Defense sector credit quality improving globally

- Rising defense budgets bring credit benefits across the sector.

- Procurement reviews will be biased to newer technology.

- Private company credit is keeping pace with public improvements.

The new geopolitical reality and economic impact of global uncertainty have begun to impact a number of industries including defense. While the new US Department of Government Efficiency (DOGE) roots out overspending by the Pentagon, Europe is planning for a material increase in defense budgets. Overall, trends show a net positive impact for defense companies in terms of spending; reflected in Credit Benchmark’s defense credit indices which show a lowered default risk outlook.

A Ukraine peace deal could ease tensions, but Europe recognizes the need for stronger domestic defense to ensure security, funded by robust economies. The Ukraine conflict, marked by satellite surveillance and AI-assisted drones, underscores evolving warfare tactics, including sabotage on energy and infotech infrastructure.

Opinions on military strategies vary. Modernists stress rapid tech advances, while traditionalists prioritize firepower and increased spending on troops and equipment. US Defense Secretary Pete Hegseth supports hi-tech for Europe and traditional focus for the US.

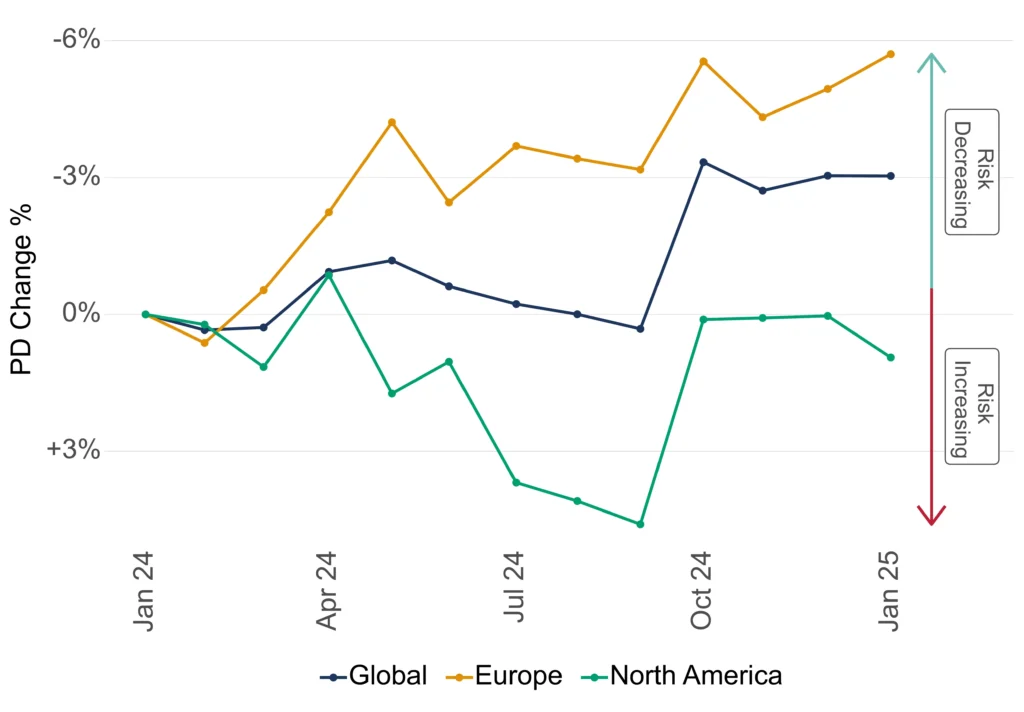

The chart below shows regional trends in Credit Benchmark’s Aerospace & Defense credit indices over the past 12 months.

Aerospace & Defense Credit Trends: Global, Europe, North America

Default risk estimates for European Aerospace & Defense companies have improved by 6% in the past year; while North America showed credit deterioration in early 2024 it has now also improved by a similar amount.

