The 2016 EU-wide stress test results covering 51 banks were published last week. Credit Benchmark data shows a clear relationship between risk and CET 1 ratios, especially under the Adverse scenario.

The stress test results can be interpreted in a number of ways, but the key messages are clear. The actual capital position of these banks has improved by E180bn (2.1%) since 2013. Under the Adverse scenario knocking 7.3% from GDP growth over 3 years, a few banks would have their capital completely wiped out.

Average Common Equity Tier 1 (CET 1) ratio would decrease from 13.2% to 9.4% with most of the individual ratios dropping into the range of 6% – 16%. The main capital hits would be credit risk (E349bn or 3.7%), market risk (E98bn or 1%) and operational risk (E105bn or 1.1%). The majority of the projected losses are in the Corporate portfolio; Commercial Real Estate losses are significantly lower.

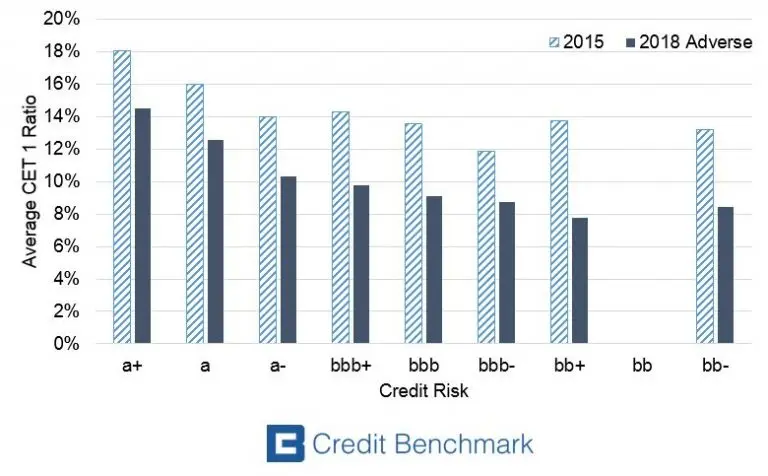

The chart below shows the average CET 1 ratios for banks in different CBC categories*, both for the 2015 baseline and for the 2018 Adverse scenario. The figure covers most of the banks in the study excluding [aa-] and [b] categories, which contain only one entity. This shows a clear relationship between risk and CET 1 ratios, and in addition shows that current credit risk is a particularly good predictor of the 2018 Adverse CET 1 ratio.

This suggests that banks already take economic risks into account when forming their views of their own industry. It also suggests that the stress test outputs will not have come as much of a surprise to banks and credit analysts; unlike their counterparts in the equity market who seem to have had an adverse reaction to these results.

Of the 51 banks in the study, it is worth highlighting the Spanish banks in the Credit Benchmark database. The CBC* for most Spanish banks has been improving since March, suggesting further improvements in rebuilding capital since the stress test results were calculated. The CBC is now close to entering the [bb+] category, one notch below Investment Grade. The chart below suggests that these CBC improvements may be anticipating stronger Tier 1 ratios.

*CBC = Credit Benchmark Consensus; a 21-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC of [bbb+] is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.