German Corporates facing accelerated credit deterioration amid economic struggles

- Credit Benchmark data shows German Corporates have second largest credit deterioration of all the major European economies.

- Consumer Goods, Healthcare and Basic Materials are the worst performing German industries.

- 1-year credit outlook also negative; deteriorations continue to outweigh improvements.

Germany faces growing economic and political challenges. While fiscal rectitude remains the bedrock of its historically rock-solid AAA Sovereign rating, the FT has commented on the scope for other factors to undermine that.

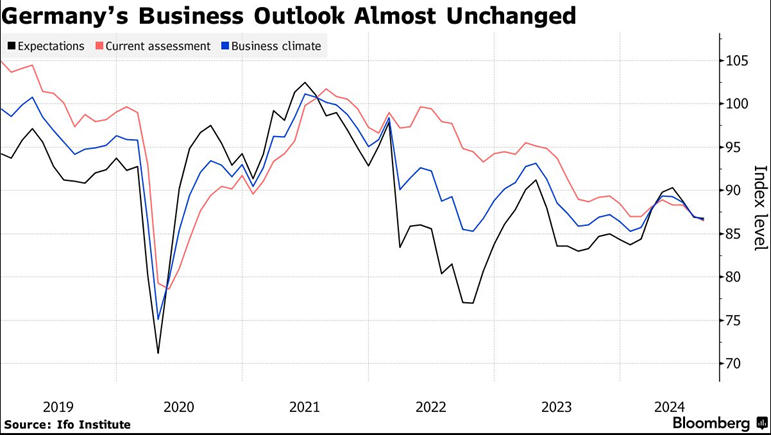

Growth is the primary concern, with GDP recording a surprise Q2 drop of 0.1%, against +0.3% for the rest of the Eurozone. Structural factors – like an aging population – are part of the problem; Ifo President Clemens Fuest recently commented: “The German economy is increasingly falling into crisis.”

And sluggish growth looks set to continue, with the Ifo business outlook slipping back to the Feb-24 level [1]

Recent gains in Thuringia for far-right party AfD suggest that economic difficulties are mirrored in political shifts, especially in the former GDR; but political tension and uncertainty can themselves undermine investment and growth prospects.

Consensus credit risk data from Credit Benchmark shows the impact across the German private sector.

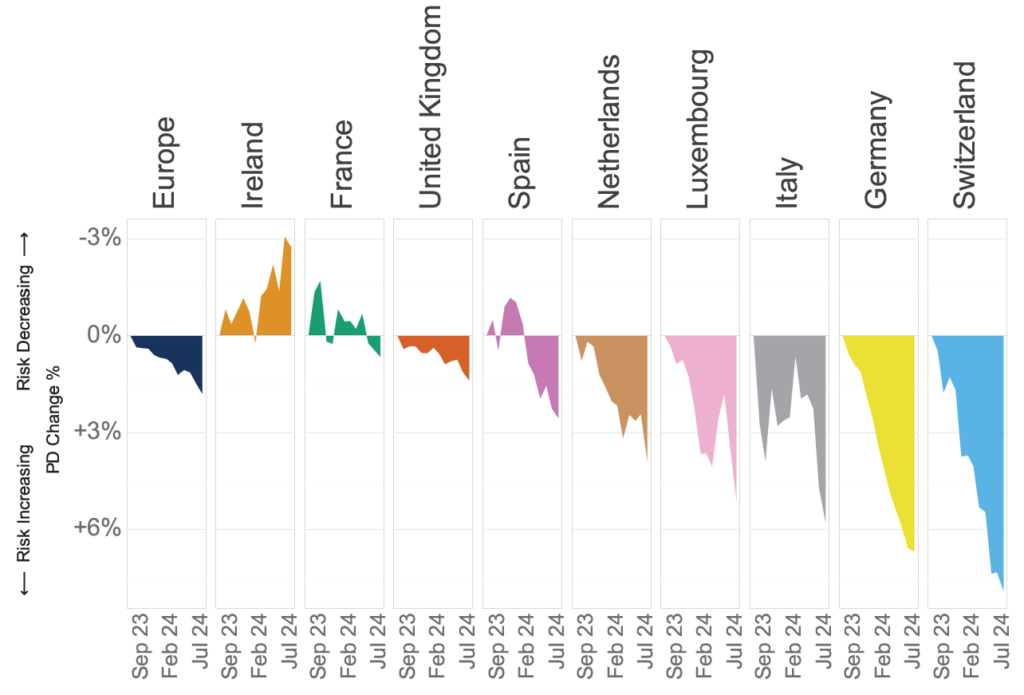

12m change (%) in probability of default: major European economies

In the past 12 months, consensus credit risk indices for German Corporates have posted the second largest credit deterioration of the major European economies. Probability of default risk shows a cumulative increase of more than 6% in the past 12 months, second only to Switzerland at around 9%. France is close to unchanged while Irish Corporates have actually improved 3% over the same period.

