Why Credit Benchmark?

Better identify, quantify, and monitor your credit risk leveraging Credit Consensus data

Since 2015 Credit Benchmark has been producing Credit Consensus Ratings & Analytics by bringing together the internal risk views of ~40 of the world’s largest banks (almost half of which are GSIBs).

Credit Consensus Ratings on 110,000+ individual obligors (less than 10% with external ratings) enable banks to maximise their available information set to enhance their risk management and decision-making across the client lifecycle. Enhanced behavioural analytics ensure banks are fully informed on how their portfolio performance compares to the market.

Solutions

How we can help your business

Automated portfolio monitoring and surveillance can flag negative or positive movement, creating additional capacity for analysts to cover a larger set of names, and expend resources to where it matters – managing exceptions and responding to early warnings.

Access to the full global consensus database (not just to internal firm data) provides greater insights for use in considering industry, geographical and sectoral business expansion. Consensus data can be used to expedite a high-level review of target clients and implement market intelligence-led prospecting.

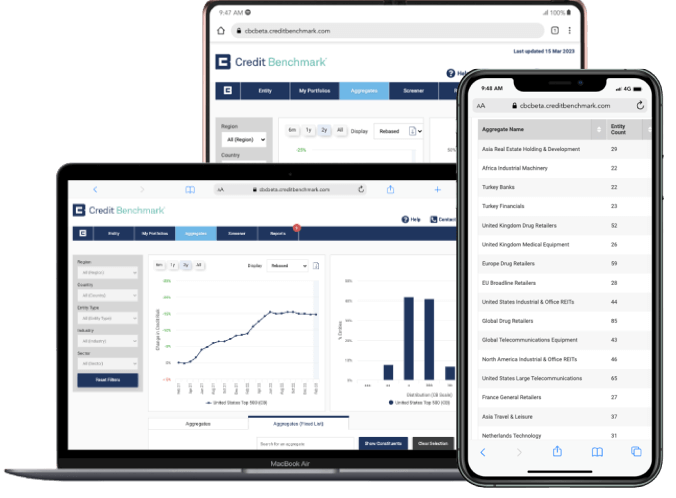

Incorporate our credit risk management software to build bespoke reports and seamlessly integrate data into internal workflows, annual reviews, new client / deal approvals, credit committees, industry reviews, portfolio monitoring exercises, early warning indicators, and pre-deal screening.

Benchmark, understand and optimise the capital allocated to the credit risk you are taking and inform decision making at an entity, sector or portfolio level.

Enhance your regulatory discussions with a better understanding of your peer landscape at a granular level through our credit risk management solutions.

Review outliers between traditional agency ratings and Credit Benchmark data.

Demonstrate a robust counterparty risk management approach to potential clients and investors.

Case Study

The Client

A major UK-based bank.

The Challenge

Leveraging external data in the end-to-end client risk management lifecycle, including origination, initial onboarding, annual reviews, early warning framework, thematic portfolio insights and distribution.

The Solution

Credit Benchmark’s comprehensive coverage at an individual entity and portfolio level has allowed the bank to embed the data in a systematic manner across the client lifecycle. When compared to existing external data sources, Credit Benchmark’s coverage was in excess of 75% of balance sheet utilisation and as such able to provide meaningful insights across the portfolio.

Additionally, due to the data exchange model where the bank received access to the full dataset (not just where there is overlap with their portfolio), Credit Benchmark’s data has been a valuable source of insight on the broader market both at the point of inception of the client relationship and throughout the traditional lifecycle.

Credit Benchmark’s thematic portfolio analysis has been embedded in a myriad of different senior management forums, allowing extensive use of the dataset and custom reporting suite to provide pertinent and valuable insights into the performance of the bank’s portfolio.

Seamless integration of the bank’s data with the Credit Benchmark’s outputs has been key to successful implementation, including utilising the weekly updates as a key input into an Early Warning framework.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Rating the unrated

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Independent

Free from “issuer-pays” conflict and any bank bias.

Real-world exposure

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Dynamic

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Expanding footprint

A unique growing global dataset.