Home » Credit Risk IQ – Industry Reports » Geographic Credit Risk

Banks contributing their internal ratings to Credit Benchmark review the geographic credit risk of each entity and assign it a country of risk.

The country of risk is the most important country the entity is exposed to and is the most representative of its credit risk profile.

Credit Benchmark’s data processing algorithms use the country of risk information from each bank combined with external data to assign a consensus country of risk to each entity.

A broad range of international and large national banks contribute their internal risk ratings to Credit Benchmark. The resulting dataset comprises consensus credit ratings across 150 countries.

The map highlights countries where credit consensus ratings are available for the Credit Risk IQ universe.

Credit risk officers within banks, as part of their process for assigning internal ratings, assess various economic, industry, environmental, and political factors that can impact businesses differently across regions.

If you are interested in seeing what Credit Consensus Ratings can offer, sign up here to access the Credit Risk IQ Reports for free.

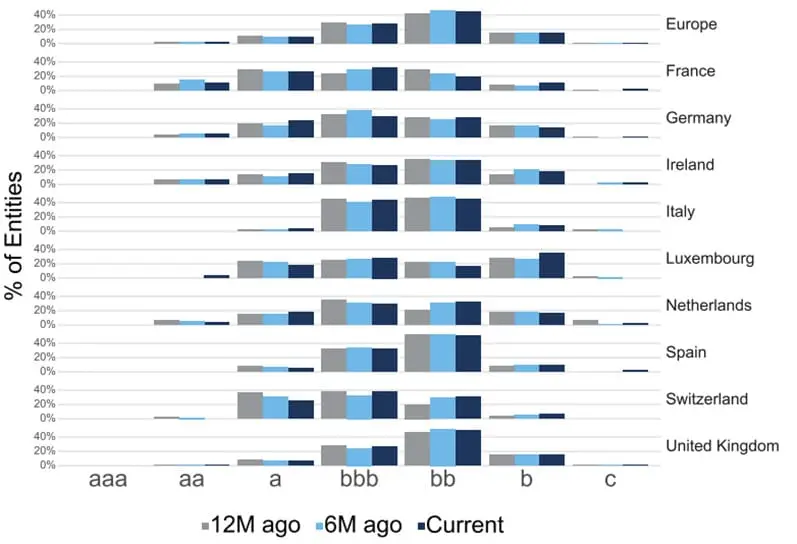

Assessing and monitoring geographic credit risk allows risk managers to quickly see systematic differences in trends and behaviours.

Reports can highlight diverging geographies and help a portfolio manager identify where to focus their attention.

The following examples show the types of insights that the Credit Benchmark data can offer.

All of the analyses shown can be tailored to your portfolio. If you are interested, please ask for a free coverage check.

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.