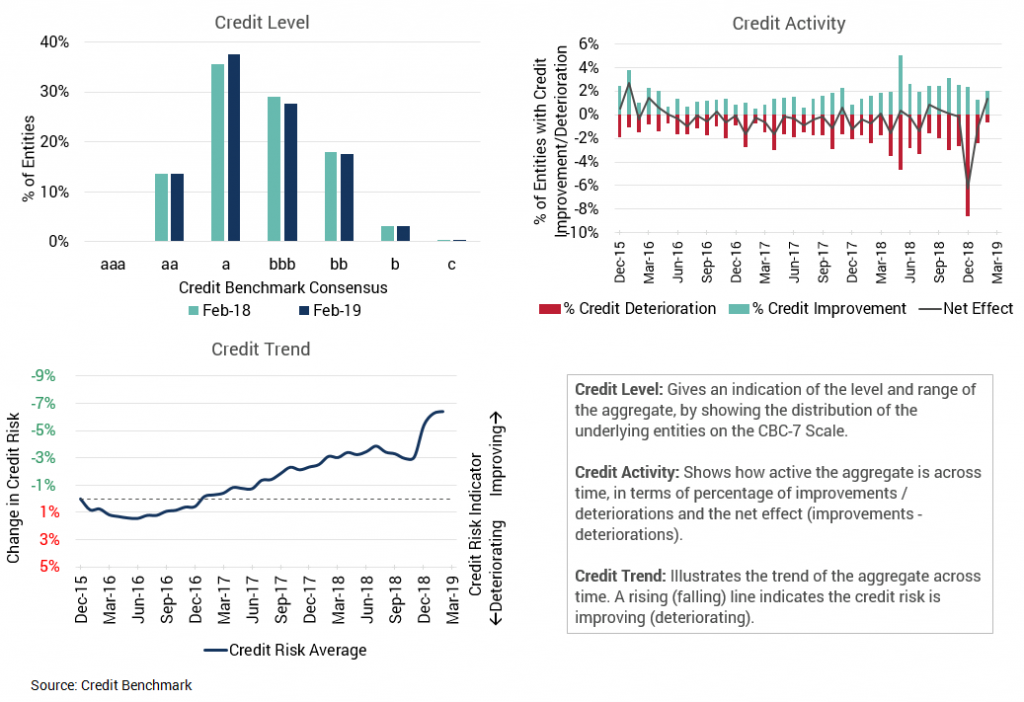

In light of the upcoming meeting, in the data below from Credit Benchmark we take a look at the consensus credit risk views of 30 global financial institutions on US large non-bank financial companies in aggregate.

Chart 1: Credit Level shows the largest rating category is a, which increased since last year.

Chart 2: Credit Activity shows that net downgrades outnumber net upgrades in 14 of the previous 39 months. December 2018 showed a pronounced spike but a swing towards improvement has occurred since then, which is reflected in Chart 3: Credit Trend.