Home » Credit Risk IQ – Industry Reports » Rating Agency Credit Risk

Banks develop their own internal rating processes and methodologies independently of traditional rating agencies.

An independent view aims to avoid the systematic risk that can occur from following a small number of viewpoints.

Credit officers might use ratings from External Credit Assessment Institutions (ECAIs) as a benchmark, but they form their own opinion. Banks can have information about the companies they lend to that is more closely related to their lending practices than rating agencies.

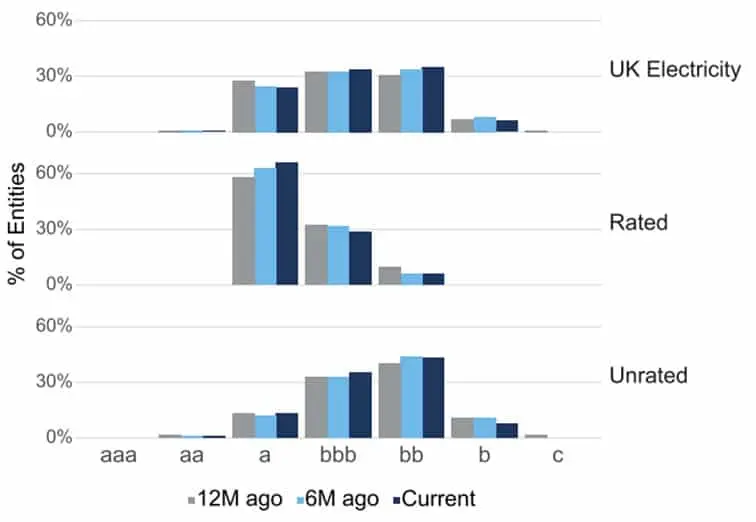

The behaviour of entities rated and unrated by rating agencies can vary due to several factors. Monitoring risk separately for these two segments can improve risk management.

Only approximately 10% of entities in the Credit Benchmark dataset have a rating from a public rating agency. We can perform a free coverage check on your portfolio. This will highlight where we provide a rating beyond the main rating agencies.

Differences in credit risk between a company rated by a traditional credit rating agency and an unrated one can stem from a variety of reasons including the level of information available, transparency, and market perceptions.

If you are interested in seeing what Credit Consensus Ratings can offer, sign up here to access the Credit Risk IQ Reports for free.

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.