The Trump effect on US sectors: default risk winners and losers

- Some core US industries to benefit from tariff protection, but retaliation likely.

- Supply chains will be hit by trade wars and deportations.

- Financials to benefit from cuts in red tape.

The seismic Trump 2024 election victory has already had some real effects (e.g. the price of Bitcoin surging past $90K) and the impact on the US economy in 2025 will be far reaching. Tariffs, tax cuts, higher long rates, regulatory rollback and mass deportations will upset the business environment for a diverse range of sectors.

Drawing on internal credit ratings collected by Credit Benchmark from the world’s leading banks this report shows recent default risk trends for some of the most affected sectors in the US and around the world. It also outlines where existing trends are set to accelerate and lists sectors that may now face major turning points. Further updates from Credit Benchmark will follow as we collect updated bank estimates.

Domestic Policy Direction

- Lower corporate taxes and reduced regulation.

- Political pressure to cut short-term rates despite inflation pressure driving higher yield curve.

- Potential for significant trade barriers and global hit to growth.

Sector Specific Analysis:

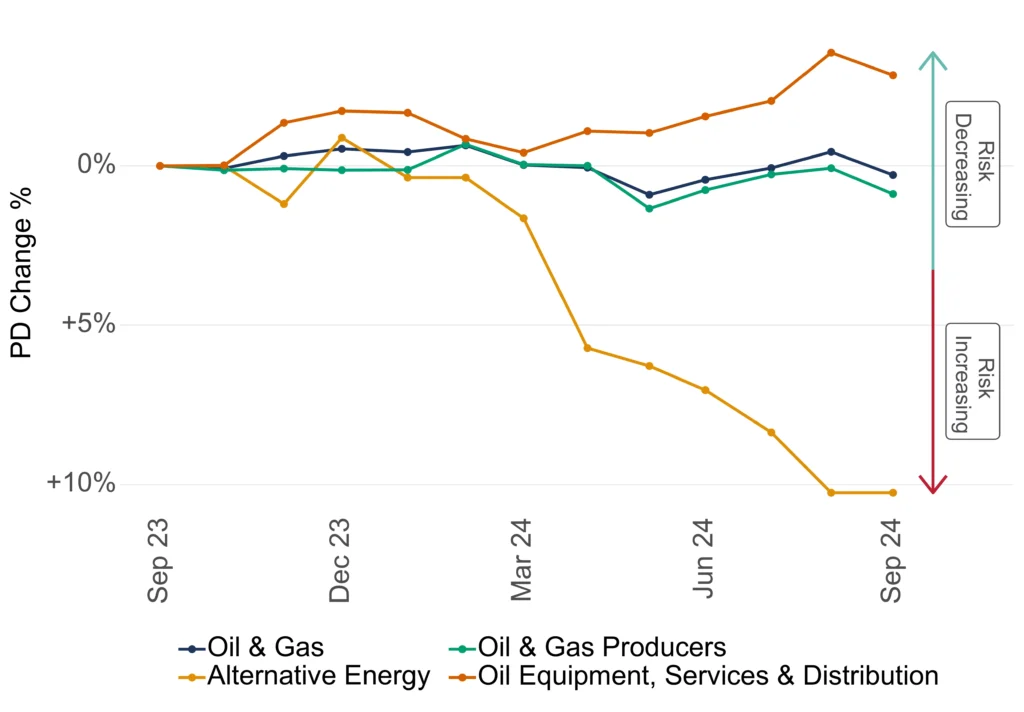

Recent Trends 2023-24: US Energy Markets

Expected impact on default risk in 2025:

- Stable default risk profile, likely to strengthen.

- Renewables: 10% deterioration in credit metrics; outlook negative.

- Key Driver: Policy shift favoring traditional energy.

