The Containers and Packaging Sector has boomed during the pandemic, with the side-effect that many consumers are now used to recycling large amounts of cardboard every week. But the sheer volume of paperboard and paper packing used by online retailers – especially Amazon – has put severe strain on recycling processes and upward pressure on packaging material prices.

This squeeze has been intensified as a growing number of countries legislate to substitute cardboard for plastic. In the EU, polystyrene food and drink containers were banned in 2021. The US is the world’s biggest plastic polluter; but this month New York state banned polystyrene foam containers and ‘packing peanuts’ . Post-Brexit, UK legislation is behind the EU, but its Plastic Packaging Tax is due in April.

While some cardboard products have a higher carbon footprint than the plastic equivalent, the shift is certainly better for the oceans, with the equivalent of one garbage truck of plastic dumped in the ocean every minute. And if current trends continue, by 2040 the weight of plastic in the ocean will exceed the weight of fish.

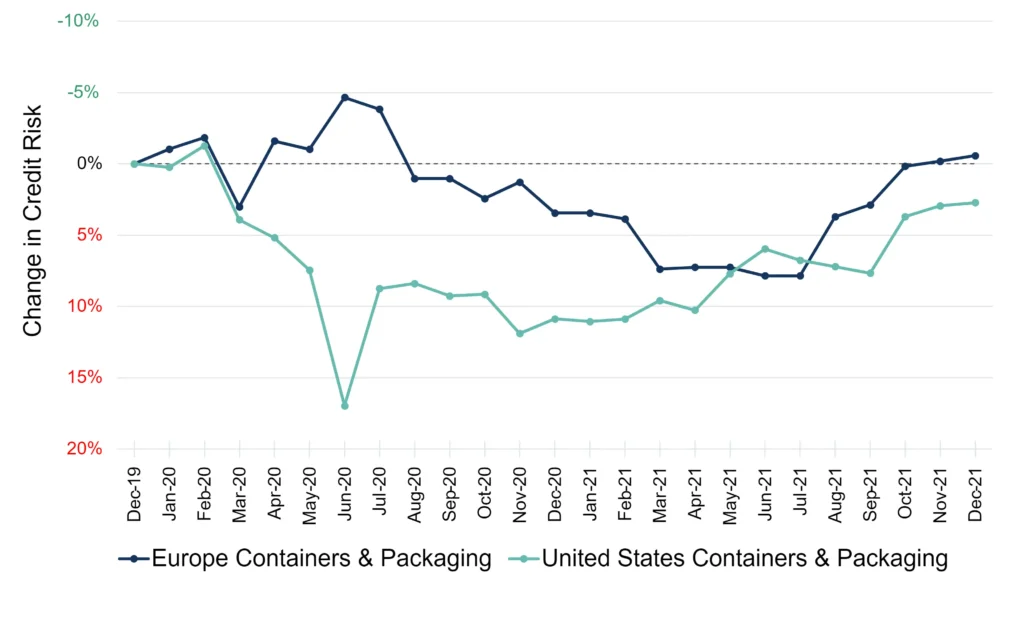

Figure 1 shows credit trends for the Europe and United States Containers & Packaging sector [please continue below to access full report].

Figure 1: Credit Trends, Europe and United States Containers & Packaging