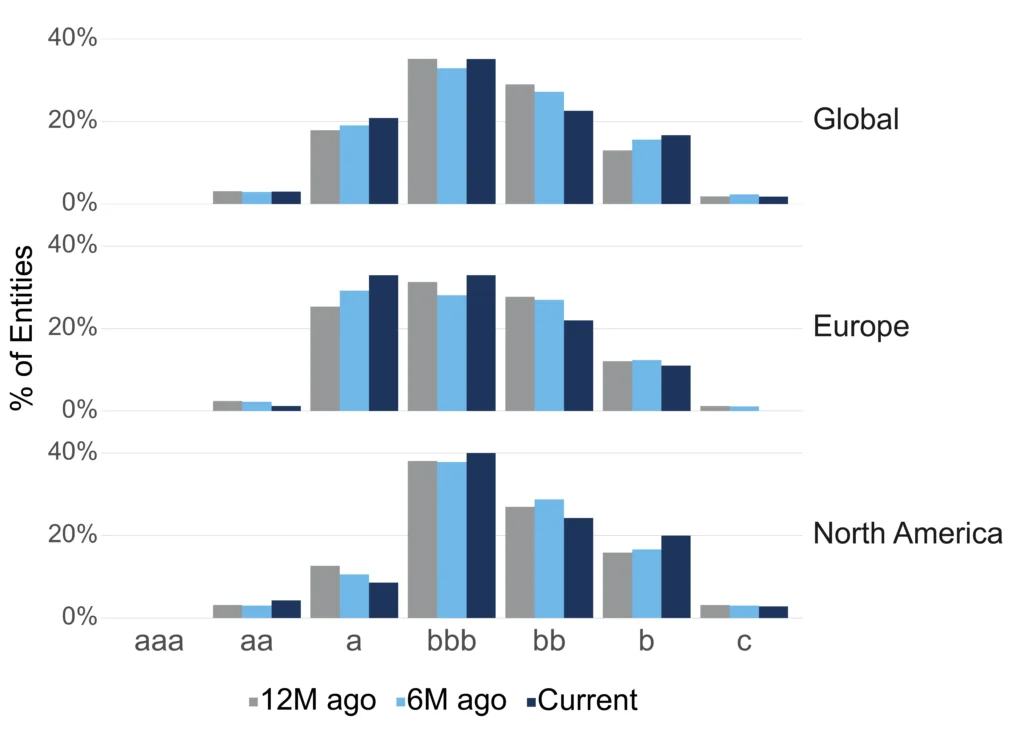

The next chart shows the credit profiles for each region.

Aerospace & Defense Credit Profile: Global, Europe, North America

The majority of companies are investment grade, but nearly a third are in the ‘bb’ or ‘b’ High Yield categories. And North America has a small but growing proportion in the ‘c’ category. If any of these are potential casualties of the DOGE reviews, there may be a one-off spike in high yield North American default rates in the Aerospace & Defense sector.

What do stock markets think? In the past year, tech-driven defense stocks (e.g., Palantir) have massively outperformed traditional firms like Lockheed and Grumman. But shares in traditional armaments manufacturer Rheinmetall are up 30% in the past month and have more than doubled in the past year.