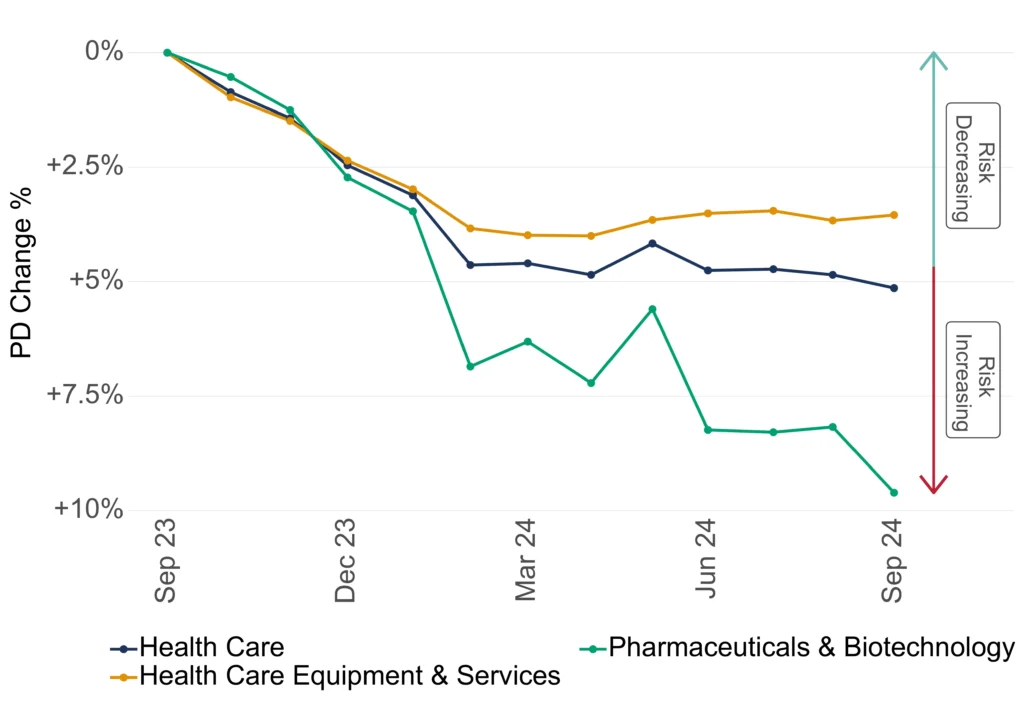

Recent Trends 2023-24: US Healthcare

Expected impact on default risk in 2025:

- Default risk to deteriorate with Federal program cuts.

- Public health policies to focus on prevention.

- Pharma hit from anticipated anti-vaccination policies.