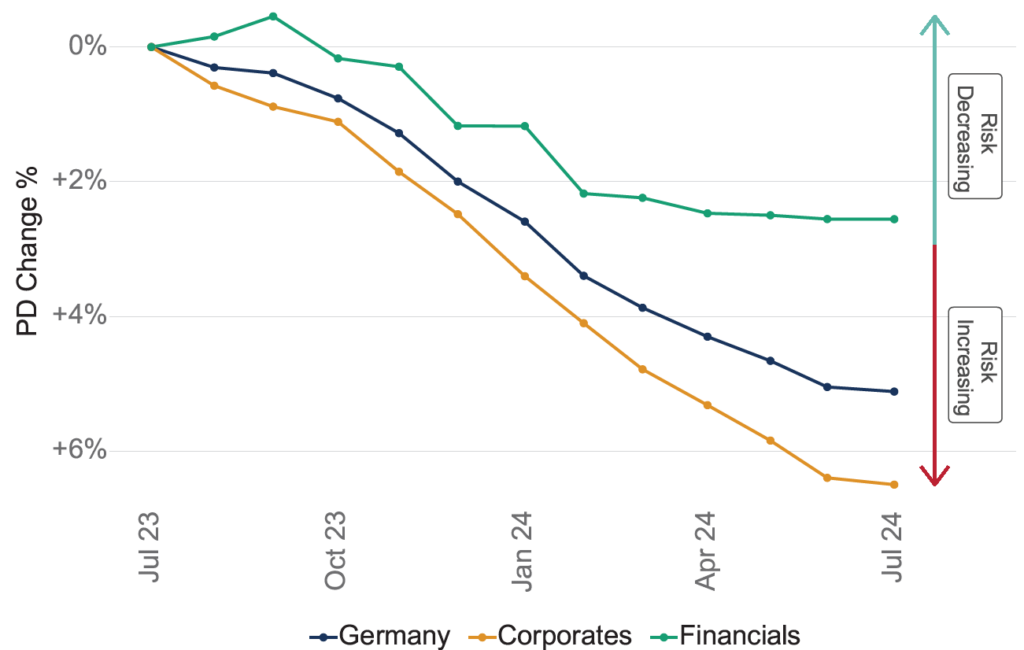

12M change (%) in probability of default: German Corporates vs German Financials

Credit Benchmark’s consensus credit ratings index for German Financials also shows a modest but steady credit deterioration over the same period (+2%).

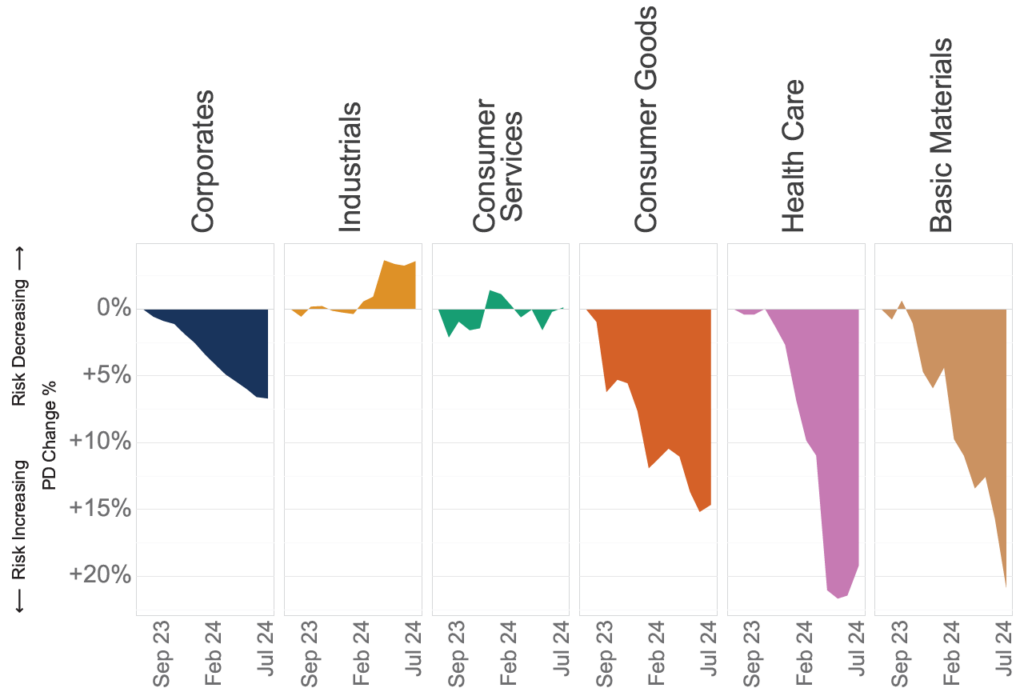

12M change (%) in probability of default: German industries

The worst performing credit sectors in Germany were Consumer Goods (+15%), Health Care and Basic Materials (+20%).