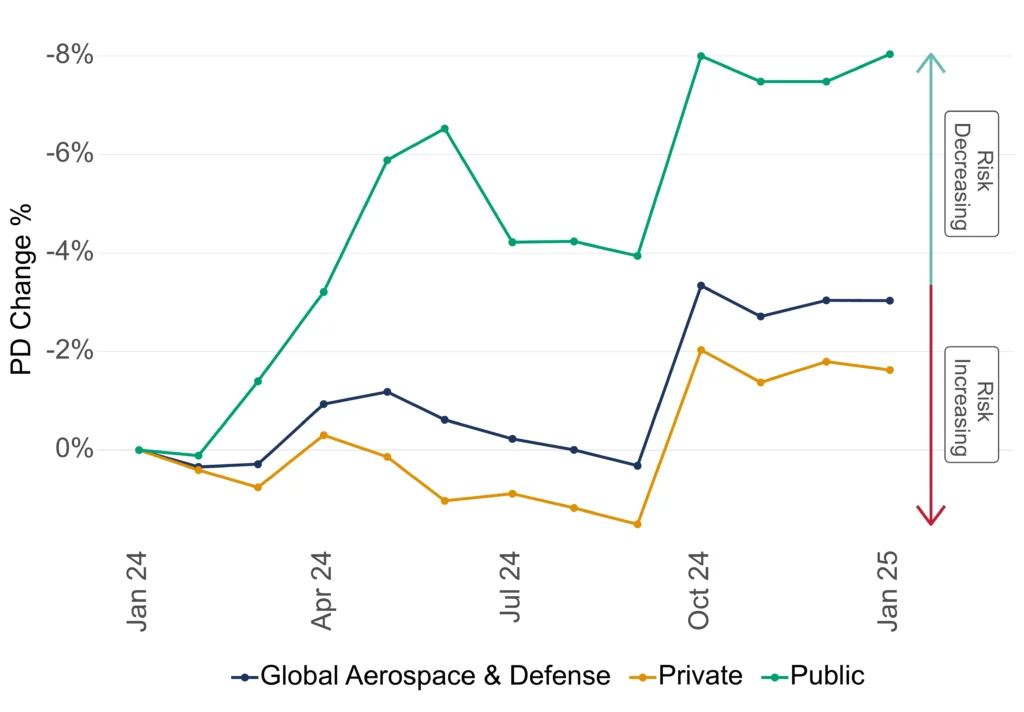

The charts below show the Credit Benchmark indices for public (i.e. listed) and private Aerospace & Defense firms globally.