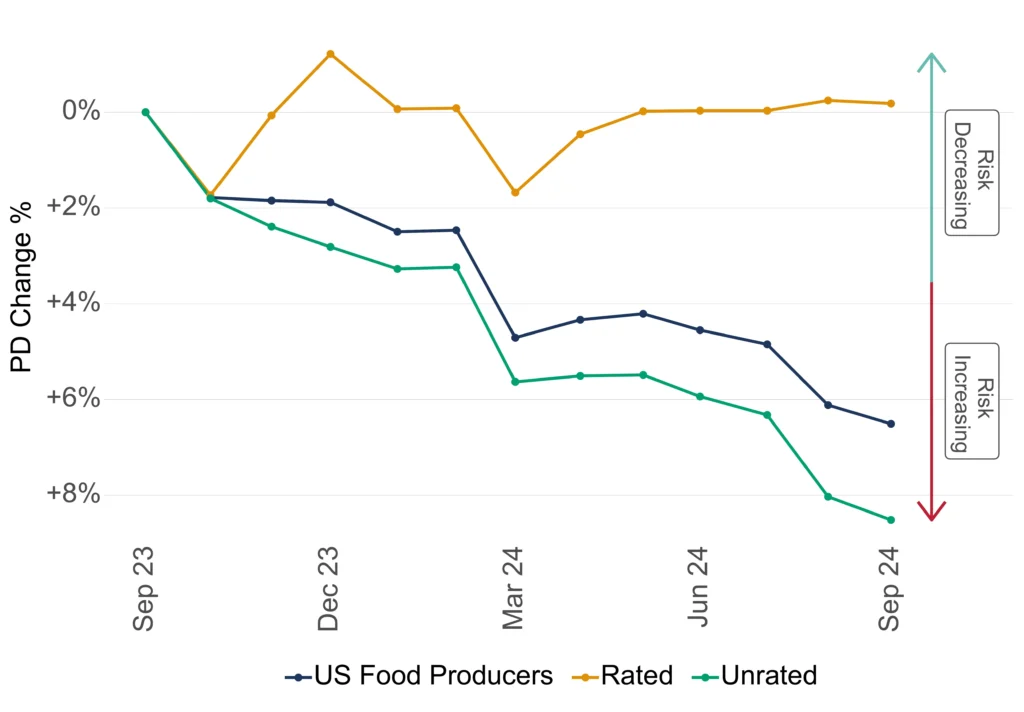

Recent Trends 2023-24: US Food Industry (Rated vs Unrated)

Expected impact on default risk in 2025:

- Positive for domestic healthy food producers (tariff protection).

- Negative outlook for processed food (impact of GLP-1 drugs).

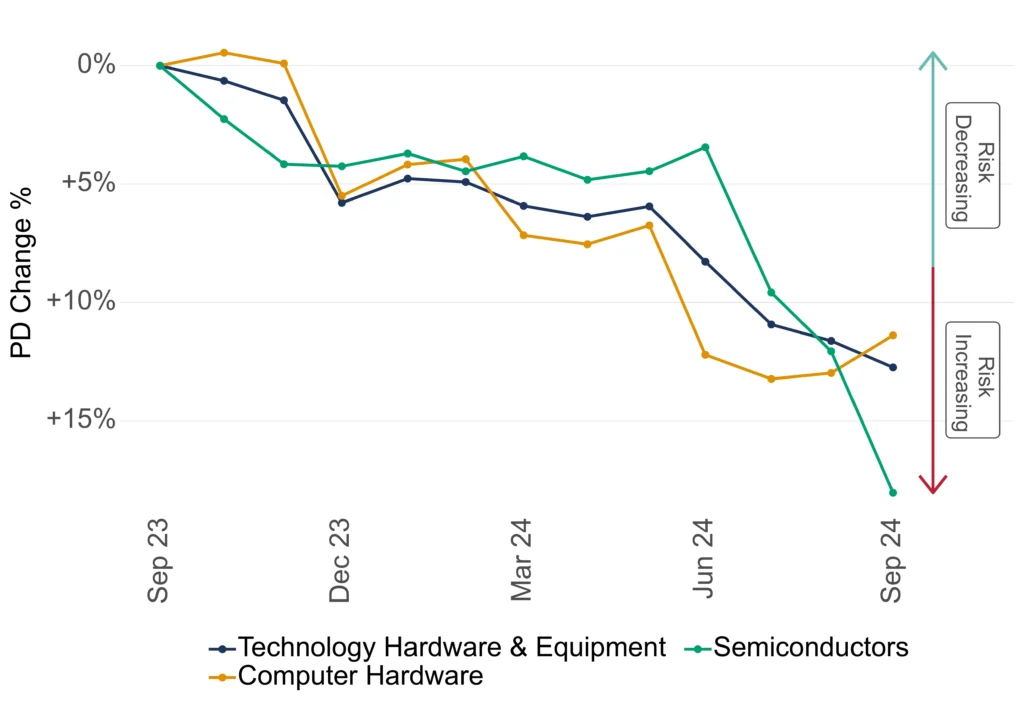

Recent Trends 2023-24: US Technology

Expected impact on default risk in 2025:

- Domestic Tech: Strong upside in cybersecurity, satellite communications.

- Anticipated shift in defense requirements and spending to drive civilian tech firm profits.

