Download the latest Financial Counterpart Monitor below.

Financial counterparts had a strong showing in the latest Credit Benchmark credit consensus data.

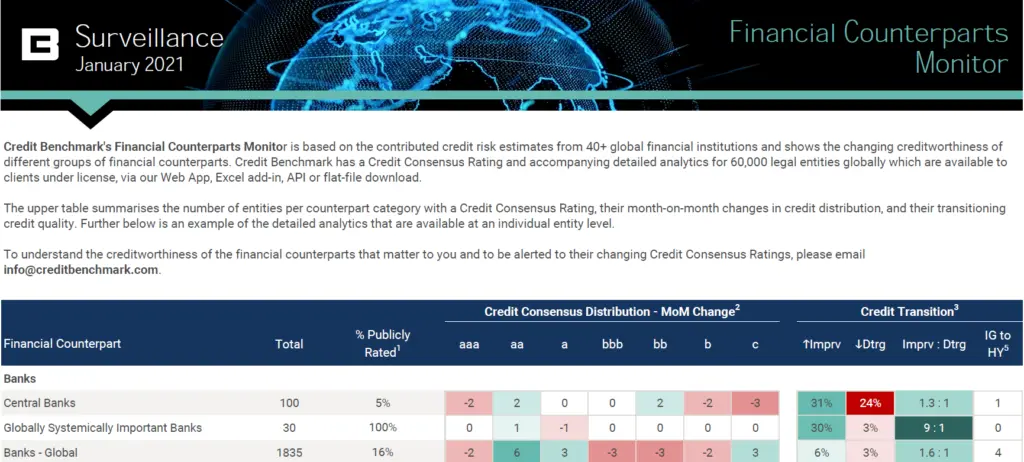

Globally Systematically Important Banks (GSIBs) came out on top, with a ratio of improvements to deteriorations of 9:1. All other categories of banks showed a bias towards improvement, with the exception of LatAm banks which had a balance slightly tipped towards deterioration, at 1:1.2. Central Banks showed overall improvement at 1.3:1, however the instances of both improvements and deteriorations were notably high this month.

It was good news all round for Intermediaries, with a positive bias in all categories. Prime Brokers showed the highest ratio of improvement to deterioration at 4:1, while CCPS showed no instances of deterioration at all.

The Buy-Side also saw overall improvement, particularly in Sovereign Wealth Funds which showed no instances of deterioration. Asset Managers performed well too, with an improving/deteriorating ratio of 2.7:1.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.