As part of the credit risk assessment of a commercial real estate investment trust (REIT), one can consider the credit risk of the REIT itself as well as the credit risk of its tenants. But what does it mean when a REIT’s credit quality doesn’t reflect that of its tenants? This case study presents Credit Benchmark consensus credit data on Boston Properties and its top 20 tenants per its 2020 annual report.

Over the last two years, credit risk of Boston Properties was rather stable. It was downgraded by S&P from A- to BBB+ in August 2020, while it kept a Credit Consensus Rating (CCR) of a until April 2021, when it was downgraded to a-.

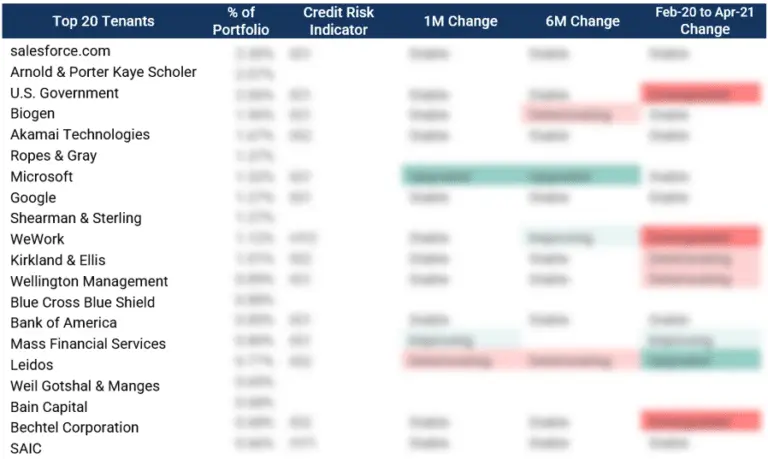

Figure 1 uses consensus credit data to demonstrate the credit risk of Boston Properties’ top 20 tenants, leveraging information available on the Bloomberg Terminal. The analysis of the creditworthiness of the REIT’s tenants shows a slightly different story than suggested by the REIT’s credit rating. [Please continue below to access full report].

Figure 1: Credit Risk of Top 20 Tenants