- Supply Chain Risk: Taiwan-China tensions could disrupt semiconductor supply globally, with knock on effects to multiple industries (e.g. autos).

Traditional Industries:

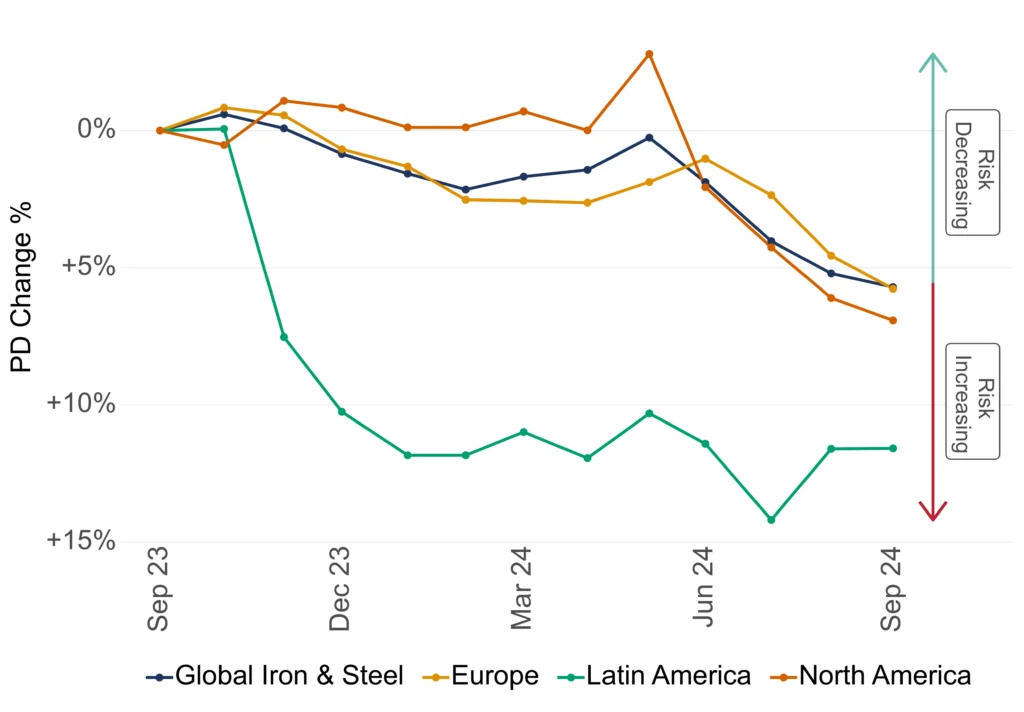

Recent Trends 2023-24: Steel (Regional Trends)

Expected impact on default risk in 2025:

- Global demand set to weaken if tariffs hit European and Asian growth; existing supply overhang could lead to sustained pressure on margins and volumes.

- US could be an outlier with scope for recovery through tariff protection.

