Outstanding derivative contracts are being progressively transferred to Central Counterparties (“CCPs”). The CCP framework is intended to minimize global (i.e. systemic) risk as well as local credit risk. This note uses Credit Benchmark data provided by global IRB banks to estimate the relative credit risk of 26 CCPs in Europe and North America, based on the credit quality of the clearing members of each CCP.

For North American CCPs, credit risk estimates are available for more than 50% of the clearing members for 9 out of the 10 CCPs, and for more than 90% for 3 of the CCPs. In Europe, the coverage of clearing members for the two largest CCPs is 70% and 79%.

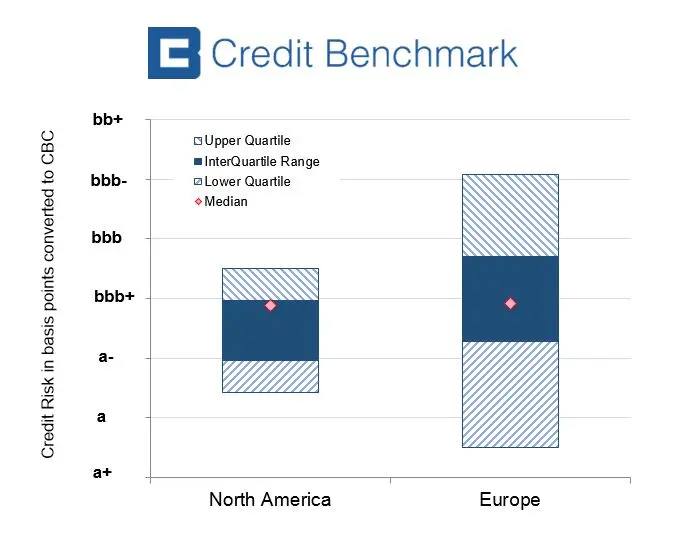

Drawing on this partial coverage, it is possible to make some provisional estimates of CCP credit risk based on the credit risk of the clearing members. The chart below shows the ranges in each region, plotted on the Credit Benchmark Consensus (“CBC*”) scale.

This shows that the medians (plotted as red diamonds) for each region are almost identical, and both are located at the boundary of a-and bbb+. In North America, the lower quartile represents a very narrow range; the CCP with the highest credit quality is in category a. In Europe, the CCP with the highest credit category is in the a+ range. The overall range for North American CCPs is also much narrower; the lowest quality CCP is in credit category bbb+. In Europe, the lowest quality CCP is in category bbb-.

CCPs are increasingly important to the global functioning of the wholesale financial system, but bank-sourced data shows that the choice of CCP choice can be important. IRB bank estimates can provide regulators, counterparties and CCPs themselves with detailed and robust views of CCP credit risks.

*CBC = Credit Benchmark Consensus; a 21-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.