Sterling has continued its downward summer slide, dropping from USD1.32 to USD1.21 since May. Analysts warned of future weakness in the event that Boris Johnson became Prime Minister, taking the view that his leadership will increase the chances of an economically risky no-deal Brexit. Market onlookers will be watching keenly now that Johnson’s victory has been secured.

As previously reported by Credit Benchmark, UK industry has been suffering under the ‘Brexit Effect’ for some time now, with downturn observed across both large and smaller businesses around the country. One of the hardest hit industries has been the UK services sector, with IHS Markit reporting a below-forecast PMI of 50.2 for UK Services in July 2019. A weakened pound has put additional pressure on UK restaurant and bar businesses by making ingredients more expensive, and adding to rising staff costs as a result of increased minimum wage rates. Oversupply has also been an issue in recent years, with 4,000 new openings across the UK over the past 4 years, often in areas with insufficient footfall. High profile closures include Jamie’s Italian, Strada, Prezzo, Carluccio’s, Byron Burger and Gourmet Burger Kitchen.

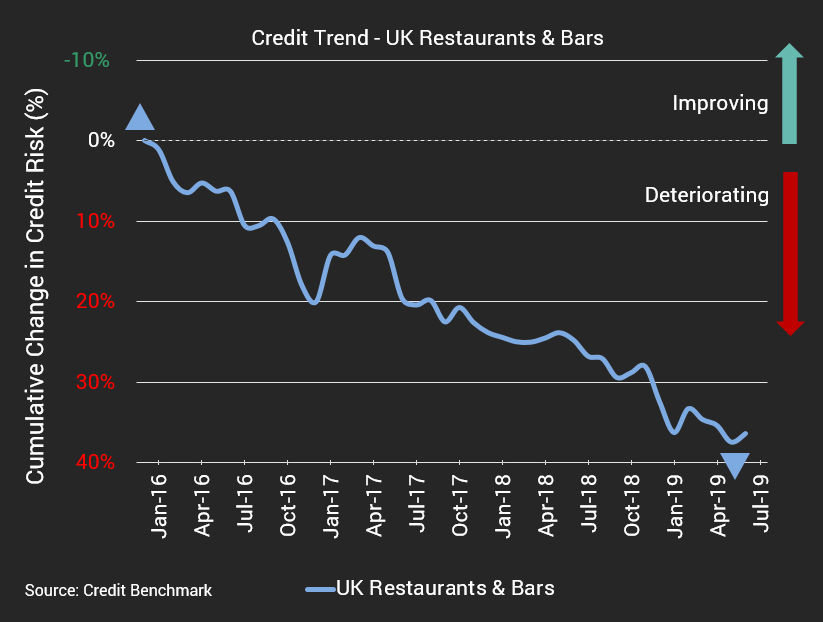

Credit Benchmark Consensus data, sourced from 40+ leading global financial institutions, tracks the credit quality of a group of UK Restaurants & Bars, with 50 constituents ranging from small localised ventures to large well-known chains. Credit quality for the group has steadily deteriorated since December 2015, barring a small respite in Q1 2017. Overall, there has been a 35% drop in credit quality in this time period.

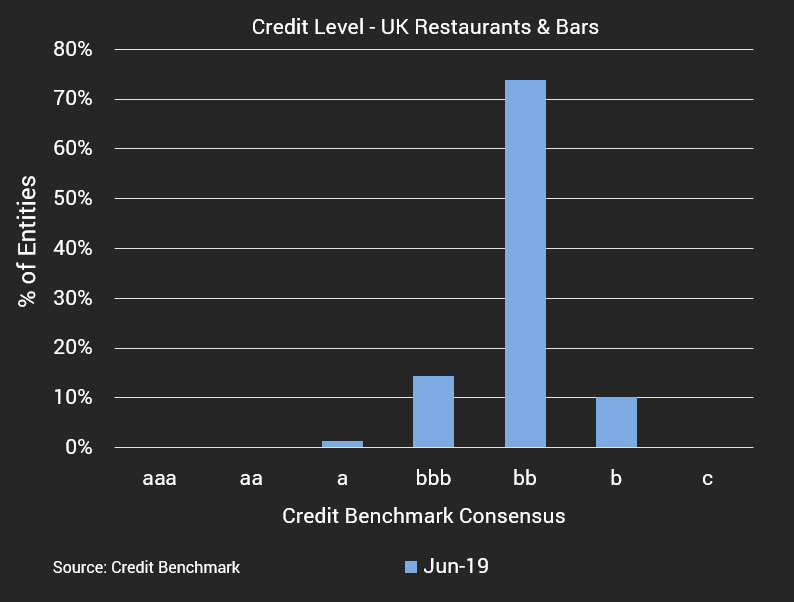

Additionally, the Consensus credit level for the vast majority of companies represented here (>70%) are in the non-investment grade category of bb, speaking to the decreased confidence lenders are feeling towards the sector in the current economic climate.

Boris Johnson has begun to unveil some of his policy plans, but Brexit will remain a moveable feast for the foreseeable future – and UK restaurateurs will continue to feel the heat.