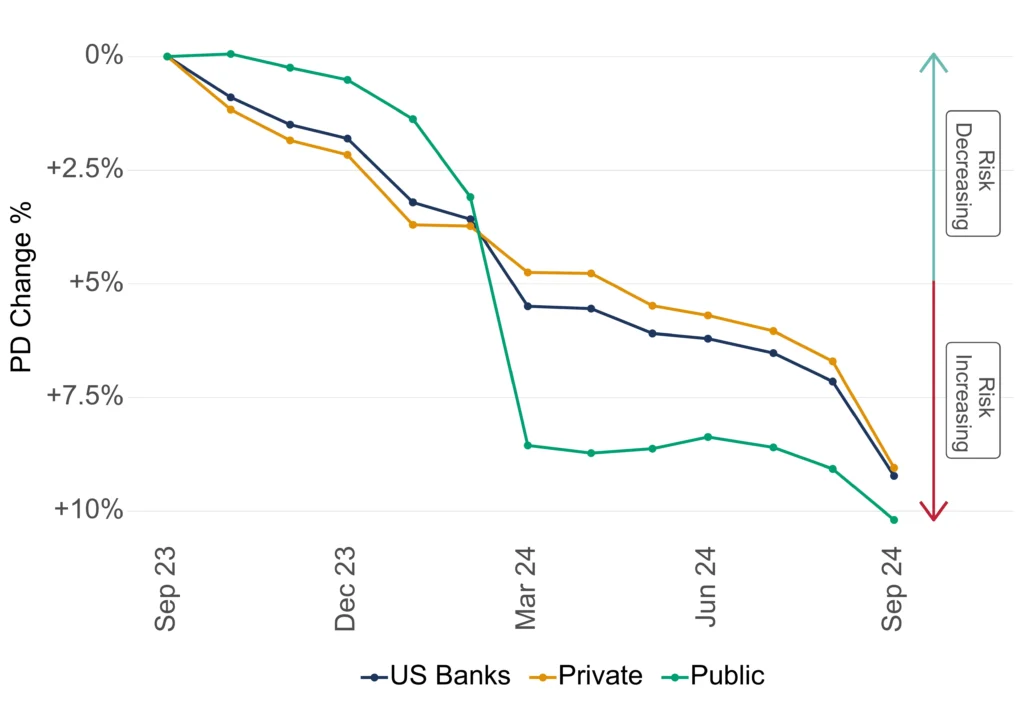

Recent Trends 2023-24: US Banks (Public vs Private)

Expected impact on default risk in 2025:

- Regulatory easing to boost loan volumes and margins.

- Non-bank sector also likely to benefit from lighter touch regulation.

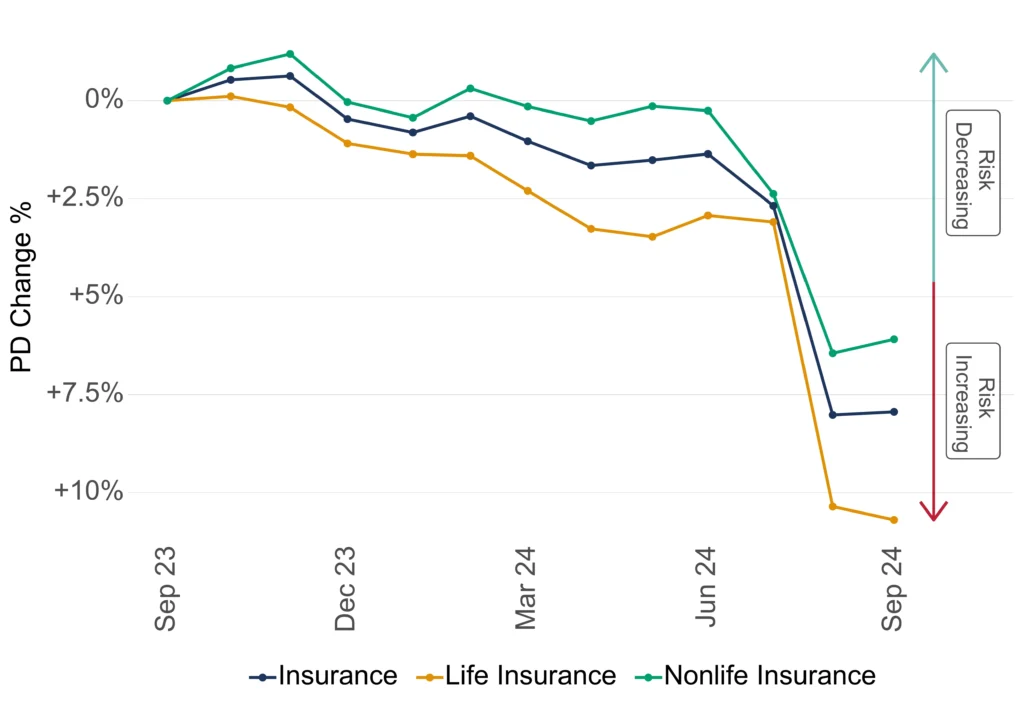

Recent Trends 2023-24: US Insurance (Life vs Nonlife)

Expected impact on default risk in 2025:

- Insurance: Negative outlook on climate risk exposure.