Global Aerospace & Defense Credit Trend: Public vs Private

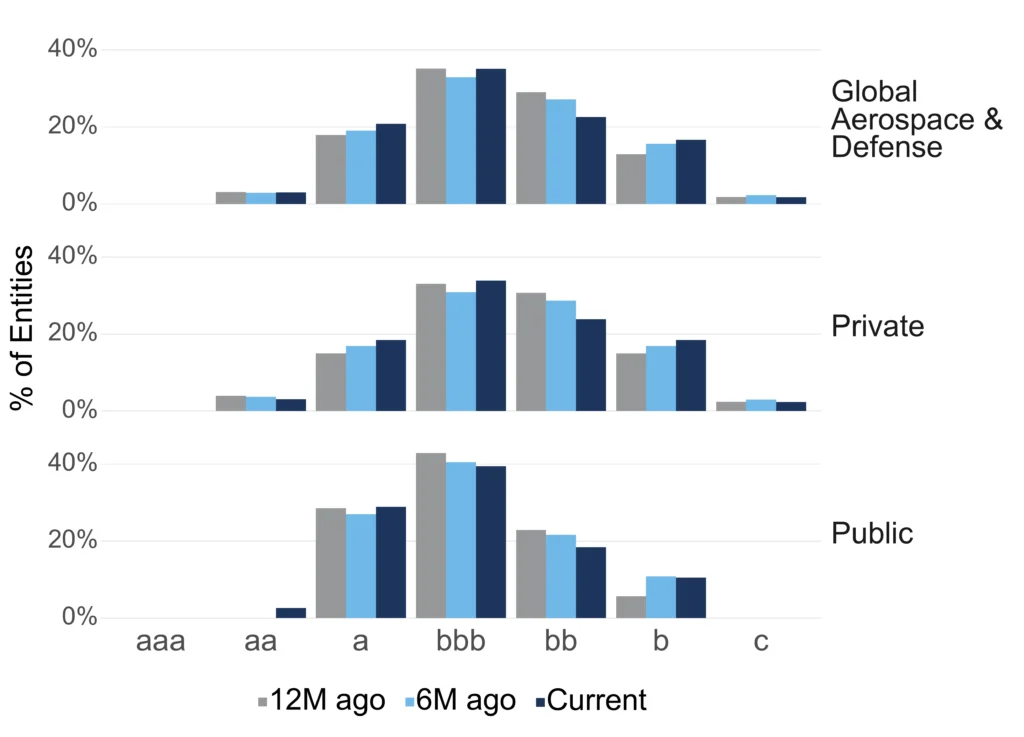

Global Aerospace & Defense Credit Profile: Public vs Private

Default risk for public borrowers has steadily improved about 6%; private credit is following suit after flatlining for most of 2024, showing around 3% credit improvement in recent months. The risk profile charts on the right show that some private firms in the ‘c’ category, (none in the public set) and this proportion has risen slightly in the past year.

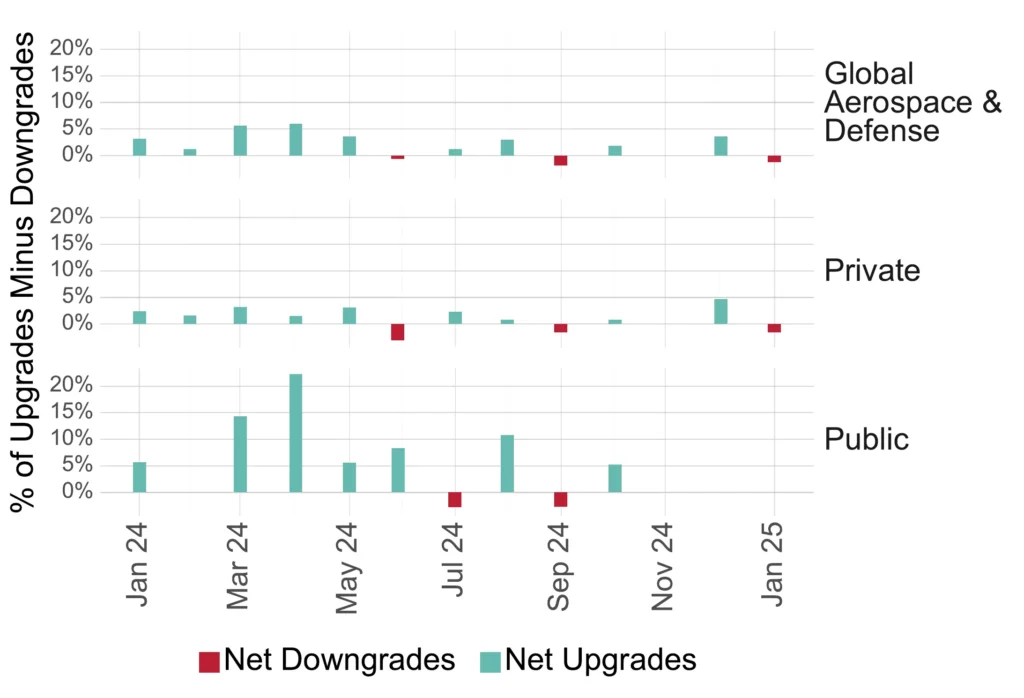

The next chart shows the pattern of credit upgrades and credit downgrades seen in Credit Benchmark’s Global Aerospace & Defense index, split by public and private firms.

Global Aerospace & Defense Credit Trend & Credit Profile: Public vs Private

Of the 13 months plotted here, credit upgrades have outnumbered credit downgrades in 9 months. The positive balance has been particularly high in public companies but private companies show the same monthly bias on a smaller scale.

Conclusion

Defense spending of about $2.7trn looks set to increase by at least 5% globally in 2025, with Europe rising by closer to 10%. Most traditional and alternative contractors will benefit, unless they are adversely impacted by the wildcard DOGE review. Credit Benchmark’s bank-sourced consensus data shows the trend swinging towards credit upgrades and lower default risks in US and Europe, across both public and private firms.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg, Snowflake and AWS. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 10,000+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.