Credit Risk IQ – Data Analytics & Industry Trends Beta

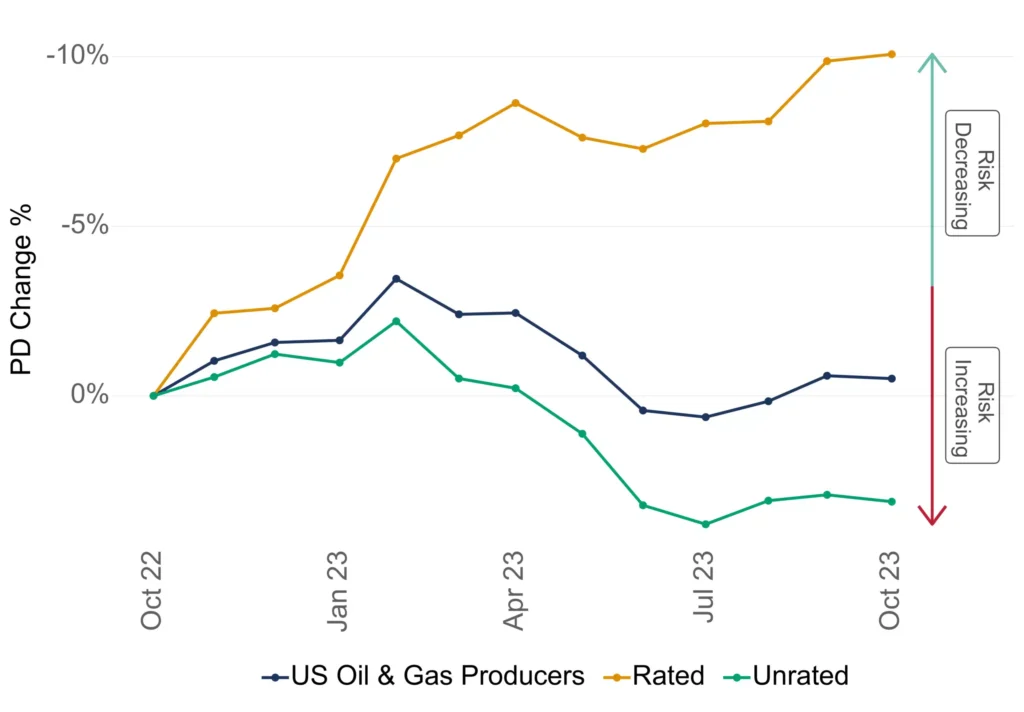

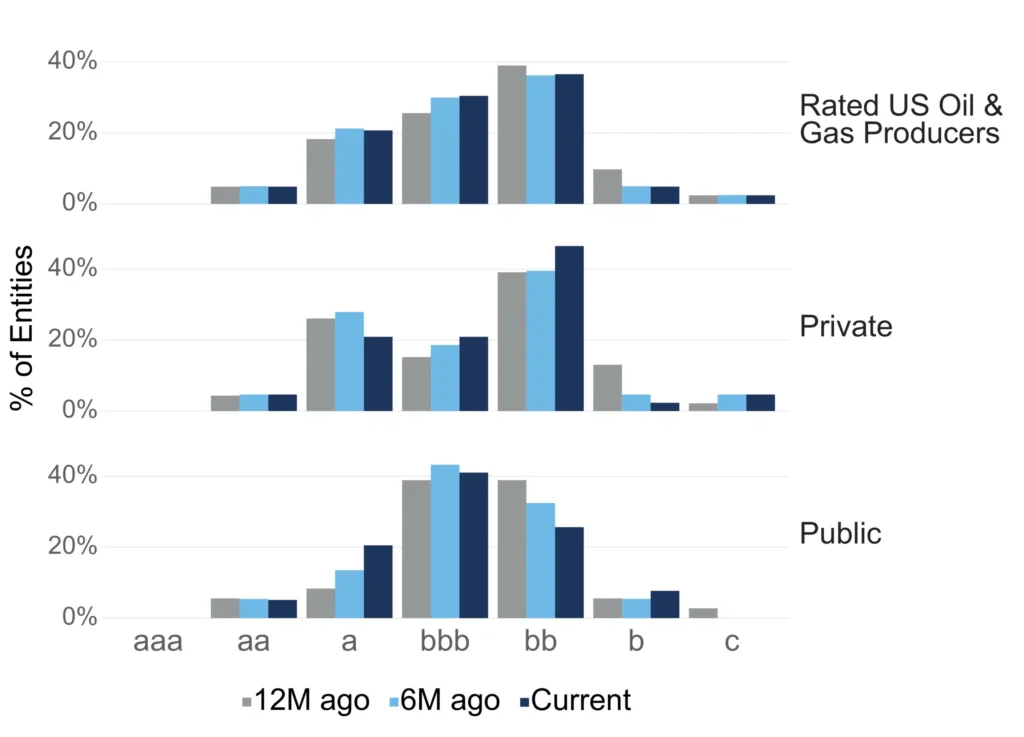

Credit Benchmark’s Credit Risk IQ Industry Trends show how credit risk is evolving through time.

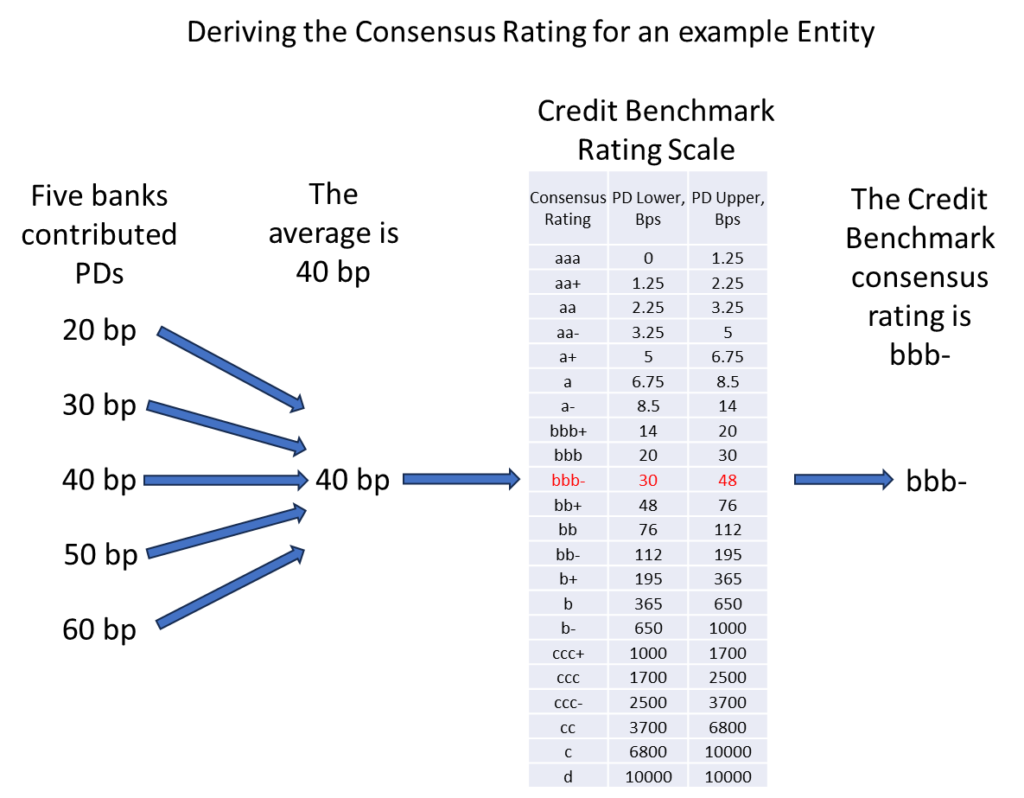

Our dataset of more than 110,000 Credit Consensus Ratings (CCRs), derived from the contributed risk views from over 40 leading banks globally provides unique insights into the credit quality of industries and countries beyond that of traditional sources of credit ratings.

The 5,500+ monthly Industry Reports highlight the breadth and depth of Credit Benchmark’s entity-level consensus ratings. The reports show how banks’ predictions of credit risk over the next year are changing across different industries.

The Credit Consensus Ratings can be analysed in various ways. We explain what the different types of analysis are.

Looking for more details on how the entity-level Credit Consensus Ratings and industry trends are derived? Read more here.

*Rated by S&P or Fitch

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

Access the Industry Reports for free to see what Credit Consensus Ratings can offer.