- Healthcare reform impact double edged but likely negative.

Trading Partner - High Impact Areas Risk Assessment:

Recent Trends 2023-24: China (High Yield vs Investment Grade)

Expected impact on default risk in 2025:

- Limited stimulus effectiveness.

- Retaliatory trade measures likely if US tariffs spike.

- Treasury selloff risk – China could liquidate US bond holdings.

Recent Trends 2023-24: Mexico (High Yield vs Investment Grade)

Expected impact on default risk in 2025:

- Direct trade exposure.

- Fiscal impact of expected deportations.

- Supply chain disruption risk.

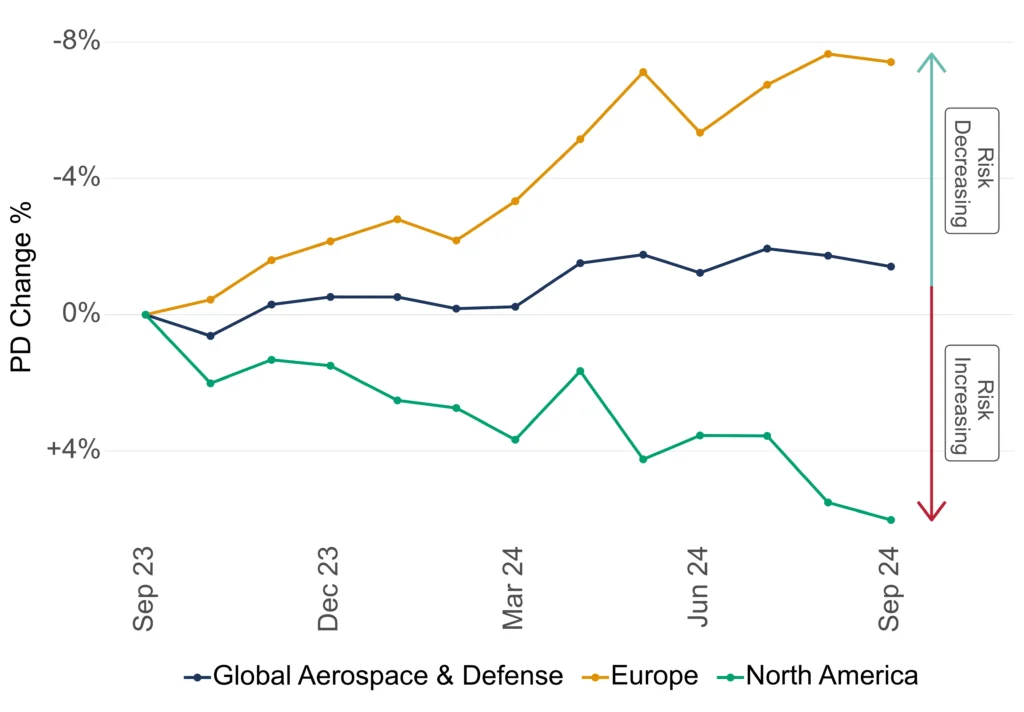

Recent Trends 2023-24: Aerospace & Defense

Expected impact on default risk in 2025:

- Europe more resilient in face of tariffs due to large internal market.

- Defense sector outperformance due to geopolitics and NATO realigment.

Risk Mitigation Recommendations:

- Increase monitoring of cross-border exposure.

- Review sector allocations with focus on domestic beneficiaries:

- Anticipated domestic beneficiaries: energy, cybersecurity, satellite comms, tech, banking, healthy food producers.

- Anticipated domestic losers: renewables, semi-conductor, pharma, healthcare, processed food producers.

- Enhanced stress testing for trade-dependent portfolios.

- Review supply chain exposures.

- Stress test for regulatory shifts.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 10,000+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.