Why Credit Benchmark?

Better manage your clearing member network risk exposure

High standards of risk management are integral to the smooth functioning of a CCP.

A lack of reliable credit intelligence on CCP member and member client credit risk at the exact legal entity level can make challenging internal models difficult.

Credit consensus data helps to fill in these gaps on CCP member and member client risk.

Solutions

How we can help your business

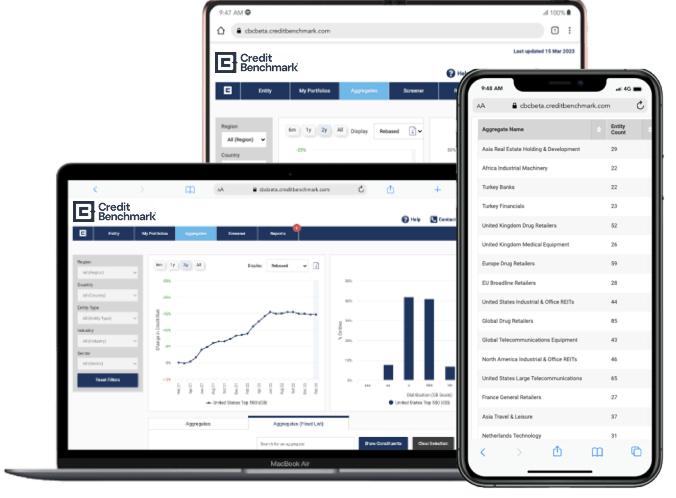

Weekly updates as financial institutions revise their opinions allow CCP analysts to continually challenge their own models and assumptions.

Monitor credit views on clearing members who do not have a public credit rating to enrich annual credit assessments of clearing members.

Conduct enhanced portfolio reporting to review trends and generate more frequent management reporting.

Leverage automating alerting on recent upgrades and downgrades within a portfolio.

Expand credit risk analysis to clearing members’ clients, including opaque buy-side names, to gain a picture of member network risk.

Help onboard new members by quickly and easily analysing the credit of new kinds of members including funds.

Case Study

The Client

A leading global derivatives clearing house.

The Challenge

The credit analyst team was spending days inefficiently analysing unrated companies to determine their membership eligibility or when refreshing the house view of existing members. On top of this, the client was concerned about being indirectly exposed to significant second order risk through members’ weaker end clients, and didn’t have the internal resources to assess the credit risk of the 2,000+ entities that made up this second order risk.

The Solution

The client was able to save time by beginning their analysis of potential new members by checking the entity’s Credit Consensus Rating, making the membership process quicker and easier. The breadth of the consensus dataset, including publicly unrated buy-side names, also allowed the client to better monitor the credit of their members’ clients, and monitor key markets with Credit Benchmark industry, sector, and geography indices.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $28+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Unparalleled coverage

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Robust methodology

Free from “issuer-pays” conflict and any bank bias.

Real-world perspectives

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Up-to-Date, in The Know

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Safety in numbers

A unique growing global dataset.

Related Material