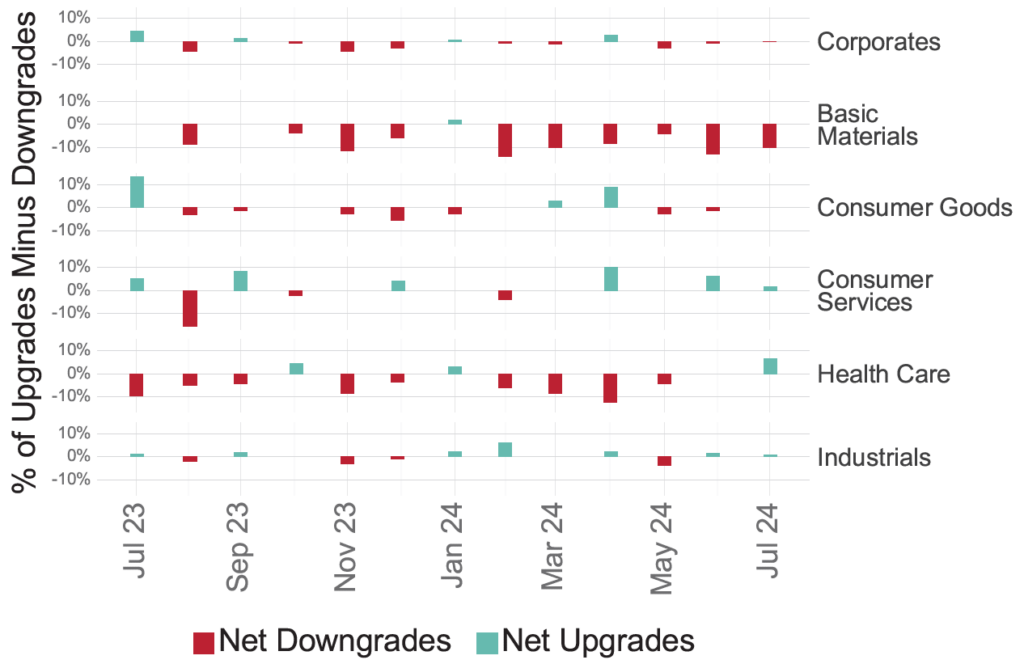

Credit upgrades vs credit downgrades net balance: German industries

German Basic Materials have posted a 6th consecutive month of net credit downgrades; last July, 10% more companies has their credit rating downgraded rather than upgraded.

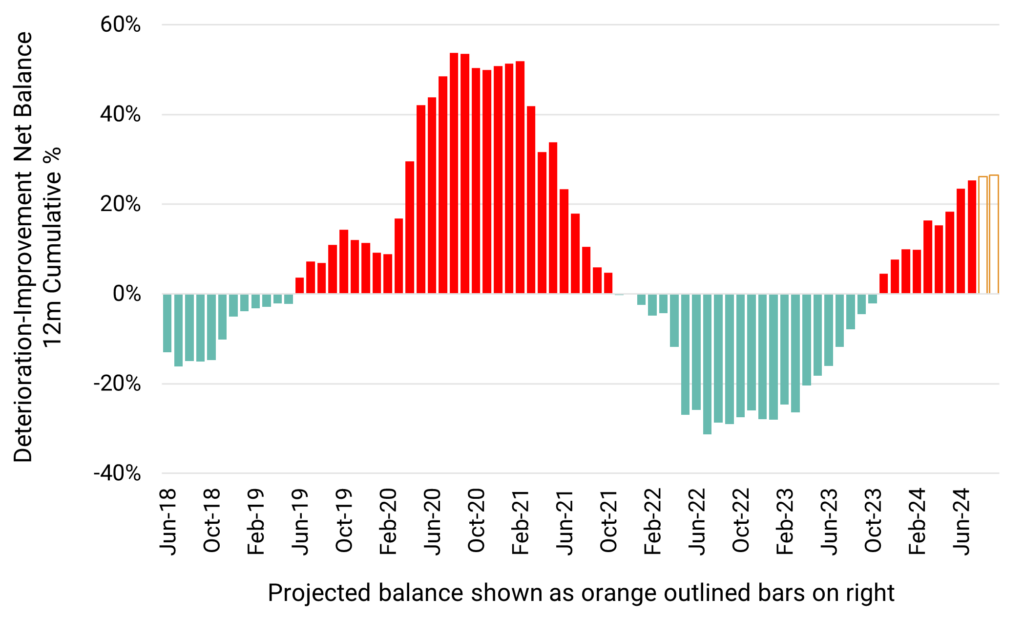

Rolling 12m net balance of deterioration and improvement: German Corporates

Credit Benchmark’s 1-year credit outlook for corporates is also negative. This chart plots the rolling 12-month balance of deteriorating and improving probability of default risk estimate changes over the past few years. Credit deteriorations continue to outnumber credit Improvements by a substantial margin.

Credit Benchmark consensus credit data is updated twice-monthly; advanced analytics are now also available on the Credit Benchmark website via Credit Risk IQ industry reports. Register now for free access.

Download

[1] The S&P’s Global Purchasing Managers’ Index for August is also below the

contraction threshold for the 2nd month in a row.