Why Credit Benchmark?

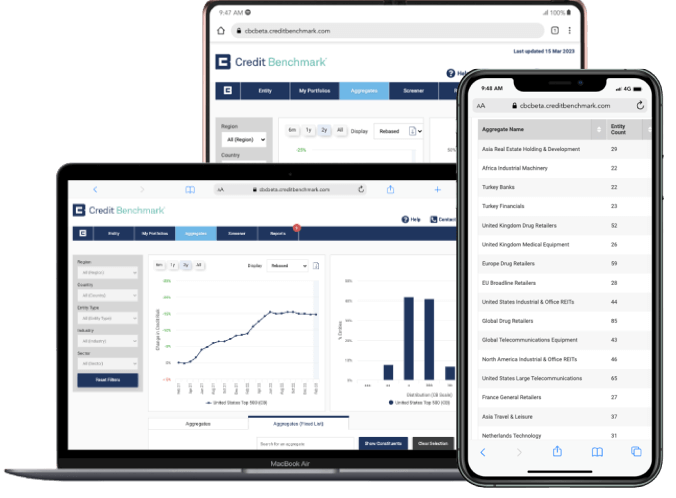

Independent consensus credit data provides clarity within the Fund Finance market

Credit Consensus Ratings are utilised for a variety of financing solutions including subscription finance, NAV financing and GP financing.

Solutions

How we can help your business

LP Look Through for Revolving Facilities: Credit Consensus Ratings provide transparency into the quality of LPs when there is little to no ratings information available.

Net Asset Value (NAV) Financing: High degree of Credit Consensus Ratings on underlying companies. 90% of Credit Benchmark’s coverage is currently unrated by traditional ratings agencies.

For firms entering the subscription finance markets, consensus data can help to plug an informational gap where a lack of a strong sponsor relationship may slow deal progress.

Understanding the creditworthiness of funds and entities when evaluating the underlying collateral base for GP and LP Financing vehicles

Case Study

The Client

A major European bank.

The Challenge

A large proportion of the client’s LP list were publicly unrated creating challenges around the accurate assessment of the credit risk.

The Solution

Following a coverage check, Credit Benchmark were able to provide robust coverage on the portfolio of interest, providing ratings on the names the client was unable to get a traditional rating agency rating for.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Rating the unrated

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Independent

Free from “issuer-pays” conflict and any bank bias.

Real-world exposure

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Dynamic

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Expanding footprint

A unique growing global dataset.